|

"Why in the hell didn't you tell me to keep my money in the stock market, you #$%@#& idiot?!"

That wasn't an unhappy subscriber, or a Tesla fan who disagrees with my bearish outlook for the stock.

Rather, it was one of my relatives who sold ALL his shares back in December after the S&P 500 lost almost 20% of its value. He missed out on all the big stock market gains since then.

How big? Since bottoming on Christmas Eve last year, the S&P 500 is up by nearly 25% and the Nasdaq is up by close to 30%.

Look, I never give investment advice to family members, and I never will. It's a no-win situation, and I don't want finance to spill over to the family Thanksgiving table.

But here are two simple truths YOU can take to the bank:

One, you almost never get bear markets with a recession. And two, if American business is doing well ... American stocks do well, too.

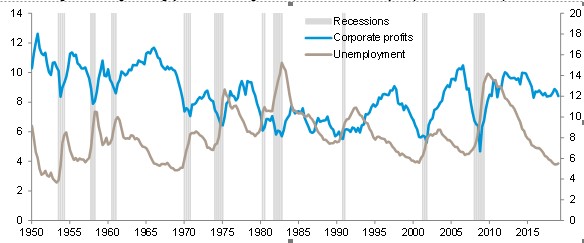

Take a close look at this chart. It's true that, these days, corporate profits (blue line) aren't growing at their 14%-plus rate in 2015 and 2016. But today, those ARE still growing at a 12% clip.

|

And the jobs market is remarkably strong, with the unemployment rate at 3.6% and underemployment below 6%.

Underemployment? This broad term refers to three types of workers:

- Highly skilled employees working at low- or semi-skilled jobs,

- Part-time workers who want full-time jobs, and

- Skilled workers with low-paying jobs.

What the above chart shows is that, without a drastic decline in corporate profits AND a surge in the underemployment rate, you should expect the economy — AND the stock market — to keep roaring ahead.

Do you see any such warnings in the accompanying chart? Heck no! In fact, I think you'll agree that it paints a pretty rosy picture for the immediate future.

And that doesn't include the freshly friendly Federal Reserve that is committed — really, really committed — to keeping the economy healthy, robust and growing.

The Federal Open Market Committee met last Wednesday and pretty much told the stock market that it will do whatever it takes to keep the bull market running.

Fed Chairman Jerome Powell opened the post-meeting press conference by stating that he has "one overarching goal, to sustain the economic expansion."

The Fed didn't cut interest rates, though, and left them at the midpoint of its target range at 2.375%. However, the Fed made it clear that it plans to cut interest rates at least one time this year and perhaps more in 2020.

The Fed members are screaming for rate cuts. Seven FOMC members expect two 25-basis-point rate cuts before the end of the year, and one member expects one cut. So, you have eight out of the nine members planning on cutting rates in 2019.

And the consensus forecast is for the Federal Funds rate to drop from 2.375% to 2.1% by the end of 2019, down from 2.624% in March.

In short, the direction of monetary policy is abundantly clear: Interest rates are headed LOWER!

That doesn't mean the stock market won't suffer a 10%-plus correction, like the painful fourth quarter of 2018, but it does mean that the long-term trend for stocks is higher.

Don't be like my unnamed family member and let the next correction scare you so badly that you sell everything you own.

Related post: 5 ways to prep your portfolio for the worst

Listen to Powell's pledge to "sustain the expansion." When the Fed cuts interest rates, it signals that it's a time for "risk on."

That means investors and traders will be loading up on riskier stocks, like technology and, one of my favorite new trends, blockchain technology.

And if you want to know what to buy, I'll give you a place to start. I'm getting ready to release my new No. 1 blockchain recommendation in the next issue of my Weiss Crypto Investor.

Click here to learn more.

Best wishes,

Tony Sagami