Beware! These Money-Torching Tech Turkeys are Coming for Your Wallet

|

They’re coming. Coming for your wallet. And if you don’t watch out, they’ll make off with your money before you ever know what hit you!

I’m talking, of course, about the record crop of tech companies planning Initial Public Offerings (IPOs) in 2019. You probably know some of the names: Uber. Lyft. Slack. Airbnb. Palantir. The We Company (formerly “WeWork”). You’ve probably used some of their services. But the reason I call them tech “turkeys” is simple …

Few of them actually make any money!

To stay afloat, they’ve been leeching tens of billions of dollars in capital from naïve, doe-eyed institutional investors. And this year, they’re coming for your hard-earned dough!

Consider: Five of the companies listed above were recently valued at a stunning $200 billion in total. But the flood of red ink they’re spilling looks like something out of a Hollywood horror movie.

Take Uber. It just reported Q4 2018 results and – surprise, surprise –they showed another adjusted EBITDA loss. It came to $842 million. That followed a $527 million EBITDA loss in the third quarter, a $614 million loss in the second quarter, and a $312 million loss in the first. Indeed, Uber has basically never proven it has a real, sustainable, profitable business model despite operating for a decade now.

Lyft isn’t much better. It was recently valued at more than $15 billion. Yet it lost a cool $254 million in the third quarter, up from $195 million in the year-earlier period.

What about Palantir? It’s a secretive data analysis firm that provides services to both corporate and government clients. It’s been doing business for a decade and a half, is valued at more than $20 billion, and is planning to IPO this year. But it hasn’t managed to turn an annual profit once in its entire 15-year history, according to The Wall Street Journal.

It’s not that I’m just cherry-picking a few, isolated examples, either. A whopping 190 companies came public last year, raising $47 billion in the process. That represented a 19% year-over-year increase in deal volume and a 32% surge in dollars raised.

But a record-high 83% of those IPO companies lost money in the 12 months prior to their offerings. That was an all-time record. The only time we even came close was at the peak of the Dot-Com Bubble, when 81% of IPO firms were drowning in red ink.

Sure enough, many of last year’s IPOs began to flop not long after they came public. And now, some of the big-money investors who have been funding overhyped tech companies are reportedly getting cold feet.

|

The Wall Street Journal just reported that sovereign wealth funds in the Middle East are balking at the aggressive deal-making and sky-high valuations popularized by Softbank and its $100 billion Vision Fund. Led by CEO Masayoshi Son, SoftBank has been throwing money around Silicon Valley for the last couple of years.

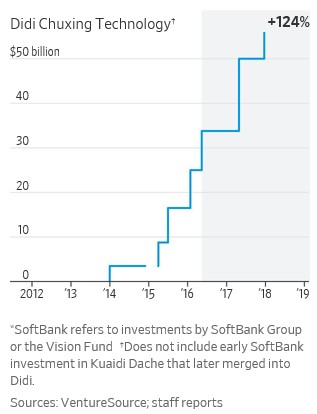

Those big checks have resulted in ridiculous charts like this one from the Journal showing the alleged worth of Chinese car-hailing company Didi Chuxing Technology. But if the money for these kinds of deals dries up, you can bet valuations will come crashing down.

Bottom line? I’ve made no secret of my skepticism about the IPO boom. I wrote as early as last July that many profitless tech plays would crash and burn, and that’s exactly what has happened. But in light of the early-2019 rally in stocks, I want to make it clear that my stance on these companies has NOT changed. Not one bit.

As a former dot-com employee myself, I can tell you that the reckless investing behavior in the tech arena ... the cavalier attitude toward losses among company execs ... the copycat business plans multiplying like rabbits ... the surge in marketing spend needed to differentiate companies from their scores of competitors ... and much more ... is NOT new.

It’s exactly what I witnessed firsthand 20 years ago. And it won’t end well for investors who get swept up in the hype. So, don’t be one of them!

Instead of buying so-called, red-hot tech IPOs ...

1) Stay focused on rock-solid, money-making, dividend-paying companies that earn high Weiss Ratings. Within that universe, I personally like those that can survive and thrive even in a tougher economy.

The ones I’ve been identifying in my Safe Money Report have been doing very well lately. You can learn more about them, and get my detailed “buy” and “sell” recommendations, by clicking here.

2) Continue to invest in gold and mining companies as a hedge against volatility and future financial chaos. That strategy has worked out well, what with gold soaring to its highest level in 10 months this week.

3) Forget about the short-term rally in “garbage” debt, such as high-yield “junk” bonds. Stay parked in Treasuries or ETFs that invest in them. This is not the time to load up on risky bonds given where we are in the credit cycle.

Until next time,

Mike Larson