Danger! Here's a trio of ETFs you should avoid!

|

|

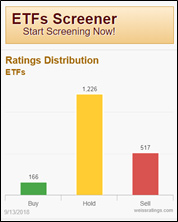

About 1,756 ETFs trade in the U.S. right now. Our Weiss Ratings ETF Screener, and our letter-grade ranking system, can help you see which to buy and which to cross the street to avoid. |

Exchange-Traded Funds (ETFs) are the fastest-growing category of investment. That's why Weiss Ratings' website and ETF screener provide a cornucopia of data and information on ETFs.

And there's more than one way to use this powerful tool. For example, today we used it to compile a list of three funds we believe you should avoid.

Here's the "avoid" criteria we used in our screener.

• Must be "Sell"-rated by Weiss Ratings

• Must be actively traded

• Must have total assets of at least $100 million

So, let's get started!

1. ProShares VIX Short-Term Futures ETF (SVXY, Rated "D"). This is a volatility ETF — that is, it is linked to the underlying CBOE Volatility Index. This is commonly referred to as the VIX. And it's a popular tool to measure volatility in the markets.

SVXY is short the VIX. This fund is rated "D" because it comes with significant amounts of risk, and it has poor rewards, too. It has a three-month return of negative 12.17%, a six-month return of negative 29.96%, and a one-year total return of negative 34.04%.

Related story: 3 life insurers whose ratings should give you pause

Moreover, SVXY offers no dividend and has an expense ratio of 0.87%. What a dog! SVXY is an ETF you should cross the street to avoid.

2. IPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX, Rated "E+"). Here is another ETF that is short the VIX. And it came out second-worst in our Weiss Ratings screen of ETF dogs that have tradeable volume.

VXX is rated an "E+" because it has a substantial amount of risk. It also has poor levels of rewards. This ETF has a three-month return of negative 9.34%, a six-month return of negative 27.23%, and a one-year total return of negative 35.13%.

On top of that, VXX offers no dividend yield. Its expense ratio is 0.89%. With this type of performance, it is no surprise that VXX is on this list.

3. VelocityShares 3x Long Natural Gas ETN (UGAZ, Rated "E+"). UGAZ ("You got gas," get it?) is a commodity ETF that focuses on natural gas. Too bad natural gas is a floor mat of the commodity markets.

This ETF is rated an "E+" due to substantial levels of risk. And it has poor returns. UGAZ has a three-month return of negative 9.75%, a six-month return of negative 5.95%, and a one-year return of negative 19.17%.

In addition to those weak returns, UGAZ offers no dividend yield and has an expense ratio of 1.65%. Man, that's expensive. Especially for a fund with that track record. We do not like to tell people how to invest, but you should consider staying as far away from this one as possible.

Related story: Rankings, ratings key in Fantasy Football AND investing

We hope you found this list useful. Now, check out Weiss Ratings' ETF screener to see what funds you SHOULD consider investing in. Just click on this link to use our website and screener technology to make a list of your own.

You do have to be a Weiss Ratings Platinum member to access this page. If you're not already enjoying the benefits that come with Platinum membership, no worries! It's easy to start your membership instantly when you click this link here.

Best,

Gavin Magor

Director, Weiss Ratings

Weiss Ratings LLC financial analyst Shane Moore contributed to this report.