How to Avoid the Losers and Ride Some of the Biggest

Tech Boom Winners in 100 Years

|

We’ve just published an urgent tech-stock e-book, “Future Shock Opportunities” and …

We’ve decided the time is NOW to rush you this abridged edition of the first chapters.

It’s so timely for two reasons:

First, because the profit opportunities we cover are not days or weeks from today. As you can plainly see in the markets, they’re here and now.

Second, because we feel it’s equally urgent to warn you of the dangers that most investors are ignoring.

Tomorrow will be your last day to access the e-book (free for our readers).

You can go there now. Or continue here for a quick read of the first three chapters …

Our overarching goal: To help you avoid the pitfalls — and profit immensely — from one of the greatest disruptions in the history of mankind.

This is no exaggeration, and it’s no joke. We see it happening all around us. And most of us have even experienced it directly, in our own lives.

The original concept of “future shock,” as described by author Alvin Toffler 50 years ago, was rapid change that shocks society.

Now, Weiss Ratings, which also began 50 years ago, has completed a major study that demonstrates Future Shock 2021 is even bigger.

But Future Shock also represents the single biggest investment opportunity of the next two years. In our e-book, we ...

- Name 15 blue chip stocks that could be wrecked by this megatrend.

- Show you how Weiss Ratings has issued “buy” signals on the biggest tech winners.

- Name the next six opportunities which could deliver similar gains. And …

- Walk you through the steps that give you the opportunity to achieve 159.8% average annual returns.

We hope you’ll be able to do two things:

First, free yourself — and your money — from the crushing blow the pandemic is delivering to huge swaths of our economy …

Second, we hope you can use that freedom to profit from the select few companies that we believe are immune from the economic fall-out. And better yet — that have the best potential to ultimately help save America from this disaster.

When the pandemic and lockdowns first hit, the economy tanked like never before. But since late March of 2020, the stock market has enjoyed one of its sharpest rallies of all time.

This begs the question: What gives? Why this disconnect?

But it’s not just a disconnect. It’s also a bifurcation — a split between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which is still in crisis, and the modern digital world, which is soaring.

As we write, these assets are exploding higher — not despite these difficult economic times, but because of them. And this great megatrend is just getting started.

Regardless of market ups and downs, technology has always been a driving force of our business. We’ve always been early adopters, not just on the rating of tech stocks, but in the adoption of new technologies.

We began rating technology stocks toward the end of 1999, when the Nasdaq was reaching bubble-level peaks.

But while Wall Street firms were unanimously touting them, we issued a landmark report titled “Seven Horsemen of the Internet Apocalypse.” Our ratings showed us what should have been obvious to everyone: Internet stock valuations were off the charts.

In fact, most of them had no earnings whatsoever — just losses. Even knowing that, we were shocked with the results of our ratings model: Not a single stock on the Nasdaq got a Weiss “Buy” rating! Almost every one was a “Sell.”

Needless to say, we received a good deal of blowback from the media and the Wall Street crowd — even some outright mockery. Then, just two months later, in early 2000, the dot-com bubble burst, and our model proved to be right on target, despite what all the “experts” were saying.

By 2003, investors had lost three-quarters of their money — on average. Many investors lost a lot more.

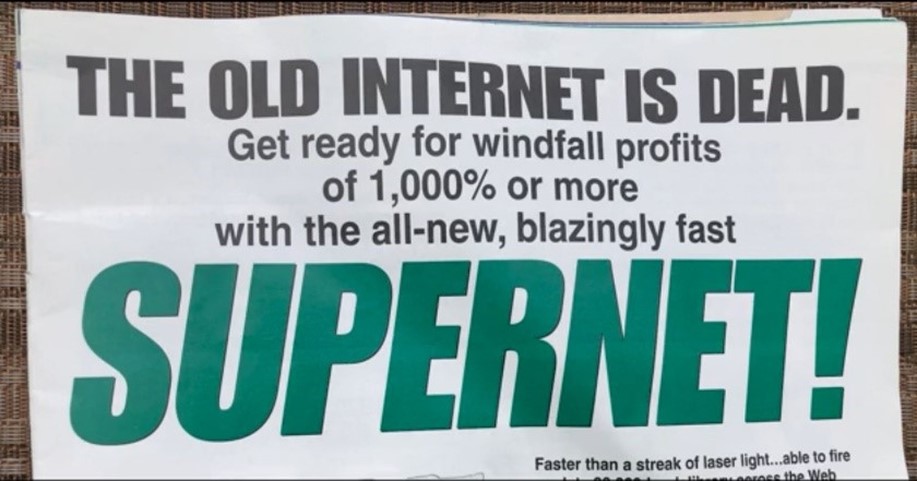

This takes us to the next major report we published, with the bold headline: “The old internet is dead. Get ready for windfall profits of 1,000% or MORE with the all-new, blazingly fast SUPERNET.”

|

At the time, most investors had abandoned tech stocks. And most experts said we were promising far too much. But as it turned out, we greatly understated the true potential; with time, the returns were far larger.

Turning to the future, we believe much of the traditional world will remain mired in what we call “the dark side,” dragged down by forces beyond anyone’s control. But at the same time, the digital world is rapidly leading us to the “light side,” where some very smart people are making enormous strides to get us out of this mess.

That’s why we issue ratings — to help investors distinguish between the two, to recognize that not all stocks are created equal.

So, what kinds of opportunities are we talking about, specifically? Just look around you, in your immediate environment, and think about it.

Have you been using new apps or video conferencing to communicate with loved ones or colleagues since the pandemic began? Have you changed your daily habits accordingly?

If so, then you’ve already experienced Future Shock first hand.

That helps illustrate why this megatrend is so powerful. And that’s one of the things creating the single biggest tech-investment opportunity since the Industrial Revolution!

Remember: Our Weiss Ratings are not just good for warning folks away from stocks that are vulnerable to a crisis, they’re also good at picking stocks that are most likely to go up — in good times and bad.

A moment ago, we told you about our 2003 report predicting a blazingly fast “Supernet.” Well, that’s also around the time when Weiss Ratings issued its first “Buy” ratings on a short list of tech stocks that have since helped create the digital world of today.

On Jan. 2, 2004 …

We issued a “Buy” rating on Citrix Systems, Inc. (Nasdaq: CTXS). Since then, it has delivered a total return of 815% to investors.

We issued a “Buy” on Cognizant Technology Solutions Corp. (Nasdaq: CTSH), which has delivered a 902% return.

CGI, Inc. (NYSE: GIB) — 914% return.

Jack Henry & Associates, Inc. (Nasdaq: JKHY) — 1,000% return.

Fair Isaac Corporation (NYSE: FICO) — 1,230% return.

Amphenol Corporation (NYSE: APH) — 1,245% return.

Ansys, Inc. (Nasdaq: ANSS) — 2,836% return

Tyler Technologies, Inc. (NYSE: TYL) — 3,450% return.

A few months later, we issued a “Buy” rating on Global Payments Inc. (NYSE: GPN), which delivered a return of 1,332%.

On Microchip Technology Incorporated (Nasdaq: MHCP) — 566% return.

IEH Corporation (OTCPK: IEHC) — 6,400% return.

Intuit Inc. (Nasdaq: INTU) — 1,424% return.

Manhattan Associates, Inc. (Nasdaq: MANH) — 1,285% return.

Lam Research Corporation (Nasdaq: LRCX) — 1,580% return.

But Apple, Inc. (Nasdaq: AAPL) was the biggest winner of all. We issued a “Buy” rating on Apple on Sept. 27, 2004, and since then, we have not once downgraded Apple to a “Sell.” So, if you had simply followed our ratings, you would have reaped a total return of more than 15,621%.

Of course, there are many Wall Street firms who recommended buying Apple at some point. But they almost never tell investors to sell before a big crash.

How do we do it?

Well, we’re not any smarter than they are. Nor do we have better access to data. The main difference is we don’t have any business relationship whatsoever with the companies we rate. We never take a dime from them for our ratings. No hard dollars. No soft dollars.

So, if a company gets a “Buy” rating from Weiss Ratings, it’s a true “Buy” rating — not a rating that’s bought and paid for by the rated company.

Likewise, we are not shy about flagging any company that falls below our Weiss Ratings standards.

The second reason we outperform stems naturally from the first: We do have an axe to grind FOR the investor; we are very concerned for investor safety.

So, we don’t look strictly at the typical things that Wall Street analysts look at.

Yes, P/E Ratios, EBITDA and Phase 3 trials are important. But we also have a set of proprietary formulas that give a pretty heavy weight to what we call “stabilizing factors.”

Not just earnings, but CONSISTENT earnings.

Not just dividends, but a long HISTORY of rising dividends.

Not just good upside price momentum, but also limited downside risk.

So unlike many analysts and investors, we’re not looking for a quick-hit return at any cost. We also value relative SAFETY. And it’s among the safer companies that you’ll find the ones that will be leaders for the long term that will truly make this great transformation happen.

For the rest of the story, be sure to read our e-book before we take it off line tomorrow.

Alternatively, if you wish to jump to the next chapters, click on the appropriate links below.

Chapter 5. Today’s Six Best Future Shock Profit Opportunities

Chapter 6. Our Future Shock Strategy Revealed

Best wishes,

Martin Weiss and Jon D. Markman