I bet you’re most likely getting ready to say goodbye to 2020 and are getting ready to celebrate with your family. As such, I’ll keep my note to you brief today.

I want to take a quick moment to make sure that you’re utilizing all of your Weiss Ratings features to protect your investments and prepare for whatever 2021 throws your way.

I talk a lot about the stock screener feature, however, there is another tool we offer that’s just as valuable.

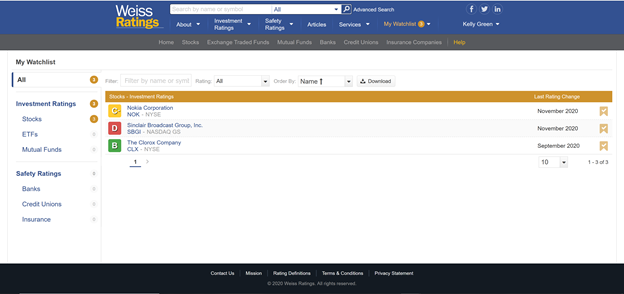

I’m talking about the “My Watchlist” tab.

|

Here, you’ll be able to store lists of stocks that you currently own or might like to own.

The quick over view shows the current rating and the last rating change. If you see that there has been a recent ratings change, you’ll be able to click and see if it is an upgrade or a downgrade and then act accordingly.

2020 has been one of the most interesting years that we’ve seen recently in terms of price action. And some of that uncertainty will bleed over into 2021. Which is why it pays to stay one step ahead of the pack.

It’s super easy to get your watchlist set up. And this small time investment can make all the difference.

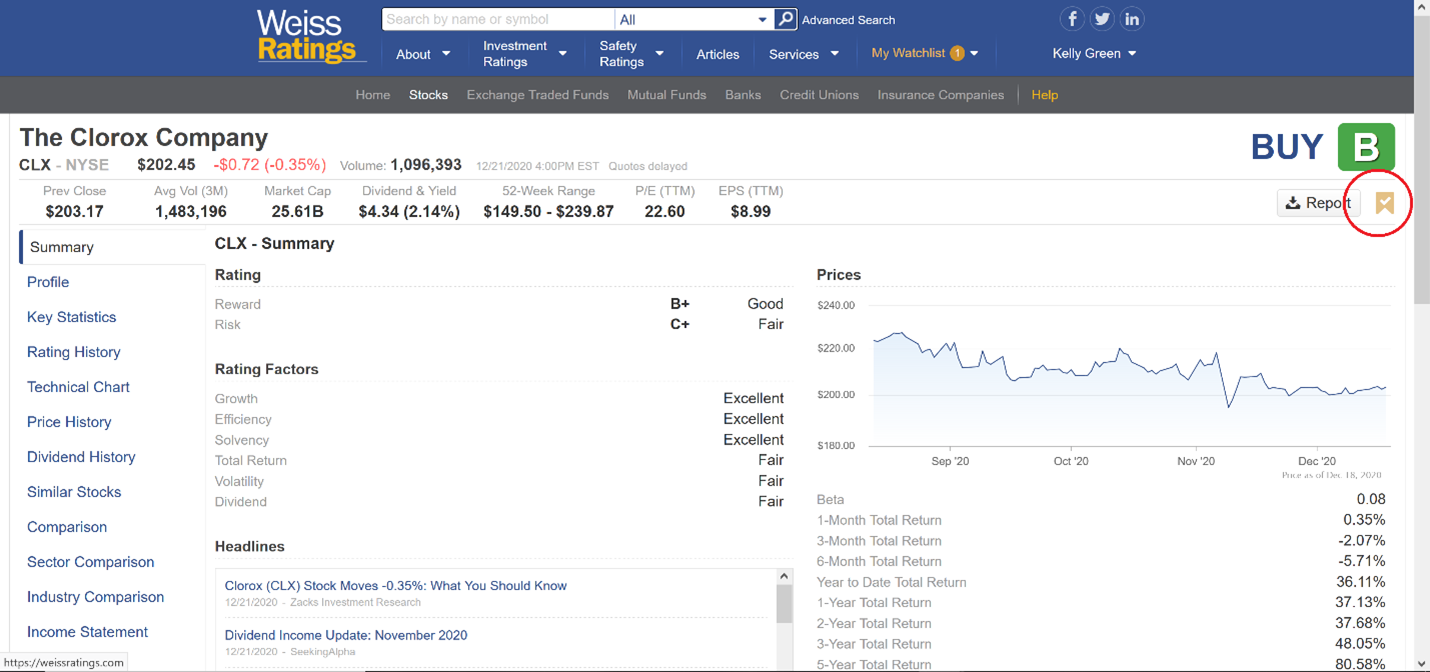

In order to add a company to your watchlist, simply look them up in the search box at the top. Then, on that company’s page, click the bookmark icon underneath the letter grade rating.

|

After the button turns yellow, that company will be added to your list found under the “My Watchlist” tab as seen in the first screenshot above.

You’ll also notice on the left that you can add banks, credit unions and insurance companies to your watchlist as well.

The safety ratings on these institutions are similar in purpose to credit ratings: The higher the rating, the more likely the institutions will remain financially stable in both good and bad times.

The last thing that you want is for an institution holding your money or insurance policy to fold overnight. By adding these to your watch list, you will be able to quickly check for any ratings downgrade.

This way you’ll be able to make a move before anything threatens your hard-earned money.

With just a few simple clicks, you can ensure you’re ready for whatever the markets throw your way in the new year.

Best,

Kelly Green