|

It’s finally here. Fed Decision Day. In a few short hours, policymakers are set to do something they haven’t done since December 2008, almost 11 years ago ...

Cut interest rates.

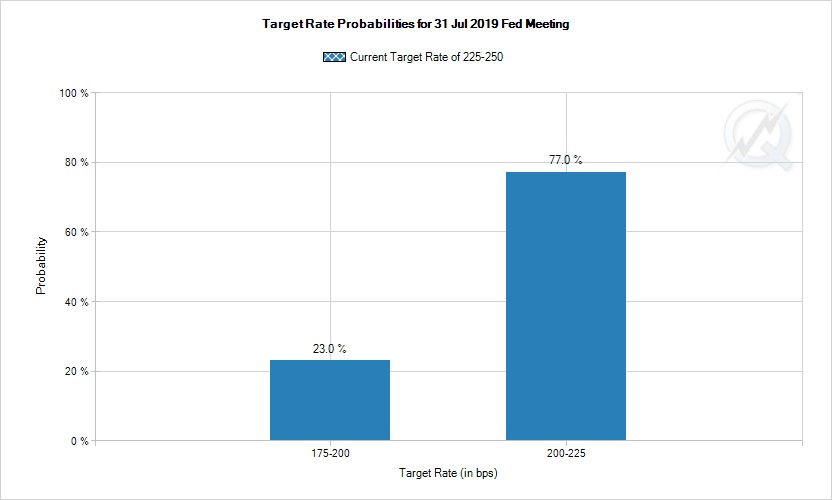

Smart money is betting on a 0.25%, or 25-basis-point, reduction. There’s an outside chance of 50 bps.

Today's Fed actions should raise three important questions …

|

- Why are they taking this step?

- What does it say about the state of the economy?

- And what should you do about it as an investor?

Let’s start with question No. 1. The Federal Reserve believes it has a serious problem with inflation. Or more specifically, not enough of it.

Now, you and I might think that’s crazy. Health care. College tuition. Groceries. None of them seem to be getting any cheaper. Even if they were, that wouldn’t be “bad” news, would it?

But that’s not how the Fed looks at things. In the Fed’s eyes, too little inflation is just as bad as too much. It’s something that needs to be fought tooth and nail. As a Wall Street Journal story noted on Monday ahead of the meeting:

Today, officials worry that inflation pressures remain too weak, not too strong. This development implies that the so-called neutral rate level that neither stimulates nor curbs economic growth is lower than in the past. And lower rates leave the Fed less space to cut them to combat a slowdown.

[Fed Chair Jerome] Powell told lawmakers this month he is worried about an ‘unhealthy dynamic’ in which ‘lower expected inflation gets baked into interest rates, which means lower interest rates, which means less room for the central bank to react’ to downturns.

Outside of its debatable inflation dilemma, the Fed has few traditional justifications for cutting today. Unemployment is near its lowest level in a half-century. Consumer spending is chugging along. GDP is growing at a solid, if not spectacular, rate.

Moreover, the financial markets are borderline euphoric, at least judging by stock prices and the Fed’s own “financial stress” indices.

These certainly aren’t the kinds of conditions that prompted the Fed to cut rates in the past.

Related post: What to buy before Powell & Co. slash rates

The last two cycles started after the brewing carnage in housing and tech stocks became too blatant to ignore and the markets were visibly cracking.

That’s not the case today. Yet here we are anyway.

That brings me to question No. 2: What does all the rate-cut chatter say about the economy?

Frankly, nothing bullish. It shows the Fed is very worried about deteriorating conditions around the world.

And no wonder! Economies from Asia to Europe are weakening. Interest rates are plummeting globally. Almost $14 TRILLION in global bonds are now trading with negative yields — something completely unprecedented in 5,000 years of recorded history. Plus, all the QE, rate cuts and other so-called “stimulus” being doled out by the Bank of Japan, the European Central Bank and others are having little (if any) impact on the real economy.

But they’re clearly having impacts on asset markets. For one thing, the promise of more accommodation is helping drive gold and silver prices through the roof. For another, it’s lighting a fire under the highly rated, defensive, dividend-focused investments I’ve been championing since early 2018.

Now we can tackle question No. 3: What should YOU do about all this as an investor?

Several positions in my Safe Money Report are showing solid single- and double-digit profits as a result.

If I’m right about where we are in the cycle, and how policymakers will respond, those gains are only going to grow in the weeks and months ahead. So, if you aren’t already on board, consider giving Safe Money a try by clicking here or calling my team at 877-934-7778.

Not quite ready to take that step? Then at least get some precious metals and mining stock exposure in your portfolio.

SPDR Gold Shares (GLD, Rated "C"), is up 11% this year, and looks to have some nice upside ahead — no matter what the Fed does today.

Sell lower-rated, money-losing junk stocks and get on board with higher-rated, yield-oriented names in more-defensive sectors. And consider adding lower-risk, fixed-income ETFs or mutual funds that focus on short- to intermediate-term bonds.

Why? Many pundits are calling today’s likely Fed cut an “insurance” move, rather than the start of a string of reductions. But if a recession is coming in 2020, as I’m increasingly expecting, the Fed will respond by cutting rates more than once.

Heck, even some mainstream strategists and economists are openly talking about the potential return of zero-percent rates here if trade negotiations fail and/or global growth tanks.

All the investments I just mentioned would benefit greatly in that scenario. One specific group of precious metals stocks is particularly suited to profit. That’s a key reason I’m here in Vancouver right now at the Sprott Natural Resource Symposium, researching and kicking the tires on them.

I’ll have more down the road. In the meantime, try not to get distracted by all the Fed chatter and hoopla today. Focus on my multi-step profit plan for this Fed Decision Day ... and beyond!

Until next time,

Mike Larson