If You’re Investing Like These Guys, You’re Doing it WRONG!

When I was in Las Vegas for the MoneyShow conference recently, I shared a ton of observations about the market with investors. That included plenty of suggestions about what they should ... and should NOT ... do with their hard-earned money.

But I tried to hammer home one point above all others: If you’re investing like you did during the long bull market run from March 2009 through January of this year, you’re doing it wrong! This is the slide I hoped would drive that message home (in an entertaining way!)

If you couldn’t join me in Vegas, don’t worry. I’ll be heading out to the West Coast for the MoneyShow San Francisco, which runs from Aug. 23-25 at the Hilton San Francisco Union Square.

|

My first presentation there is called “The Everything Bust: Causes, Consequences, and Profit Opportunities.” It’s scheduled for 1:45 p.m. – 2:15 p.m. on Friday, Aug. 24.

My second presentation is “Hype Vs. Reality: How Playing the Skeptic Can Make You Rich.” That one will run from 6 p.m. to 6:45 p.m. on the same day. You can register to attend – for free – by using this link. Or you can call the MoneyShow team at 1-800-970-4355 and tell them you’re attending on my invitation.

But suffice it to say, I will continue to stress that message — because I keep seeing many people approaching this market in the absolute WRONG way! The action in garbage stocks like iQIYI (IQ, Rated "D+") is a perfect example.

IQ is a Chinese video streaming service majority owned by Baidu (BIDU, Rated “C”) that’s been operating since 2010. Unfortunately, in every single one of those eight years, it lost money. That includes $554 million in 2017, $463 million in 2016 and $410 million in 2015.

What about the future? It must look better or the “Netflix of China” wouldn’t have been able to go public in a March 2018 IPO that raised $2.25 billion, right? Nope! As of June 2018, analysts were forecasting losses to surge to $789 million in 2018 and $723 million in 2019.

Again, let me repeat that for emphasis: 8 years of operation ... 8 years of losses ... and another $1.5-BILLION-PLUS in losses likely over the next 2 years (at least).

Yet investors have been piling into IQ shares like the company is spinning straw into gold!

The stock soared from its $18 IPO price to $43.93 as of Tuesday, a gain of 144% in just a few weeks. Bloomberg helpfully explained that one of the reasons it’s surging is that it has “become a darling for millennial investors on the stock trading app Robinhood.”

|

|

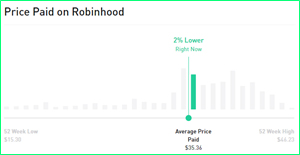

A quick look at Robinhood shows that its users have paid an average of $35.36 per IQ share. |

I feel like channeling my inner John McEnroe and going “You can’t be serious, man. You cannot be SERIOUS!” Who in their right mind is buying this complete and total crap? It’s exactly like what I saw in 1999-2000 right before the first tech bubble burst.

My advice? If you want to preserve and grow your wealth for the long term, leave highly speculative stocks like IQ in the dumpster where they belong. Instead, stick with the kinds of safer, more stable, highly rated names I’ve been recommending in my Weiss Ratings’ Safe Money Report.

Keep holding a much higher allocation of cash, too. This is a much riskier, more volatile market than what we had for the last several years. You have to approach it as such!

Until next time,

Mike Larson

P.S. Weiss Ratings is the “secret sauce” that has made the Weiss Ultimate Portfolio so successful, Martin Weiss personally entrusts his own retirement funds to this portfolio. And he invites you to join him. Go here to watch all the details. Or go here to activate your membership.