On Tuesday, the Nasdaq Composite was down 10% compared to the high last week. This index is a market-cap weighted index of over 2,500 common equities listed on the Nasdaq exchange.

Although we use the Nasdaq to talk about what’s going on in tech stocks, it’s only 50% technology stocks. It also includes consumer services, health care, financials, industrials and other prominent industries.

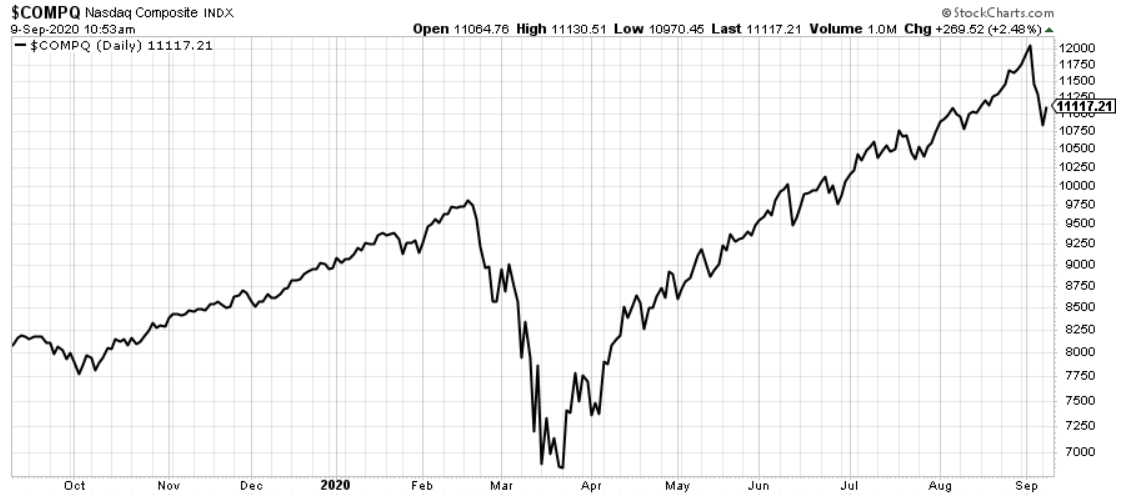

Take a look at how these companies have been doing over the last year.

|

The Nasdaq Composite is up 41% in the past year and up 64% since the March bottom. So, should we even be surprised by a correction? No.

But too often investors see a correction as a reason to panic.

Look back at that price chart. You can already see that shares started to recover at the beginning of yesterday’s trading.

Remember: The goal is to buy low and sell high. Not buy high and panic sell. When a dip happens in a sector, or in the market as a whole, look for the bargains. Look for the opportunities to get a good price on a solid stock.

If you have a way to pick solid stocks, beautiful! If not, you can use the Weiss Ratings to help.

Today, I went to the stock screener and looked for all stocks that were listed on the Nasdaq exchange. Then, I sorted by rating.

Our top-rated stock today is Ollie’s Bargain Outlet Holdings, Inc. (Nasdaq: OLLI, Rated “B”). You’ve probably seen an Ollie’s Bargain Outlet if you’ve spent time on the East Coast, even if you’ve never been a customer.

The company has 333 store locations in 23 states across the Eastern United States. Ollie’s is known for its “good stuff cheap” motto and broad selection of brand name products across all categories. That sounds like a company that would be ready to profit from consumers looking to stretch their dollar a little farther in uncertain times.

Ollie’s released its second-quarter numbers at the end of August, and they show what you’d expect to see — total net sales increased 58.5% to $528.3 million. It was the best quarter in the company’s 38-year history.

And investors are taking notice.

|

Shares were up nearly 70% from the beginning of the year to their high on Aug. 26. Since then, shares have slid 17%. What has changed?

Well, on the call, management said it would not provide guidance for the second half of the year. I don’t think that should matter at all. Consumers are still going to be looking for deals until there is more certainty regarding the pandemic.

Meaning, this slide could be a great buying opportunity for anyone looking to add Ollie’s to their portfolio.

Our second stock is Security National Financial Corp. (Nasdaq: SNFCA, Rated “B”). The company has three main segments: life insurance, funeral service and mortgage loans. Plus, it’s always looking to expand its business with strategic acquisitions. Shares have corrected around 7.5% since Aug. 14.

Our runner-up is TechTarget, Inc. (Nasdaq: TTGT, Rated “B-”). TechTarget is a global leader in purchase intent-driven marketing and sales services. Earlier this week, shares had corrected around 8%.

If you’re holding solid companies in your portfolio, a correction should be nothing to fear. It’s an opportunity to grab some extra shares at a market discount.

I always recommend to use some kind of objective method to check if a company is solid. And weissratings.com is a great resource to see all that data in an easy layout.

Best,

Kelly Green