Protect Yourself from the Rot Spreading in Credit Markets

|

My colleague Sean Brodrick’s hard-hitting, dynamite presentation GOLD RUSH 2019-2021 is now online and available to view. Click here to view it right away. That's because Sean talks about the THREE powerful, cyclical forces that are converging right now — for the first time ever — to drive gold from $1,500 to $3,000 and beyond … BEFORE the end of 2020!

Plus, you'll see how you can claim a FREE bar of pure Swiss gold. There's only one way to get in on this $75,000 gold giveaway. Get the details when you watch Sean's timely video.

One reason investors are taking such a shine to gold again? They know that something is lurking out there.

Festering.

Spreading.

I’m talking about the rot behind the walls in the credit market. Not many analysts and investors have caught on ... yet. But it’s there. It’s serious. And if you’re not careful, it’ll be coming for YOUR portfolio next!

Look, if you’ve been following my work for the past couple of years, you know I’ve been incredibly worried about ballooning debt levels.

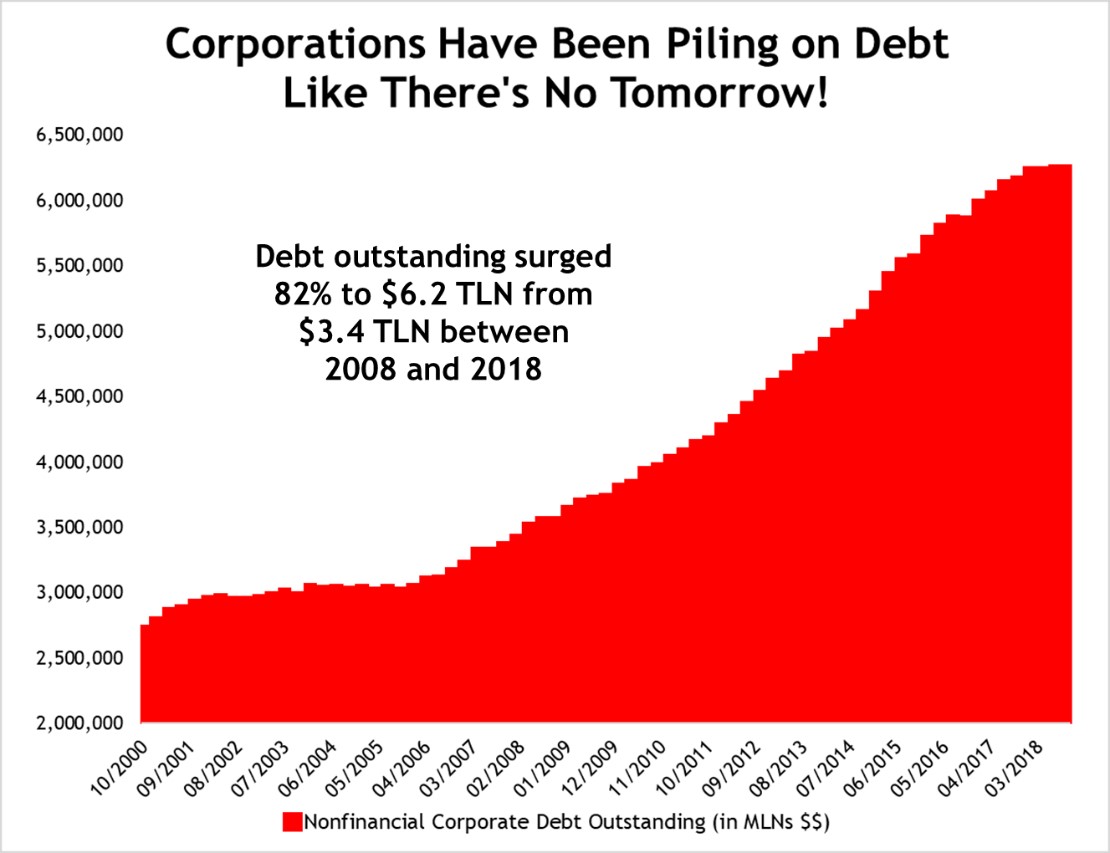

But not MORTGAGE debt, like in the last cycle. This time around, it’s CORPORATE debt that has me worried.

That’s because this time around, companies have been the worst offenders rather than consumers. They’ve been borrowing trillions of dollars in the bond and loan markets, and they’re now buried under a mountain of debt that puts Everest to shame.

Just look at this chart. You can see that corporate debt soared 82% to $6.2 trillion at the end of 2018 from $3.4 trillion a decade earlier.

|

|

Source: Federal Reserve |

But now, the economy is slowing. Geopolitical tensions are rising. And delinquencies and defaults are beginning to climb. Result: Investors and lenders are starting to balk at funding the riskiest bonds and bundles of loans.

The Wall Street Journal reported yesterday how prices of higher-risk bonds are dropping, yields on higher-risk bonds are rising, and the extra premium junky companies have to pay to borrow is rising quickly.

The article zeroes in particularly on "CCC"-rated debt. If you know anything about the credit ratings scale that companies like Standard & Poor’s and Moody’s Investors Service use, you know that "CCC"-rated paper is some of the riskiest stuff out there. Bonds rated that low default at much higher rates than bonds the "B" and "A" ratings buckets.

Well, an index tracking those bonds is dramatically underperforming higher-rated bonds this year. A couple hundred billion dollars’ worth of lower-rated bonds and loans are now trading for as little as 80 cents on the dollar, or less.

This is a sign investors are unloading this junky paper as fast as they can.

At the same time, S&P Global Ratings recently noted that its ratio of ratings downgrades to upgrades is skewing heavily to the downside. In fact, it hasn’t issued this many downgrades relative to upgrades in a decade!

As I’ve noted many times in the past 18 months, the debt markets keep failing to “confirm” attempts by the stock market to hit — and hold — modest new highs. All of this confirms that yes, there is rot behind the walls ... and it’s not going away. It’s getting worse.

And if you’re just watching the S&P 500, you’re not getting a complete picture of what’s going on out there.

In the last downturn, the slumping performance of subprime mortgage bundles proved to be the “canary in the coal mine” for bigger debt problems. In this cycle, the slumping performance of higher-risk corporate bonds and bundles of loans looks like precisely the same thing to me.

My advice: Stay away from higher-risk junk bonds, and the ETFs and mutual funds that invest in them. Shun companies with high debt loads, lackluster cash flow, and lower Weiss Ratings ("D+" or below).

Finally, make sure you allocate funds to “chaos insurance” investments. That includes gold, silver, and mining shares. Because if this credit rot really starts to spread (as I expect it will), the broader bond and stock markets could be facing serious trouble down the road.

Until next time,

Mike Larson