'Safe Money' Strategy Hits Pay Dirt as Gold Soars to Six-Year High!

|

I love it when a plan comes together for investors like you. And boy has it ever in gold!

After languishing for years, gold is now rising from the ashes and screaming higher like a fiery phoenix! It just topped $1,442 yesterday, extending its recent gains to more than $170+ an ounce. That leaves gold trading at its highest level since May 2013!

Gold mining shares have done even better. The benchmark Amex Gold Bugs Index (HUI) just surged 33% in a month. It’s now up a whopping 44% from its September 2018 lows.

And while the stock market cheer squad on television won’t highlight this data, guess what? The SPDR Gold Shares (GLD, Rated “C”) now sports a 1-year total return of 11.7%. That beats the 10.4% return of the SPDR S&P 500 ETF (SPY, Rated “B-”). And yes, simply owning government debt has generated bigger gains than the stock market, too. The iShares 20+ Year Treasury Bond ETF (TLT, Rated “C”) is up 12.3% in 12 months.

The good news? If you’ve been following my work here at Weiss Ratings, at live investor conferences, and in my Safe Money Report, you should be on board with this rip-roaring rally. That’s because I’ve been speaking bullishly about gold since last summer, and advocated strategies that can help you profit from its gains.

I laid out the “Generalist’s Case for Getting on Board with Gold” back in February, for instance. And in Safe Money, I’ve recommended both a favorite gold mining stock and (more recently) the GLD. Subscribers have building open profits in both positions. (You can join them by clicking here.)

But if I’m right, this move is just getting started. Why? It goes back to four incredibly powerful, bullish forces:

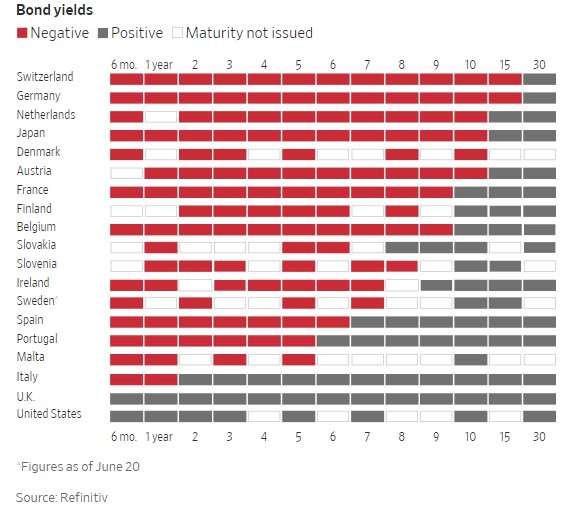

Force #1: A resumption of falling interest rates here PLUS deeply negative rates abroad are fuel for gold. While gold “yields” only 0%, that certainly beats the widespread, NEGATIVE yields investors are “earning” on government bonds all around the world.

Just look at this graphic the Wall Street Journal recently posted. It shows how widespread the negative-yield sickness is globally. You have to go all the way out to THIRTY YEARS in terms of bond maturity to earn a positive yield on Swiss and German government bonds, and past 10 years to earn one in the Netherlands, Japan, and Austria.

|

|

Source: Wall Street Journal |

Force #2: Rising volatility, increasing recession risk, and a wishy-washy stock market boost demand for “chaos insurance.” For all the hype about the S&P 500’s flirtation with a new high, we’ve reached this resistance zone four times now. And the fact is, the major averages haven’t ALL made convincing, broad-based, powerful new highs in concert since back in January 2018.

At the same time, we’ve seen a series of higher lows in the VIX index of volatility and a deterioration in the economic data both here and abroad. Recession risk is clearly on the rise, and that has investors (rightfully) seeking out safe havens ... safe havens like gold.

Force #3: Gold shines as an UNDERvalued asset in an ocean full of OVERvalued ones. I’ve talked about the “Everything Bubble” concept before. The term refers to the widespread, extreme asset market gains we’ve seen in everything from stocks to junky bonds to commercial and residential real estate to esoteric assets like collectibles and artwork.

But gold and gold stocks have mostly been watching from the sidelines. The metal topped out around $1,920 an ounce back in 2011, fell to $1,045 in December 2015, then largely chopped sideways until this year. That means they are actually relatively cheap ... and could have a LOT of catching up to do.

Force #4: Supply, demand, and pricing trends improving as central banks plow back into gold. I went into a lot more detail on this at my presentation on gold at the MoneyShow Seattle last week. You can view the presentation online here if you like.

Suffice it to say that not only is investor demand for gold rising nicely, but central banks are actively buying, too. Throw in an expected slowdown in mine supply, and you have an even more bullish backdrop for bullion.

None of that precludes short-term pullbacks. I wouldn’t be surprised in the least if gold stopped to catch its breath soon. But just as I’ve been saying since last summer, the trend has changed. Gold looks to be entering a new bull market. And that means you’ll want to use corrections as opportunities to get on board.

Until next time,

Mike

P.S. Given the gargantuan rally in gold, the timing for the Sprott Natural Resource Symposium couldn’t be better! I’ll be presenting at the event, which runs from July 30 through August 2, 2019, and would love to see you there.

This event brings together the world’s smartest minds in finance, investment research, economics, and natural resources ... all under one roof. Over four dynamic, information-packed days, speakers will reveal their findings and how you can profit from the best gold and resource opportunities in the current markets.

Click on this link if you’d like more details about the schedule, venue, speaker list, and more. Then when you’re ready, use this link to get registered. Best of all: As a Weiss Ratings reader, you qualify for an extra $100 off Sprott’s already-reduced “Early Bird” pricing. Use the code “GENL19” to receive it. But the offer expires on July 5, so don’t wait too long.