These undervalued, underappreciated stocks are trouncing the averages. Are you on board?

|

It’s been a solid year for stocks, as I’m sure you’ve heard. Now, I’m closely watching how equities perform at this “moment of truth.”

They’ve spent spending 18 long months in purgatory ... underperforming even plain-vanilla Treasury bonds. But they’re trying to break out. We’ll see whether this move sticks.

No matter the outcome, though, there is one undervalued and underappreciated asset class that’s BEATING the averages over the past year …

And there’s a group of stocks levered to it that has been trouncing them.

Yet they rarely get any press — perhaps because their past stint in market purgatory lasted even longer than the S&P 500’s.

I’m talking about gold and gold miners.

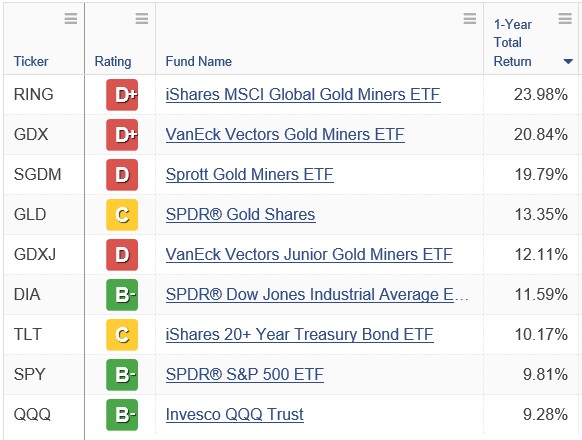

Just look at this table, which I built using the Weiss Ratings ETF Screener tools available at our website. It shows the 1-year performance of the SPDR Gold Shares (GLD, Rated “C”) ETF that tracks bullion prices, as well as a handful of the largest gold mining ETFs. They include both larger funds like the VanEck Vectors Gold Miners ETF (GDX, Rated “D+”) and smaller ETFs like the iShares MSCI Global Gold Miners ETF (RING, Rated “D+”).

I also included the three ETFs that track the S&P 500, Dow Jones Industrial Average and the QQQs, plus the ETF that tracks long-term Treasury bonds.

What do you see?

|

|

Source: Weiss Ratings. Data Date: July 15, 2019 |

The gold bullion proxy GLD returned around 13.4% over the past year. That handily beat the 9.8% return of the SPDR S&P 500 ETF (SPY, Rated “B-”) and 10.2% return on Treasuries.

Okay, but what about year-to-date? It’s been a strong year for stocks, so surely they must be coming out on top, right?

Well, that depends on what KIND of stocks you’re talking about.

Two of the four ETFs in my chart that own gold stocks actually beat the Invesco QQQ Trust (QQQ, Rated “B-”), while three of the four topped the SPY.

|

|

Source: Weiss Ratings. Data Date: July 15, 2019 |

In the very short term, the performance gap is even more glaring.

The RING ETF shot up more than 23% in the past three months, compared with a rise of only around 4% for the SPY and QQQ.

As for GLD, it returned roughly 2.5 times as much as the stock market averages during the same period.

|

|

Source: Weiss Ratings. Data Date: July 15, 2019 |

We all know hindsight is 20/20. And I wouldn’t be surprised at all if both gold and gold miners took a breather after their big recent run.

But in the longer term, these figures validate all the things I’ve been telling you about gold and gold stocks since last summer …

They benefit from several forces, including rising volatility, the global proliferation of negative interest rates, and the ongoing turn in the credit and economic cycles. Plus, they’re among the handful of relatively cheap, undervalued assets in an ocean of overvalued ones.

So, while you’re waiting to see whether this attempted breakout in stocks holds or not, consider adding precious metals or miners to your portfolio. They’ve clearly outshined the averages for some time now. Yet unlike money-losing IPOs or red-hot tech stocks, they seem to have very few champions and get very little press.

That tells me this bull market is likely just getting started.

It’s also why I’m so excited to attend and present at the Sprott Natural Resource Symposium that runs from July 30 to Aug. 2 in Vancouver.

Dozens of metals and mining experts, executives and presenters are going to be there, so it’ll be a great chance to do some on-the-ground research. If you’re interested in joining me, you can get more details and register using this link.

Finally, I’ve added an extra gold-focused spot to my list of events at the MoneyShow San Francisco. It runs from August 15 through August 17 at the Hilton San Francisco Union Square. Complete event and registration details are available at this link.

I hope to see you at one or both events. I’m confident that together, we can identify some compelling profit opportunities in this underappreciated sector.

Until next time,

Mike Larson