Earlier this week, I wrote about the large divergence between the performance of U.S. stocks and stocks abroad. But I’m not sure I was truly able to convey how unusual and unprecedented the recent action has been.

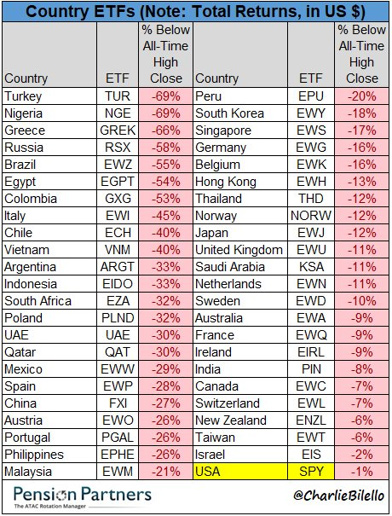

Then I stumbled across the chart below on my Twitter feed. (You can follow me using the handle @RealMikeLarson.) It’s from a company called Pension Partners. The firm measured how far single-country ETFs, spread across all the major continents, are trading below their respective all-time highs.

|

The conclusion? While the S&P 500 is only off roughly 1% from its peak, foreign ETFs have plunged 25% on AVERAGE. That’s firmly in bear-market territory, using the conventional “20%-drop” definition.

And again, that’s just an average. Many countries are in truly horrendous shape.

The ETF tracking Turkey is down 69%, as is the ETF that invests in Nigeria. The ETF tracking Greece is off 66%. Russia? -58%. Brazil? -55%. Italy? -45%. Chile? -40%. Argentina? -33%. South Africa? -32%. South Korea? -18%. Singapore? -17%.

In other words, it doesn’t matter if you’re talking about the EMEA (Europe, Middle East, Africa) region ... South America ... Asia ... or, frankly, anywhere. Foreign ETFs have been absolute dogs for investors.

Our Weiss Ratings have clearly picked up on this trend, too …

I ran an ETF Screener yesterday of all 152 funds whose prospectus objective is listed as “foreign stock.” Not a single one managed to earn a Rating of BUY (“B-” or higher). Twenty were rated SELL (“D+” or lower), including all of the following shown here.

|

|

Data Date: Sept. 11, 2018 |

To me, there are only two ways out of this situation. Either foreign stocks play catch UP to U.S. stocks ... or U.S. stocks play catch DOWN to their overseas counterparts.

When we had a similar situation play out in 1997-'98, U.S. markets were only able to ignore turmoil in foreign currency, bond and stock markets for a while. The overseas crisis ultimately got so bad that it washed up on our shores, and the Dow tanked 20% in just a few weeks.

Will past be prologue? I don’t know for sure. But I do know that when you combine this huge “U.S. vs. the World” divergence with all the other issues I’ve raised so far this year, my best advice is (still) to stay conservative!

Focus on “Safe Money” stocks. This video I recorded at the San Francisco MoneyShow last month explains in more detail why they should be great investments at this stage in the cycle. Be sure to also carry higher levels of cash, and avoid overhyped, over-owned, over-loved stocks in sectors like technology.

This isn’t the same market we had from 2009 through January 2018. Don’t invest like it is!

Until next time,

Mike Larson

P.S. If you're looking for more “Safe Money” stocks, click here to get my latest recommendations.