What’s Behind the Banking Industry’s Disappearing Act?

|

Banking may be the single-most important industry for any economy. Without strong, liquid, loan-making banks, capital flows would slow dramatically and the economy would grind to a halt. That’s why we follow the business so closely, on your behalf, at Weiss Ratings.

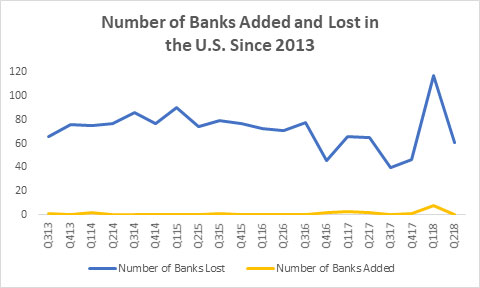

Right now, there’s a disappearing act going on in banking. More specifically, we’re losing banks at a very swift and consistent rate! Our data shows we’ve lost an average of 72 banks per quarter since Q3 2013. That’s 1,441 in the span of only five years.

During that same timeframe, only 20 new banks were founded. That works out to an average of just one new bank a quarter. If nothing changes, we could see the number of banks shrink to just 2,707 from 5,547 over the next decade.

|

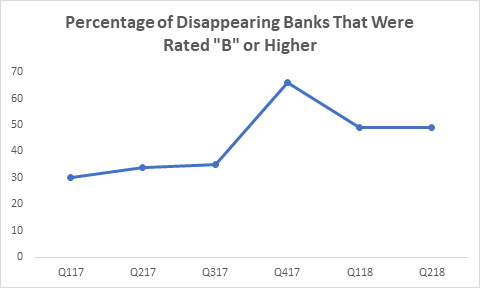

When you dig a little deeper, you see some other interesting trends. For example, data from the last six quarters shows that, on average, 43.8% of the banks that disappeared were strong institutions. They were mostly acquired, as opposed to banks that failed.

In fact, Q2 2018 figures show that out of the banks dropped from the economy, 49% received a “B” or higher grade from Weiss Ratings before they vanished. They had median assets of $535.5 million and median profits of $3.81 million. In other words, not only are we losing banks in general, we’re losing high-quality, smaller institutions.

|

Moreover, the trend is accelerating. In Q1 2017, 30% of disappearing banks were considered strong at the time they failed or were acquired. That has since risen to 49%. If this trend continues, the U.S. economy could be headed for a highly consolidated banking sector.

Why are so many smaller, well-performing banks choosing to be acquired instead of continuing to do business? And why are so few new ones taking their place?

Several factors come into play, including increased regulation, financial innovation, changes in expectations about relationship banking, and more. Economists haven’t identified which of these pressures is most important.

But one thing is certain: Smaller banks are feeling the pressure and dropping off at a very swift rate. If something doesn’t change, an already concentrated banking industry will get even more so in the coming decade.

Best,

Gavin Magor

Director, Weiss Ratings

Weiss Ratings LLC financial analyst Shane Moore contributed to this report.