The thing about Jim Bianco is he’s established a consistent presence on big-time financial TV without resorting to histrionics. He plays it straight. And that’s a pretty solid reflection of the work he does at his eponymous firm, Bianco Research.

His relative equanimity is the big reason why this short thread of his on Twitter Inc.’s (Nasdaq: TWTR) social media platform over the weekend resonated with me, and it only flashed brighter after I read Dr. Martin Weiss on Monday.

“My opinion of Bitcoin,” Bianco began his thread. “Bullish! A lot more upside.”

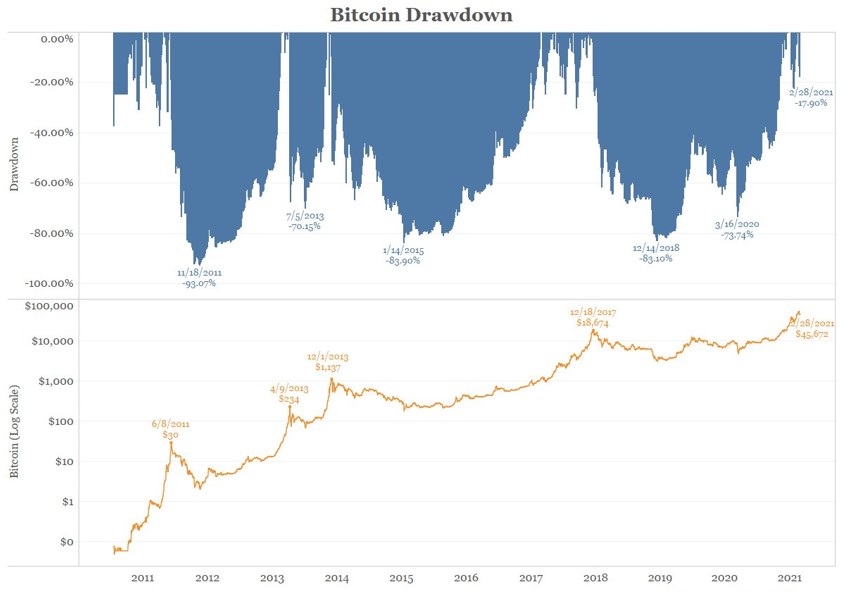

He provided context for Bitcoin’s recent correction: “Five times Bitcoin corrected 70% or more. Five times Singer gloated and said it. Five times it made a new high. Will likely happen again. My bet is not this pullback.”

The “Singer” Bianco invokes is billionaire hedge-fund manager Paul Singer, who said in 2018 that Bitcoin would one day be understood as “one of the most brilliant scams in history.”

My opinion of bitcoin. Bullish! A lot more upside.

— Jim Bianco (@biancoresearch) February 28, 2021

What about the Paul Singer's that want to say "I told you so?"

5 times bitcoin correct 70% or more. 5 times Singer gloated and said it. 5 times it made a new high. Will likely happen again. My bet is not this pullback

(1/x) pic.twitter.com/T3WmRETSea

More recently, in a Jan. 28, 2021, note to clients of his $42 billion Elliott Management Corp., Singer wrote, “We continue to press on for the day when we can say, ‘We told you so.’”

Well, today is not that day.

Here’s the graphic Jim Bianco used to illustrate his “bullish” point of view:

|

In follow-up tweets, he compared Bitcoin’s recent travails to Apple Inc.’s (Nasdaq: AAPL) and Amazon.com, Inc.’s (Nasdaq: AMZN) respective paths to trillion-dollar market domination, using similar graphs.

Here’s what he wrote about Apple:

BTC's pattern is typical of disruption. 1980 $AAPL went public. It had a 20 time gain by 1982 and Jobs was on the cover of TIME. It was indeed a transformational technology. But as the chart shows, for the 20 YEARS an investor had NO GAINS and five drawdowns of 68% to 82%!

Or $AMZN. By 1999 it had a 100 time gain and Bezos was POY celebrating e-commerce. If you agreed, you suffered 94%(!) loss in 20 months and was still down 67% NINE YEARS later. Keep this in mind with BTC, it is never easy to bet on disruption. Only looks obvious in hindsight.

That’s the key: “BTC’s pattern is typical of disruption.” As Bianco intimates in the last entry in his thread, this is for investors with big imaginations: “It is never easy to bet on disruption. Only looks obvious in hindsight.”

In his quest to see Bitcoin brought low, Singer also said the world’s No. 1 cryptocurrency is “not just a bubble. It is not just a fraud. It is perhaps the outer limit, the ultimate expression, of the ability of humans to seize upon ether and hope to ride it to the stars.”

I’d say it is an “outer limit,” an “ultimate expression,” and the best version of that promise is a replacement for a rickety old-school financial system that reflects a world gone by. Something short of that, even, says we’ll at least see more competition, greater efficiency and more freedom.

(I’d also say it must be more than coincidence that Singer dropped “ether” in there; he surely too must be obsessed with Ethereum, the lynchpin of the “decentralized finance” revolution whose token is called “Ether.”)

Here’s how Alex Benfield framed the current situation in the Friday issue of Weiss Crypto Alert:

At this point, this week has taught us plenty about the inherent volatility of the cryptocurrency market.

Parabolic price runs come hand in hand with swift corrections. It’s much, much easier to swing-trade crypto markets as medium-term momentum shifts between the bulls and the bears than to day-trade them. If you strategize properly, cryptocurrency’s volatility can work to your advantage.

That being said, it’s obviously anybody’s guess as to where prices will go in the short term. Any insider can tell you the market’s direction over the course of five or 10 years. Guessing the direction over the next five or 10 hours is a whole other ball game.

What you can do as an investor is prepare yourself for what might come. In this case, that means readying for a potential drop of another 10% to 20% in Bitcoin and the overall market. Bear in mind, of course, that we’ve also forecast that the crypto market has much room on the upside over the course of the next 12 to 18 months.

In this context, a potential drop of 10% to 20% from here should be treated as a potential buying opportunity.

It will surely be interesting to see where the market goes in the short term. But it’s nowhere near as exciting as where things are going in the long run.

I’ll be keeping an eye on where Bitcoin and the rest of the crypto market goes from here. Savvy investors should consider doing the same.

Best,

David Dittman