6,600% Jump by Underdog Is Warning Shot for 5G Wireless Boom

Crazy-fast, next-generation wireless networks are coming, and they will change everything.

Sure, we have heard this before. Experts promised big things from 2G, 3G and 4G LTE. But 5G, which is short for “fifth generation,” is different because it’s an exponential improvement over what we have now. This means many of the jaw-dropping technologies of the future now become possible.

Connected and self-driving cars, smart cities, rich virtual reality experiences, delivery drones and billions of Internet of Things devices all await the stable, low-latency network 5G promises.

The business opportunities for a network 40 times faster and more stable than 4G are almost unlimited. So it makes sense that wireless networks are all-in.

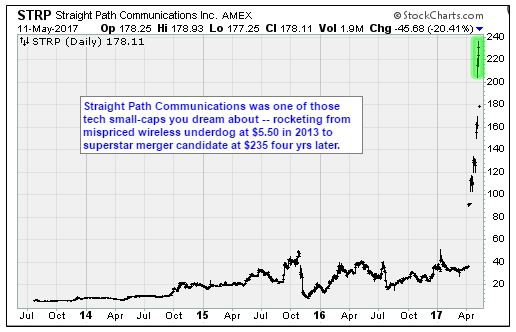

This week Verizon (VZ) bested AT&T (T) in a bidding war for Straight Path Communications (STRP). The tiny Glen Allen, Va., company had the foresight to gather the most valuable commodity in the race to 5G: 29 GHz and 39 GHz millimeter spectrum.

In October, the company had nine employees and an enterprise value of $400 million, based on its $36 share price. Then in April, telecom giant AT&T bid $95.63 per share. And in early May, its rival, Verizon, lifted the bid to $109.64, and then again to $135.96, and ultimately sweetened the offer to $184. With that offer, Straight Path suddenly had a value of $3.1 billion.

It’s a success story common to this era. Entrepreneurs are finding that old business rules don’t necessarily apply. There is value lurking in many unlikely places as big companies with deep pockets seed what some are calling the “Fourth Industrial Revolution.”

Finding the emerging technology companies that will play outsized roles has certainly been my focus. I comb research reports, newswires and corporate reports, looking for clues. They are the names that show up in my reports to members.

Straight Path was on my radar for the past two years. It was almost one of the signature first picks of my tech stock trading service. But even a veteran like myself ultimately decided to back away, as the 5G promise seemed too good to be true.

Most expect 5G will not officially roll out until 2020. Even if that is so, it turns out that investors can … and should … get ready now.

In the first part of the buildout, infrastructure will be key. Earlier this year, Verizon said 5G trials would begin in 11 U.S. cities by summer. And this week, its project in Ann Arbor, Mich. — with partners Samsung and Cisco (CSCO) — demonstrated efficacy for a multivendor setup.

Ultimately, 5G won’t just replace wireless networks. It will replace fixed broadband infrastructure, too. This means millions of new antennas, switches, modems and other gear built by undiscovered or underappreciated emerging technology companies. Later, it will mean new software applications.

It’s a fresh upgrade cycle not yet priced into the markets because many believe 2020 is too far away.

They are wrong. Winners are already being determined. Waiting to invest will be too late. It’s less than three years from now. Consider how recent 2014 seems. Three years is nothing.

If that doesn’t make sense, it’s the same reason many didn’t see the value in Straight Path.

We are in the midst of the greatest investment opportunity since the last Gilded Age. Connection to the Internet has changed the way we live and work. It has also created entirely new industries. As connections become exponentially faster, even more new opportunities will arrive … and multiply.

The first step is finding the winners who rise out of 5G deployment. I’m on the case.

Best wishes,

Jon Markman

P.S. To be among the first to hear about the potential winners of the coming 5G rollout, you have to be a subscriber. Click here to make sure you don’t miss a single recommendation!