Mark Fields is out as the top man at Ford (F).

Conventional wisdom puts the blame somewhere in the vicinity of Elon Musk, CEO at Tesla (TSLA). Don’t believe it.

The auto business faces a perfect storm of falling prices, rising competition from used vehicles, and a potential avalanche of dodgy loans.

How key stocks react will set up the future for investors. And the direction may surprise you. Let me explain.

U.S. auto companies continue to sell a lot of vehicles. The Automotive News reports that automakers sold 17.5 million vehicles last year, a record. It was the seventh consecutive year of growth.

Unfortunately, dealers must work really hard to move new cars these days. Buyers want incentives. They refuse to pay sticker prices. And dealers can forget about margin-fattening extras like undercoating and prep packages.

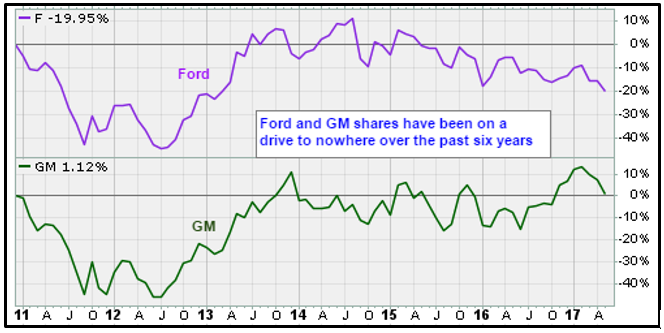

As a result, autos sell for less on average and with lower profit margins. That’s doing a number on internal business metrics. It’s reflected in the weakness for Ford and General Motors (GM) shares. Both are down this year. In fact, Ford swerved to near five-year lows.

Meanwhile, used-car prices are plummeting. Part of the problem is past prosperity. After all of those years of sales growth, dealerships are flooded with used cars as owners trade them in or sell them outright. Plus lots of cars and trucks are coming back off lease.

Rental outfits like Hertz (HRZ) are adding to the glut. The company curiously chose to focus on more expensive SUVs while it faced fierce competition from well-financed ride-hailing startups.

Now, it’s selling off fleets in a weak used-car market, putting even more downward pressure on the prices for both used and new cars.

As if all of that was not bad enough, the auto loan market looks a lot like the subprime mortgage market before the financial crisis. In a research report, Larry Jeddeloh, analyst at TIS Group, notes lax underwriting has creeped into the market for asset-backed securities.

Stop me if you have heard this before.

Santander Consumer USA, the biggest consumer-loan company in the country, has $15 billion worth of outstanding loans. To sell off its portfolio of asset-backed securities, it has been packaging loans into high risk/high reward pools. The average loan is 16% annually, with a more than 70-month term, loan-to-value ratio of 110%, and borrower FICO score less than 600. Not good.

According to reporting from Bloomberg, Moody’s revealed Santander verified incomes for only 8% of applicants for its high-risk pools.

These asset-backed securities had been rated Aaa as recent as February, and found their way into many conservative portfolios.

This should be the point where investors flee most consumer-credit and auto stocks. You certainly have to feel for ex-Ford CEO Fields. He was in a tough spot. No amount of smooth, happy future Musk talk could have helped.

The outlook is grim. Auto stocks should decline given the fundamental outlook. However, if they stop falling and stabilize, something important is happening.

I’m not saying that will happen. But it could.

This is one of the important lessons from Jesse Livermore, the trading whiz fictionalized in Reminisces of a Stock Operator:

Pay attention to the market. Just as stocks should rally on good news, they should remain weak against the backdrop of bad news.

Pay attention to the market. Just as stocks should rally on good news, they should remain weak against the backdrop of bad news.

When this is no longer true, sellers have been exhausted.

I expect the news cycle for auto stocks will remain lousy for the foreseeable future. It will be important to monitor how the key issues perform. Looking for important divergences is one of the benefits I bring to members of my Pivotal Point Trader service.

Livermore famously observed that the market tries to trick the greatest number of people possible. My job is to make sure that doesn’t happen so that investors can stay in the driver’s seat.

Best wishes,

Jon Markman