Bitcoin’s (BTC) future is brighter than a glistening sun beaming on the ocean.

Skeptics don’t understand the bigger picture when it comes to the bellwether cryptocurrency. But don’t let the naysayers or Bitcoin’s recent weakness distract you from the bigger picture … I believe that it will ultimately trade much higher.

Jamie Dimon, CEO at JPMorgan (NYSE: JPM), America’s largest investment bank, said that he believes Bitcoin — the largest crypto by market value — will be regulated by the government.

He also said he thinks Bitcoin is worthless.

• Dimon’s right about regulation, but completely wrong about price … which is ultimately headed much, much higher.

Dimon is a longtime crypto skeptic. Either he’s still missing the point … or he’s talking his book.

I guess the saying may be true … you can’t teach an old dog new tricks. Dimon just isn’t getting it.

|

| Dimon has been CEO of JPMorgan since 2005. Source: Finextra Research |

The point of Bitcoin is its finite supply. There will only ever be 21 million created which in turn creates scarcity — a great driver for price appreciation. So far, 18.22 million have been mined.

On the flipside, the world is awash in fiat currencies that are not bound by any supply constraints.

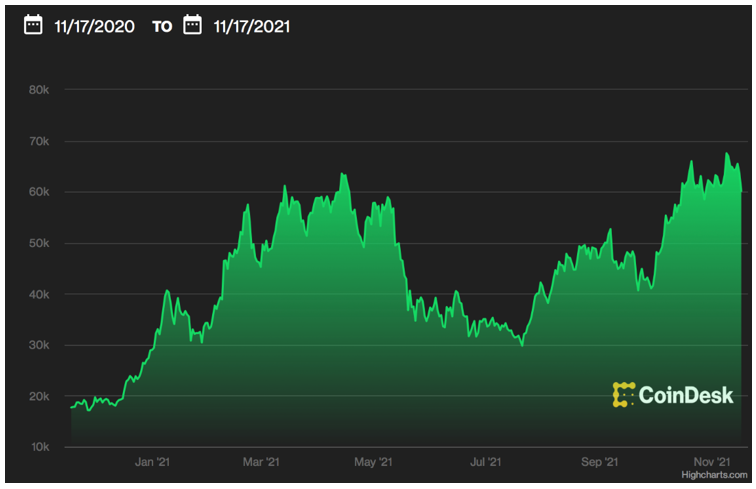

|

| BTC is up around 240% over the past year. Source: CoinDesk |

• This works well for money center banks like JPMorgan.

Currently, the Federal Reserve is buying $120 billion worth of fixed-income securities every month. Some of these purchases are mortgage-backed securities. Others are Treasury bills and even bonds issued by companies like Verizon (NYSE: VZ) and Apple (Nasdaq: AAPL).

These real-world assets are being acquired by the Fed in purely digital transactions.

• The Fed isn’t using money, per se. It is creating it, digitally. And the supply is unlimited. That’s a recipe for eventual disaster.

In April, Fed Chair Jerome Powell told “60 Minutes” the central bank has the ability to create money through the purchase of real-world securities.

This process increases the money supply, providing liquidity. Powell also freely admitted that at the onset of the COVID-19 pandemic, the Fed simply flooded the system with money.

This signals a major alarm that the current system is broken.

Related Post: Bitcoin Gets Even More Real as Germany Gives Blessing

With the banking system vulnerable in the aftermath of the Great Recession, the Fed began digitally printing money at breakneck pace.

Ultimately, that liquidity averted a catastrophe … yet the real crisis was just delayed because our current fiat currency is worthless … technically.

• And that’s a major reason why Bitcoin was born.

Bitcoin is based on math, decentralized authority and the idea that currency should not be unlimited.

Like I said, the amount of Bitcoin is finite and its scarcity will only increase its inherent value like that of diamonds or gold.

That scarcity is embedded in the code. Every digital coin is added to a public digital ledger called the blockchain. These cryptographically secure entries can’t be altered or deleted, making the system trustless.

• Skeptics often argue Bitcoin was created out of thin air, which isn’t true at all. If anything, our fiat currency was created out of thin air.

Actual Bitcoins must be mined using a rigorous cryptographic process. That’s far more stringent than the opaque process the Fed uses to create an unlimited supply of fake money.

In the end, it’s investors who get to decide the value, and that’s what’s really important. It’s why Bitcoin is here to stay for the long run.

And what’s worse? Saying one thing and doing another.

• JPMorgan has actually been bulking up on its exposure to cryptocurrencies.

Beginning in August, the wealth management division permitted crypto purchases for its well-heeled clients. The firm now has a fully staffed array of crypto analysts serving institutional clients.

That last bit is extremely important … Bitcoin is being bought by pension, insurance and hedge fund managers. There is a real constituency of professional investors who clearly do not believe the cryptocurrency is worthless … in fact, just the opposite.

This brings me back to regulation.

• Dimon is right about that. Regulation is coming.

The Biden administration has been clear that Bitcoin is an asset class and holders will have to make disclosures and ultimately pay taxes, according to a report at Bloomberg.

Custodians like banks and trust companies will also face “know your client” (KYC) regulations to prevent money laundering.

That’s a good thing.

Clearing out fraudulent crypto players will increase legitimacy, which will in turn attract even more professional investors, leading to higher prices as those deep pockets chase a finite number of Bitcoin.

Related Post: Coinbase Is a Great Way to Bet on Crypto

Bitcoin is currently trading at $58,193.70.

|

| Source: Coingecko |

Savvy investors should strongly consider having some exposure to crypto in their portfolios.

In the past, I’ve recommended both Coinbase (Nasdaq: COIN) — a wildly profitable crypto exchange — and MicroStrategy (Nasdaq: MSTR), an enterprise software firm that’s acquired 105,085 bitcoins at an average cost of $26,080 to my Weiss Technology Portfolio.

There’s no other way to put it: Bitcoin is here for the long run, and it’s time to embrace it.

Best wishes,

Jon D. Markman