Bitcoin’s Surge of Success is Anything but Cryptic

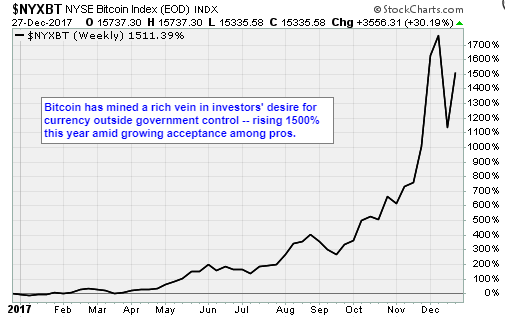

Trading near $14,000, Bitcoin is up 1,500% this year. And still, most investors would be hard-pressed to explain the monetary unit in a paragraph or two.

Cryptocurrencies are decentralized, peer-to-peer, transparent, and they can’t be faked. They are the perfect investment story for this era of populism, and public distrust of institutions.

Investors need to understand what is happening, and why. They need to be ready.

Bitcoin, the most visible cryptocurrency, was born in 2008 when a white paper authored under pseudonym Satoshi Nakamoto appeared on a cryptography mailing list. The big idea was a better electronic payment system, through the use of cryptography.

Nakamoto’s concept was sound. The underlying code was completely open source. The ledger system, called the blockchain, was transparent and permanent. As a reward for maintaining the ledger, coins are mined into existence through computer-assisted cryptography. The peer-to-peer network structure meant anonymity and no central authority.

In January 2009, the first 50 coins were mined.

It came into existence at a significant point in history. The financial crisis gripped the entire world. Stock indexes had plummeted. Wall Street institutions failed. Confidence in traditional fiat currencies, as a store of value, seemed more vulnerable than at any point in modern history.

Bitcoin brought hard and fast rules. It brought transactional transparency.

At the time, it seemed the perfect response to the instability of the central banking apparatus. Most people believe the money they earn, save and invest is backed by hard currency, like gold. In reality, paper money supply is unlimited.

It only has value because it is supported by the government that issued it. By contrast, the limit for bitcoin is 21 million coins. It cannot be duplicated, manipulated or forged because it is the product of a blockchain with complete transparency. And no one party or government controls bitcoin. It is the product of a distributed trustless consensus.

In that context, the inherent value of bitcoin is more clear.

Recently, some hedge funds have taken substantial positions. They see the cryptocurrency as an asset class much like gold, except with artificial scarcity. The trick is determining where something like bitcoin fits. Currently, one good guess is some multiple of the future value of all mined gold.

And that is where the math starts to get interesting. In 2011, the best estimate for mined gold since the beginning of human history was only 5.8 billion ounces. The current price is $1,280. That means the present value of all gold is approximately $7 trillion. If bulls are right, all things being equal, it is only a matter of dividing $7 trillion by the 21 million bitcoin limit.

That is a significant number. It explains the material demand for the cryptocurrency.

It does not come without risks. While the mechanics of blockchain are sound, transparency comes at a cost. The peer-to-peer exchanges are still woefully underpowered. There is also the problem of fraud, non-standardized transaction fees, and general cybersecurity for the exchanges.

In 2014, Japan’s Mt. Gox bitcoin exchange was hacked. Thieves stole 850,000 coins. The company later filed for bankruptcy. In 2016, Bitfinex, a Hong Kong-based exchange was hacked, leading to investor losses of $77 million. Earlier this month, Youbit, a South Korean exchange, was forced to close after suffering its second cyber-attack. Investors lost $73 million in coins.

Most important, these problems are getting worse as the stakes, and value of bitcoin increase.

Thus far, for my members, I have focused on more traditional ways to invest in cryptocurrencies. One company develops best-in-class semiconductors that are required to run the sophisticated software required to mine coins. Last quarter, the company had $140 million in sales to crypto mining operators.

Another company is investing heavily in blockchain. The distributive ledger that underpins bitcoin has many applications. Its transparency opens doors in healthcare, foodservice, banking and many other sectors. And one large public company is miles ahead of the rest of the market. The stock continues to quietly make new highs ahead of the rollout of a massive blockchain in development for a consortium of banks.

The bottom line is bitcoin, and the technologies behind its rise are real. Be ready. Cryptocurrencies are going to be bigger than most people imagine.

Best wishes,

Jon Markman