The cycles that accurately warned of the Great Depression and nearly every major investment since …

Are all sending the same shocking message: The most severe economic and geopolitical earthquake of this century is knocking at our doorstep.

Next week, Dr. Martin Weiss and Sean Brodrick will present their forecast of the nightmare ahead … and uncover investments that are designed to generate profits as this crisis unfolds.

To claim your free seat, click here now.

There's plenty of uncertainty driving the market right now.

Inflation, higher interest rates, the war in Ukraine, but another conflict is brewing right now in Asia.

- China is flexing its muscles, and it's bad for tech companies everywhere.

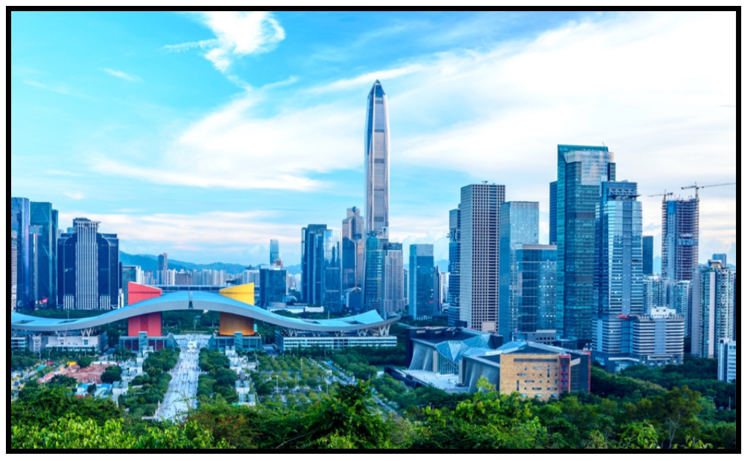

Due to rapidly rising COVID-19 cases, China is imposing a nonessential business lockdown in Shenzhen, the tech hub where most of the world's gadgets are made.

It's a shot across the bow for some of the major tech companies that do business there like Apple (AAPL), Amazon.com (AMZN) and Qualcomm (QCOM).

- The health of the global economy hangs in the balance. The ultimate losers will be Chinese firms.

It's wise for investors to steer clear of geopolitics.

Handicapping the political motives for leaders in Russia and China is difficult in the best of times.

The countries are deliberately tangled in the fabric of the global economy, providing metals, energy and inexpensive labor.

At the same time, the political landscape in those countries is far removed from Western ideals of liberal democracy.

Through globalization, previous Western leaders sought to provide a shared interest. The health of the global economy was supposed to ensure cohesion.

Manufacturing moved to China and millions of rural Chinese were lifted from poverty, while the West secured another rapidly developing marketplace for its goods and services.

The relationship was designed to be mutually advantageous.

- Unfortunately, political leaders in the West and China see the world quite differently.

These divergences are bubbling to the surface in the wake of the Russian invasion of Ukraine … and China is hinting it may have more in common with the invaders.

That's why the lockdown on Monday in Shenzhen is so important.

Shenzhen links Hong Kong to China's mainland.

In a little over 40 years, the southeastern port city has grown from a fishing village of 30,000 to a thriving metropolis of 17.5 million.

Its state-of-the-art, high-tech manufacturing facilities build everything from iPhones and Amazon Alexa smart speakers to thousands of other tech components bound for the West.

- The major issue now at hand? Hiccups in production that will cause lasting disruptions to the global supply chain.

Officially, the Chinese government claims the lockdown in Shenzhen is the result of "only 60" new COVID-19 cases, according to a report from ABC News.

Coincidentally, the new closures come at a time when U.S. State Department officials are pressuring Chinese diplomats to abandon the country's informal alliance with Russia.

It's not hard to see where all of this is headed …

- A new allegiance between Russia and China is forming.

Last week, the U.S. Securities and Exchange Commission (SEC) announced that the first of five Chinese companies have been asked to hand over accounting information to back up their financial statements.

The Financial Times notes that in total, some 270 firms could eventually be delisted.

All of this is bad news for investors in Chinese stocks. And it looks like it could get a lot worse.

What's one way investors can look to play this trend?

With the Direxion Daily FTSE China Bear 3X Shares (YANG) exchange-traded fund (ETF).

Shares are currently down around 60% since Tuesday, and this could be attractive weakness for some investors.

- Shares ran up a whopping 108% over the past few weeks, before recently falling back to normal levels in recent trading sessions.

I would argue some softening in rhetoric is the main cause for the recent tumble.

Savvy investors should consider adding shares using recent weakness. Just remember to always do your own due diligence before entering any trade.

Best wishes,

Jon D. Markman