Apple (AAPL) CarPlay is the latest victim of the global chip shortage, and its impact on the auto industry will be enormous.

Last week, the Automotive News Europe reported that BMW (BMWYY) car buyers are finding their expensive new vehicles can't connect to CarPlay or Android Auto, the two leading smartphone standards.

"Lost connection" is a perfect metaphor for the situation.

If you've driven a newer car in the last several years, you know that newer technology has become commonplace.

Modern cars and trucks are almost expected to come with all the modern conveniences like sophisticated navigation, advanced driver-assistance systems and state-of-the-art infotainment.

CarPlay and Android Auto are software platforms developed by Appleand Alphabet (GOOGL).

They let car owners link their smartphones, and run familiar applications like Google Maps, Waze, Pandora, Spotify (SPOT) and Apple Music. The platforms depend on compliant semiconductors and software.

The ongoing chip shortage is exposing the biggest weakness of the legacy automakers: They are not technology companies, and their reliance on tech is now turning out to be a major burden.

For most of the last two decades that skill set didn't matter … but now it does in a big way.

Tech & Auto: 2 Worlds Now Converged

Traditional automakers were good at making cars and trucks the old-fashioned way.

General Motors (GM), Ford (F), Stellantis (STLA), Volkswagen (VWAGY), Toyota (TM) and others built massive supply chains. They outsourced parts manufacturing, and even made many of those suppliers interchangeable. It was a bulletproof strategy to build vehicles at scale and keep competitors out.

Then the COVID-19 pandemic occurred.

Dangerous "Black Swan" events like the pandemic and war are sparking chaos and uncertainty in the markets. Dr. Martin Weiss has just issued a new warning about how these events have unleashed three great threats to investor's wealth. Click here to get the facts and discover his four steps for navigating this crisis.

Expecting slower sales, executives at legacy automakers cut orders for the semiconductors that power navigation, advanced safety and infotainment systems.

Chip suppliers obliged, and then moved on to orders from customers in the consumer electronics sector.

Automakers lost their place in the queue. They are paying for their lack of foresight to this day. But that's not the main reason I would avoid buying shares of most legacy automakers. It's worse.

Most auto firms are still not focused on integrating software engineering talent.

Almost two full years into the shortage, the industry is still dependent on solutions from third party software firms. It's a mess with no easy fix because auto execs believe outsourcing is an industry strength. It's not, just look at Tesla (TSLA)'s incredible success.

Tesla's Brilliant Blueprint for the Industry

Tesla has become a vertically integrated vampire in the automotive world, to switch metaphors.

Elon Musk maintained chip orders in 2020 and has since accelerated purchases.

When supplies ran short in 2021, he had company engineers rework the vehicle codebase to work with microcontrollers, according documents filed at the Securities and Exchange Commission (SEC).

Independence is a theme at Tesla. Its electric vehicles (EVs) have never directly supported CarPlay and Android Auto.

While Google Maps is licensed, the Tesla infotainment platform is proprietary. Smartphones connect via Bluetooth, an open standard outside the control of Apple, Alphabet and chipmakers.

A statement from BMW last week revealed that to maintain its production schedule, the company was forced to change to a different chip.

The Automotive News notes that silicon does not currently support CarPlay and Android Auto. The platforms have come as standard equipment since 2020 in most new BMWs. CarPlay and Android Auto are the link to the modern digital world.

Bad Could Get Even Worse

Auto company stocks have been weak in 2022, yet the worst may be yet to come.

The industry is drowning in debt. Interest rates are rising. The economy is set to contract. Production at the leading legacy automakers will surely follow.

Volkswagen, Toyota, Ford, BMW and GM owe $211B, $185B, $154B, $127B and $114B respectively, according to the latest financial filings. Tesla has only $13B in longer-term debt.

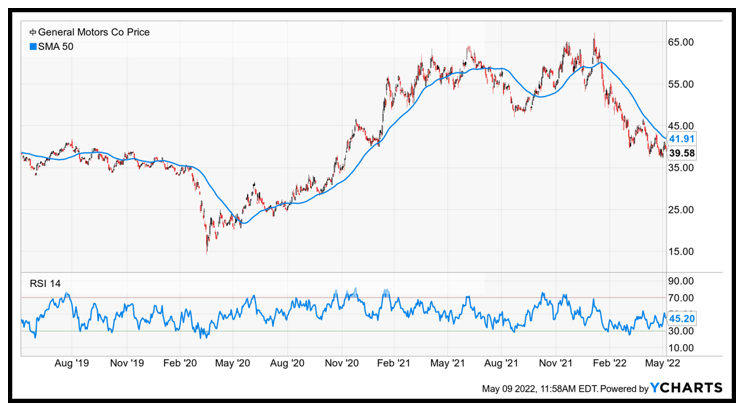

Investors should be especially careful with shares of GM, down 32.4% year to date.

Ironically, executives have pushed the company all-in on EVs at a time when sales of internal combustion engines cars are needed to service soaring debt levels.

A statement from GM in 2021 promised to only produce EVs by 2035. And the Detroit-based firm has 30 new EVs planned by 2025, at a cost of $27 billion.

Although GM shares are down 32.5% in 2022, existing GM investors should strongly consider selling into strength to protect capital. Remember to do your own due diligence.

Best wishes,

Jon D. Markman