Consumers Turn Cold on Brands. Here's What to Buy Instead

Big, iconic brands are dying. It’s the strangest thing.

Decades of advertising, with billions spent, are having no impact.

Brands used to be everything. Now consumers don’t care.

It makes this a perilous time for investors.

Amazon (AMZN) is playing a big role. The online giant’s business model is slicing-and-dicing through industry margins like a shiny new Ginsu knife.

Retail chains are shuttering stores at an epic rate. The mix runs the gamut from Abercrombie & Fitch (ANF) and J.C. Penney (JCP) to Macy’s (M) and Sears (SHLD).

2017 is set to surpass the worst year on record for store closures. Some 6,163 stores closed in 2008. Compare that to just the first six months this year, when there were already 5,300 store-closing announcements.

Mall traffic declined 50% between 2010 and 2013. And with fewer stores to visit, that trend isn’t likely to reverse.

While suburbia is rife with zombie shopping malls, that is only half the story. Consumers now routinely refuse to pay up for what they used to consider tried-and-true products.

Catalina, a research and marketing group to the grocery industry, found 90% of consumer-packaged-goods companies are consistently losing market share.

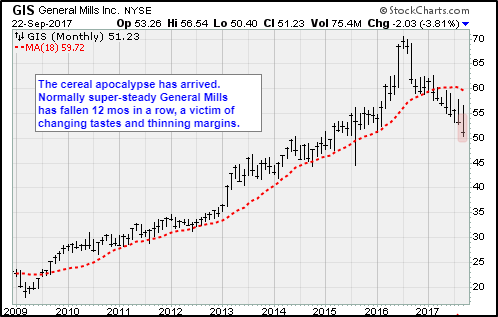

For example, check out the chart above for General Mills (GIS). As you see, it’s no wonder that gloom stalks the shareholders of companies that hawk consumer packaged goods.

Sadly, the carnage carries far beyond Frosted Flakes and Kleenex. The pain extends to other leading brands in products like fashion, TV and washing machines. Even high-end carmakers are slowly bleeding market share.

The main reason: We are glued to our smart devices. Most people check their devices 150 times per day. It is also where shopping begins. And we are more likely to search for categories and features, than brands.

Need a warm coat for the fall? Try down-filled jacket. TV? Type “4K.” Washing machine? Front-loader should do the trick. When we need to power up that cute mechanical stuffed bear, you know the search begins with “batteries” — not “Energizer.”

Google’s entire business has been built on selling these key words to advertisers. And Amazon is only too happy to direct shoppers to its own brand, — called “Basics.”

AMZN quietly launched the private Basics label in 2009. By 2016, Basics became the most popular brand of batteries sold online — without a lick of traditional advertising.

Investors are wise to pay attention. In this era, a big, well-known brand is not nearly enough. It may even be a hindrance. And getting stuck in one of these stocks is a death sentence for your portfolio.

On the other side of ledger, opportunity awaits. While the mega-brands have stagnated, nimble and focused companies continue to build market share and reward investors.

For example, while most of the consumer-packaged-goods industry contracted, one company used smart, strategic acquisitions to leverage its poultry franchise into pork, beef and processed foods.

The company now dominates entire categories with a diverse portfolio of brands. The strategy is a winner. Market share and cash flow are surging.

Another company has been helping transportation and logistics companies navigate international red tape for decades. Now Descartes Systems Group Inc. (DSGX) uses that experience to manage supply chains in real time. The evolution is natural.

Such nimble, focused companies come from every sector. They have been able to build amazing franchises because they dominate their niches, often holding several brands within the same category.

It’s corporate sleight of hand. It’s also a margin and profit bonanza.

Those profits mean share buybacks, dividend increases and more strategic acquisitions. It’s a great combination for shareholders.

And that is the irony …

Iconic brands are supposed to be tried-and-true, beyond reproach. However, with few exceptions, the companies you should be buying — like water-heater maker A.O. Smith Corp. (AOS) — are not iconic. They are pragmatic. They continually disrupt and challenge their own businesses. They employ a multi-brand, market-domination strategy.

They do what it takes to maintain or build market share along with profitability. And in the process, they make shareholders rich.

Best wishes,

Jon Markman

P.S. My subscribers are sitting on 3% and 11.5% gains, respectively, in A.O. Smith and Descartes. And that’s just after two months in these positions! I’m getting ready to unveil my next knock-it-out-of-the park opportunity to my subscribers. To make sure you’re on the list to receive my next recommendation, the very moment I send it to my subscribers, click this link here.