Terra (LUNA), an important digital coin in the Terra ecosystem that was supposed to be pegged to the U.S. dollar, crashed last week to near zero, and it's having a far-reaching impact on stocks, bonds and other risk assets.

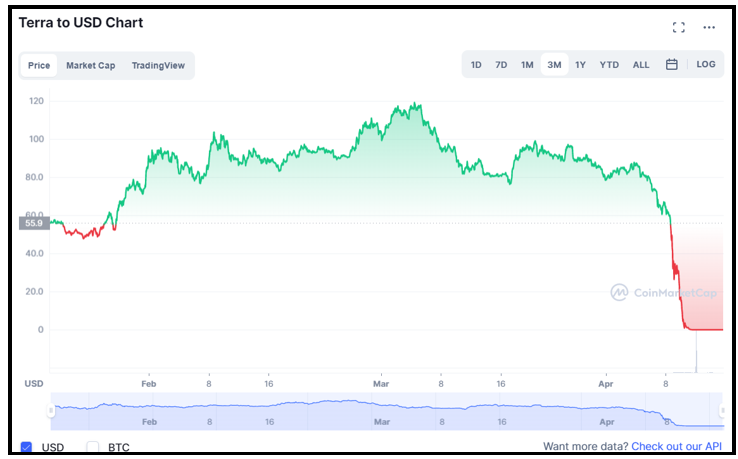

LUNA has fallen from $116 in April to $0.000167 as of writing. When the UST peg broke, panic ensued, and investors sold risk assets of all stripes.

For many investors, this contagion effect feels like déjà vu. The Russia and Asia currency crises of the 1990s roiled markets and wiped out fortunes.

The news seemed to come out of nowhere … then everything suddenly went off the rails as investors learned about exposure at money center banks in the U.S. and in Europe.

With all the volatility and uncertainty happening in the world, investors need income they can rely on. One of our senior analysts, Mike Larson, has the answer.

Mike and his team spent two years and over $3 million building, testing and perfecting a method for identifying winning trades every week. Today, this system identifies opportunities to collect an average of $1,000 or more from the markets almost every Friday, with 98% accuracy.

If this is of interest to you, Mike is hosting a special Masterclass event demonstrating how anyone can use this method on their own. Click here to see how it works.

A Valuable Lesson for All Investors

Crypto has become a substantial investment category in a short period of time. It's the perfect trap for performance chasing among leveraged professional money managers.

To get a better understanding of the situation at hand, let's start with Terraform Labs.

The blockchain project was developed by Do Kwon and Daniel Shin, graduates of Stanford and the University of Pennsylvania, respectively.

Related Post: Crypto's First War

The pair thought they could disrupt the global payments system with a low cost blockchain alternative. To eliminate cryptocurrency volatility, Terra engineers built a suite of decentralized digital coins pegged to real world, fiat currencies like the U.S. dollar, Korean won and the euro. The twist was these so-called stable coins were not backed by actual fiat currency holdings.

The peg was maintained by a clever arbitrage relationship with LUNA. The Terra ecosystem permitted unlimited swapping of LUNA for UST, and vice versa.

If UST deviated from its $1 USD peg, traders would be incentivized to buy or sell LUNA outside of the ecosystem, then swap it for UST inside the Terra ecosystem for a low-risk profit.

This model — called mint and burn equilibrium — depended on economic incentives to stabilize UST, while dynamically adjusting the supply of the underlying parts.

The weakness of the system was that investors were at the mercy of the external market for LUNA coins. If confidence waned or the price fell precipitously, investors would be further incentivized to keep selling LUNA to swap into UST, creating a death spiral of sorts.

Anchor was the third rail in the Terra ecosystem. It existed to create demand for LUNA and UST. Anchor offered investors huge incentives to park assets in the ecosystem. It was essentially a Terra savings account with a promised 20% annualized yield.

In hindsight, UST, LUNA and Anchor were all too good to be true.UST was supposedly pegged to the U.S. dollar, although the structure held no dollars.

UST was interchangeable with LUNA, yet neither was supply-constrained. And Anchor offered savers a 20% yield. The ecosystem worked so long as LUNA coins were increasing in value.

Once the value started declining, problems quickly ensued. In early April, the alternative coin soared to $116. Now, a month later, it's practically worthless.

Bloomberg reported on Sunday that Terra investors might've lost $45 billion in the grisly collapse.

The financial disaster revives memories of the Asian and Russian currency crisis. These catastrophic financial events began as isolated regional currency crises created by overextended governments.

They ended as full-blown contagions as professional investors globally were forced to reveal, and later unwind their exposure.

Learn From Past Fallouts & Be Cautious

History doesn't repeat itself, but it often rhymes, and a past situation comes to mind that's eerily similar to what's happening now.

Long Term Capital Management (LTCM) was a wildly successful hedge fund founded by John Meriwether, a renowned bond trader, and Myron Scholes, a Nobel Prize winner, in 1993.

LTCM used extreme leverage and arbitrage to promise big returns to investors. The strategy hit a snag in 1998 when the Russian bond default threw debt markets into a tailspin.

Related Post: How to Invest in the Internet's Future

At the time, LTCM held approximately 5% of the global fixed income market. The unorderly demise of LTCM would've triggered a worldwide financial crisis. The Federal Reserve ultimately engineered a $3.65 billion bailout loan, but the S&P 500 succumbed to a 19.3% decline.

This should serve as a lesson to investors: Big blowups like Terra usually lead to bigger blowbacks in the investment community. It looks like it's time to tread carefully while investors await the fallout.

If history is any indication, a time of great reckoning could be coming both in crypto and other conventional assets linked to it through margin loans or collateral.

Best wishes,

Jon D. Markman