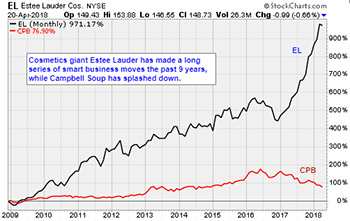

Estee Lauder Grows Sales Unlike These Other Iconic Brands

You might have noticed that iconic consumer brands are struggling in the stock market this year. And the prospect of immediate improvement is grim.

Just look at Philip Morris International (PM), which sells Marlboro cigarettes outside the United States. The company announced a first-quarter earnings beat last week. But managers said sales of new tobacco products fell short of expectations. This sent PM shares down 15% and knocked the wind out of competitors’ stocks as well.

It’s a lesson for investors. Growing sales is hard work.

For tobacco companies, the writing has been on the wall for a long time. Most western governments are hostile, so marketing has shifted east … and to the developing world.

But even that is not enough, especially as the U.S. government considers putting additional regulations in place.

The bottom line is that, for cigarette and e-cigarette makers, sales growth is slowing.

Philip Morris bet $4.5 billion on iQos, a cigar-sized metallic sleeve that accepts special tobacco sticks. The electronic device heats, but does not burn, the tobacco. The company claims slipping a butt into iQos gives a smoker all of the benefits of lighting up, without the harmful side-effects.

It’s a dubious claim, but the stakes are high.

iQos is clearly aimed at technology-conscious, early adopters. The problem is that people are just not buying.

Brands that used to be able to skate by on name recognition and clever marketing are having a tough time getting consumers to buy new, high-margin products.

Mm! Mm! … Not ‘Good’ …

You know the Campbell Soup (CPB) “Mm! Mm! Good!” slogan. It’s something you might hear from consumers. But, these days, it’s probably not something an investor would say about the stock.

In February, Campbell’s reported dismal second-quarter financial results. Gross margins were down 2.2 percentage points, to 35.2%. Denise Morrison, chief executive officer, complained about higher supply chain costs, inflation for raw materials and lower sales.

She’s being generous, to herself.

Now, the company did enjoy some good news last week, when the Reputation Institute ranked Campbell’s at the top of its 2018 U.S. RepTrak 100 list. That’s the first time the company received this honor.

But, like Philip Morris, Campbell’s cannot count on reputation alone to turn a profit.

Campbell’s is failing because consumers are not buying Bolthouse Farms, its super-premium band of salad dressings, juices, protein drinks and soybean plant milk. And the brand hasn’t been living up to the company’s expectations for several quarters.

The situation is dire. Morrison says retailers have started reducing shelf space.

In 2012, she was so excited about the prospects, Campbell added $1.55 billion in debt to acquire the Bakersfield, Calif., company. It was supposed to offset continued weakness in the core soup business.

Morrison was wrong, obviously.

Great companies meticulously stitch together competitive advantages. Their managers understand the needs of their core consumers, and they use strategic acquisitions to impede disruptors.

Those kinds of companies continually grow sales, protect their operating margins and create lasting shareholder value.

I have a list of such companies.

I call them The Power Elite because their managers have built elite franchises that continually evolve with the market. They use their power to grow sales. And they make their shareholders richer.

The shares of these companies are not often on sale. They are too good. But it is important to have a list, just in case.

Here’s a name that fits the bill nicely …

A Company That Believes in

‘Bringing the Best to Everyone We Touch’ …

And This Includes Shareholders

Estée Lauder Cos. (EL) is best known for its lines of skincare, makeup, fragrances and haircare products.

The company operates in the same sector as Philip Morris and Campbell Soup (consumer discretionary). Yet it has been immune to corporate missteps.

Managers have made one great decision after another, to the delight of shareholders.

In the 1960s and 1970s, the company built paradigmatic brands in Aramis and Clinique.

When celebrity designers transcended brands in the 1990s, Estée Lauder secured licensing agreements with Tommy Hilfiger and Donna Karan for fragrances and lotions.

When boutique cosmetic makers began to make inroads, the company acquired MAC Cosmetics, a maker of natural makeup; La Mer, a skin crème developed by the physicist Dr. Max Huber; and Bobbi Brown Cosmetics, an upstart line developed by the famed makeup artist.

In the 2000s, it worked out licensing and product development deals with rising stars Michael Kors and Tom Ford.

Since 2010, Estée Lauder acquired Smashbox, Rodin, Becca Cosmetics and GlamGlow. And in 2016, the company paid $1.45 billion for Two Faced, a fast-growing brand popular with millennials.

The strategy should be obvious. Estée Lauder managers let the market pick the winners; then it adapts. That way, they head off potential disruptors. In the process, the company gobbles up valuable cosmetic counter shelf space … plus a whole lot of mindshare.

The strategy is a winner. In 2017, sales advanced 5% to $11.8 billion. Free cash flow was $1.3 billion.

The 10-year compound rate of return is 21.6%. And the best is yet to come as many recent investments begin to bear fruit.

Estée Lauder is succeeding where other companies have failed because its managers are playing by a different set of rules. This is what great companies do to grow sales.

Best wishes,

Jon D. Markman

P.S. Want more investing ideas like Estée Lauder? You can get my timely buy and sell signals sent straight to your inbox when you become one of my Power Elite subscribers. Start here today.