On Friday, executives at Alphabet (Nasdaq: GOOGL) announced that the company is setting up Isomorphic Labs, a commercial venture that will use artificial intelligence (AI) to develop drug therapies.

Great companies — like Alphabet — use their scale and cash flow to invest in new businesses that can also scale quickly over time. It is a very likely path to grow shareholder wealth.

• Drug discovery and Alphabet might seem like an unlikely fit … but it’s actually the start of something very special.

Although the Mountain View, California, company earns the bulk of its profits from Google and its huge digital advertising complex, thinking of Alphabet strictly in those terms misses the point.

Alphabet is also a machine learning company … and a very, very good one.

Since the advent of Google, founders Larry Page and Sergey Brin used connected computers and algorithms to make sense of patterns in large amounts of data.

They built an internet search business in the era of ad-based search engines. Their algorithms were better than the rest. Scaling the business to dominate digital ads was the next logical step.

Page and Brin added other businesses that could scale quickly using Google’s networked computers, algorithmic prowess and advertising sales. Email (Gmail), YouTube and Google Maps were natural fits.

But those were just the tip of the iceberg when it came to acquisitions.

DeepMind, a cutting-edge AI company, was acquired in 2014 by Alphabet for $500 million. The London-based company was co-founded by Demis Hassabis, a former chess prodigy and neuroscientist.

Although DeepMind only had about 50 data scientists, engineers and researchers, its strong reputation within the AI community allowed Hassabis to effectively recruit talent, even away from Google at the time.

• But under the Google umbrella, DeepMind was able to truly blossom.

The company developed algorithms in 2015 to better simulate human-sounding speech. A year later, researchers were working on software for early detection of acute kidney injury and breast cancer.

In 2016, DeepMind made headlines when its AlphaGo algorithms defeated Lee Sedol in a match of “Go”, a strategy game that is notoriously difficult for computers to master.

• The biggest AI breakthrough at DeepMind occurred in November 2020 when its AlphaFold AI system solved the protein folding problem, a complexity that had befuddled biologists for 50 years.

Proteins fold as they develop. The seemingly random shape is closely tied to function.

In theory, the ability to predict these shapes in advance, coupled with DNA sequencing, should mean researchers are able to develop new drug therapies easier.

• And reimagining drug discovery is the exact focus of Isomorphic, Alphabet’s new for-profit business run by Hassabis.

In a blog post, Hassabis says that AI and computation will help scientists take their work to the next level. These tools will move past simply analyzing data and toward new predictive and generative models.

All of this could possibly lead to finding cures for some of humanity’s most devastating diseases.

And this should seem familiar ... it’s the same game plan Page and Brin used to accelerate the growth of Google from mere search to a powerful digital advertising behemoth. Better still, this business and others are hiding inside of Alphabet.

What investors often miss is how these companies are legit new businesses in their own right. They have chief executive officers, boards of directors and the ability to raise capital. In some cases, like with YouTube, they are enormous businesses ready to be spun out of Alphabet to the benefit of shareholders if the opportunity arises.

For example, YouTube has sales comparable to Netflix (Nasdaq: NFLX), a business currently valued at $287 billion. It’s also a leading player in streaming media.

• Isomorphic has similar potential in drug discovery. It’s a bet on future alpha in the purest financial sense.

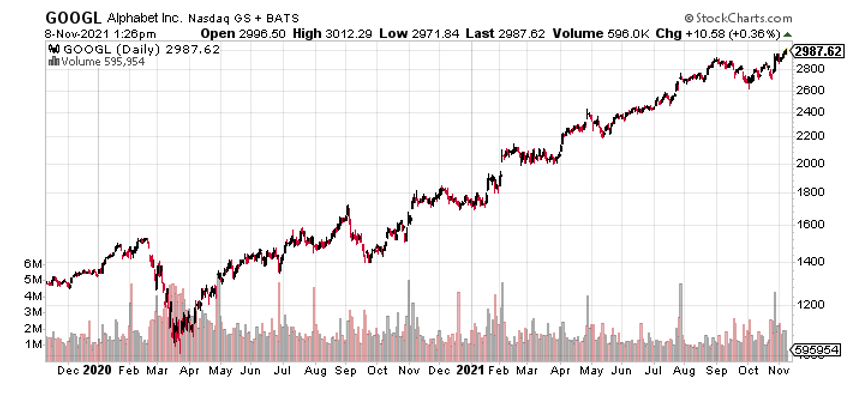

Alphabet shares currently trade at only 26.6 times forward earnings and 8.2 times sales. Even with the huge investments executives have made in the other bets, the overall operating margin is still an impressive 30.3%.

|

Shares recently traded at $2,897.40

This is a wonderful business that is inexpensive by any measure.

Longer-term investors should consider buying shares on any near-term decline.

Best wishes,

Jon D. Markman