By 2030, the United Nations wants everyone on the planet to have a digital identity. It’s an enormous task.

Microsoft (MSFT) and Accenture (ACN) have been tinkering with blockchain schemes for years. So far, their interest has been about financial tech.

Now they have an ambitious prototype that could give a digital blockchain ID to each of the 1.1 billion people who don’t have documented proof of their existence.

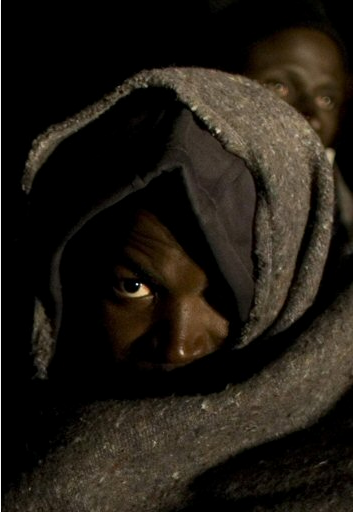

These people – who account for about one-sixth of the world’s population – live in social limbo. They’re excluded from many social, political, economic, educational and health programs.

Blockchain is secure, fast and flexible. And it’s also a huge opportunity for investors.

Bankers know this. That is why they have been falling all over each other to invest in platforms.

They see the potential to eliminate costly back-office operations. They see low-latency transactions and reduced counterparty risks. It’s banker nirvana.

Fatter profits, less fraud and fewer people shuffling papers.

It’s ironic the same technology might also solve the myriad problems that face refugees and their host countries. Driven from their homes by war or natural disasters, refugees often arrive in camps with little more than the clothes on their backs.

Without adequate IDs, it’s difficult for refugees to start new lives. Without uniform IDs for refugees, it’s difficult for aid workers to provide adequate services fairly.

To solve the problem, Accenture and Microsoft have joined to support ID2020, a program to give people digital identities. The program will use a secure database to store anonymously collected biometric data like fingerprints, iris and facial scans. Then Blockchain will link each individual’s data to a unique identifier. As people receive services, like healthcare, they collect digital stamps that are linked to that identifier.

It’s a win for all involved. Refugees get a dependable personal identity record. Host nations get a reliable account of services provided at distinct locations. Accenture gets to show off their biometric software platform. And Microsoft gets to tout the scalability of its Azure Cloud.

It also showcases the immense flexibility of blockchain. The distributive ledger system has its roots in Bitcoin. What makes it unique, and so valuable as a standalone technology is transparency.

In the simplest terms, blockchain is a heavily encrypted, permanent digital ledger system. It resides on many computer systems at once so it can’t be controlled by one entity.

Once data is added, each ledger post cannot be altered or revised in any way. Transactions, including corrections, can only be added. Nothing can be deleted from the record.

The result is complete transparency. Decentralization means there is less opportunity for fraud.

There have been plenty of public accolades. Price Waterhouse Coopers, the global accounting and consulting firm, called it a once-in-a-generation opportunity.

In a 2016 research report, PWC highlighted the possibility for a new breed of low-latency, financial contracts capable of self-executing. The cost savings would be staggering.

These instruments would remove the middlemen, literally.

Irving Wladawsky-Berger, a MIT lecturer and early IBM maven, went even further. He called blockchain the next major step in the evolution of the internet. He reasons that the internet is great, but doing business online still requires a large leap of faith.

With security and transparency, blockchain overcomes these limitations.

With all of the praise, you might think hordes of investors would be all over blockchain. Nothing could be further from the truth. Most investors are missing it. They believe it’s too complicated, too esoteric.

Finding emerging technology investment ideas that others miss is the service I provide to all my subscription-service members.

Blockchain is happening. It’s mobilized and a number of public companies have established important footholds.

One company is building a massive platform and attracting all the right partners in financial services. Another is pushing the technology into the Internet of Things. It’s merging the digital and physical worlds with a blockchain dose of checks and balances. Still another is building government software applications.

And that is just the start. Possibilities exist in biotech, natural resources and the military, too.

The time to add positions in the development is now. The potential market is enormous.

For a start, consider AccenturePLC (ACN) itself for your portfolio. It’s a $76 billion consulting firm based in Ireland that trades at an unchallenging multiple of 19.1 times next year’s earnings.

Best wishes,

Jon Markman