70% Gains This Year ... and Why We're Holding on for More

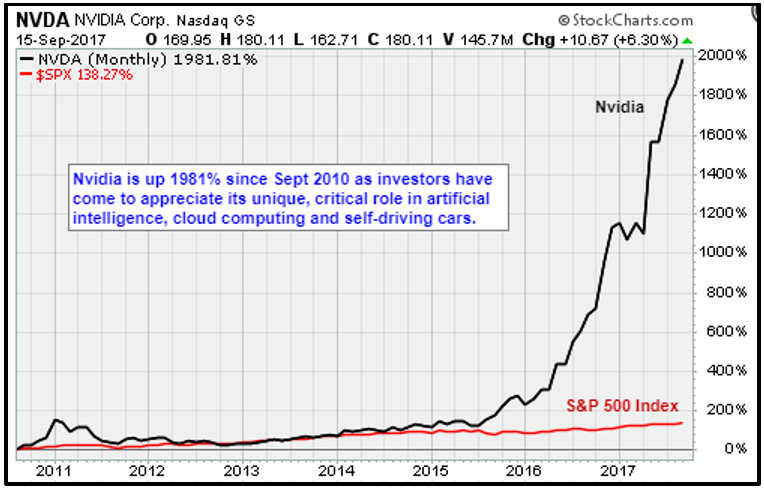

Shares of semiconductor-maker NVIDIA Corp. (NVDA) surged to a record high Friday of $180.11.

Some analysts are upbeat about new markets and the company’s lead over competitors.

The gains bring its market capitalization to $108 billion. Five years ago, the burgeoning artificial-intelligence giant was valued at only $6.9 billion.

The incredible performance is a lesson to investors.

Look for passionate, focused companies with dominant franchises. And, above all else, let winners run.

Founded in 1993, NVIDIA set out to build graphics hardware for PC video gaming. At the time, it was a tiny market, at best.

By 2006, PC gaming was booming and NVIDIA had established its leadership in the field. That’s when NVDA released CUDA. The innovative software architecture allowed game developers to program every pixel. It was an evolution in graphic design.

Today CUDA has moved way beyond hyper-realistic World of Warcraft landscapes and awesome Call of Duty explosions. It is the dominant deep-learning architecture.

Cuda’s already powering real-world, self-driving cars. In the future, it will be the brains behind smart-factory robotic systems and commercial drones.

It’s a huge market.

C.J. Muse, a research analyst at Evercore ISI, believes investors are still underestimating that potential. He also thinks NVIDIA is building an AI lead that will be nearly impossible to replicate.

Friday, he lifted his price target to $250, from $180.

Members of my Tech Trend Trader service have been NVIDIA investors for a while now. The stock has performed exceptionally well.

NVDA shares rose 69% this year, and 1,201% over the past five years. Although there have been periods of weak performance, neither the longer-term trends nor the fundamental outlook have changed.

It’s easy to sell winning positions. We are all well acquainted with the adage, “buy low, sell high.” But, there’s a problem with that old saw.

Historically, that’s not the way to make real money in the stock market. You must relentlessly cull losers. And, you must resist every temptation to sell winners.

Picking bottoms and tops is a sucker’s game.

The good news is there are plenty of NVIDIAs in the making. In the past, computing power and data limitations have been headwinds for AI development. Now they have improved enough to become tailwinds.

The companies at the eye of the gale, like NVIDIA, are about to win big.

Cameras, microphones, scanners, accelerometers and other sensors will collect the data for future AI systems. As these gizmos find their way into everything, sales will ramp up.

Recently I came across a video of Jen-Hsun Huang, the CEO and cofounder of NVIDIA, talking about the future of artificial intelligence. He was understandably bullish. He was even more enthusiastic about the role sensor-makers would play in the development of AI.

One company I track makes sensors to detect electric surge, vibration and mechanical shock. Sales shot up 21% last year. It has long-term business relationships with BMW, Dyson, Sony, Samsung and Caterpillar, among others. Another company makes precision force sensors used for weight applications. Another makes laser focus systems.

All of these companies are dominant in niche markets that are on the verge of exploding. It’s not hard to draw parallels to NVIDIA 25 years ago.

Successful longer-term investing is about finding dominant companies in high-growth parts of the economy, and then having the fortitude to hold on.

We are at the very edge of an explosion of useful new AI technology that will rival the investment opportunity of the commercial Internet in the early 1990s. Get in the game, and stay in the game.

Best wishes,

Jon Markman