Netflix (NFLX) is a perfect business. BUT, you absolutely should not buy its stock.

And I want to tell you why. But first, you need some background.

This month, Netflix (NFLX) did the unthinkable.

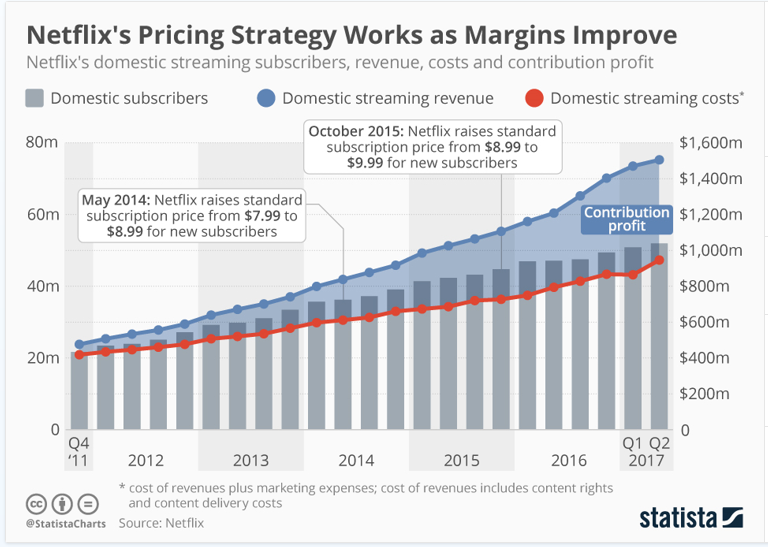

In a world of falling prices for consumable media, it raised prices. Ironically, the move will most likely have no impact on its business, other than fattening margins. In fact, the stock gained 5.4% the day the news came out. And just a few days later, shares moved above the $200 mark — an all-time high.

Netflix is a rarity. Its brand is so strong it has pricing power. And the media company has raised its prices four times so far.

In 2007, when Netflix was a DVD-rental company, it offered streaming as a free add-on. By 2009 streaming was so popular, the company launched a stand-alone streaming service for $7.99 per month.

Five years later, Netflix raised the streaming price to $9.99 for new customers, while still charging existing members at the old rate. In 2016, Netflix killed the legacy discount.

Now, all the streamers must pay $10.99.

Netflix executives argue that they’re giving customers good value with more engaging content. They point to the critical and commercial success of Netflix’s original programming. Shows like “House of Cards,” “Stranger Things,” “Orange Is the New Black” and “The Crown.”

In August, Variety reported that Netflix would spend $7 billion for content in 2017. The massive budget makes it the envy of Hollywood. And Shonda Rhimes – the hit-making producer behind “Grey’s Anatomy,” “How To Get Away With Murder” and “Scandal” – recently joined the fold.

Now, to be fair, Netflix’s customers have done plenty of grousing. Nobody likes paying more for something they are already getting.

For most companies, the combination would be the kiss of death. But, while Netflix customers complain about higher prices, they still don’t bail on the service.

As the chart below illustrates, they grudgingly accept higher prices.

The ability to pass along price increases is the cornerstone of some of the world’s most valuable businesses. Apple (AAPL), Alphabet (GOOGL) and Microsoft (MSFT) routinely find ways to increase the amount customers pay for their services.

Netflix is like those businesses in other key aspects. Its managers are relentless and focused. They stick to the things the company does well.

Today, Netflix is still in the business of delivering entertainment to consumers. The process has simply been reimagined with technology.

And as the business has grown, it has benefited from what’s called “the network effect.”

In the simplest terms, the network effect happens when:

As more people use a service, more people want to use the service. For example, many people buy iPhones because their friends have iPhones.

And many people stream Netflix so they can talk with friends about binge-watching the latest hit show, like the family crime drama “Ozark.”

The network effect is a powerful advantage and a key barrier to entry for new competitors.

In June, the streaming service topped 50 million subscribers in the United States. For perspective, that is more than cable TV.

Worldwide, subscribers have reached 100 million. With the price increase, most will be paying $10.99 per month. Imagine what that will do for cash flow.

BUT, investors should still steer clear.

As a great business, Netflix ticks most boxes. Demonstrably, it has been a great stock.

However, finding great stocks is the easy part. Making great investments involves strategies to maximize returns while diminishing risk.

My team uses data and decision science to thoroughly screen and research publicly traded companies. Of 4,500 stocks in our database, I have found only 70 or so that are really worth your time. (I just alerted my subscribers about two stocks to buy today. There’s still time to get in … click here to get started now.)

And of those, just a handful make sense at current prices. Most have simply risen too high, too fast. At this stage, Netflix shares fall into that category.

Best wishes,

Jon Markman

P.S. Have you signed up for The Edelson Institute’s three-day investment symposium yet? It’s going to give you solid, practical, protection and profit recommendations that are unavailable from any other source. It’s a FREE bonus event for our members. Registration closes at midnight tonight, so don’t wait to sign up. Click this link here and let us know you’re coming.