Jensen Huang is a big idea guy. He transformed a sleepy computer graphics processor company into an artificial intelligence leader. Now he wants to bring AI everywhere.

On Monday, NVIDIA Corp. (Nasdaq: NVDA) announced that the company will acquire ARM Holdings for $40 billion in cash and stock. ARM is a designer of the low power microchip architecture used for iPhones, Androids and other devices.

It’s a big bet on a world of ubiquitous smart chips and sensors.

It’s not the first time Huang bet heavily on a really big idea. He began betting on AI way back in 2006. Today, most investors take for granted that AI is transformative. But that was not the case more than a decade ago. NVIDIA was a smallish maker of graphic processor units for video game players.

Huang’s vision — and chutzpah — put the company at the forefront of a computing movement. He recognized that GPUs excelled at processing multiple small calculations in parallel. The development of CUDA, an open programming platform, allowed software developers to harness the power of GPUs to perform general processing.

The architecture made GPUs a natural fit for cloud computing and large providers like Amazon Web Services, Microsoft Azure and Google Cloud raced to add new hardware.

The acquisition of Mellanox in 2019 strengthened NVIDIA’s data center business. The Israeli company became the gold standard for intelligent, end-to-end connectivity products for servers, storage and network infrastructure. Its adapters, switches, cables, processors and software hyper-converge networks increase throughput while decreasing latency.

Huang told an interviewer that he envisions server farms transformed into an intelligent network: One giant compute engine, infused with AI

The ARM deal is the logical expansion of that big idea.

ARM might be the most important chip company in the world. The British firm operates behind the scenes, licensing the basic blueprints for other companies to design and build ultra-low power microprocessors.

Qualcomm Inc. (Nasdaq: QCOM) uses ARM licenses to build its Snapdragon suite of mobile chips. The same is true for Samsung and even Apple Inc. (Nasdaq: AAPL). Its A-series of chips power iPhones, iPads and soon will find duty in Macbook computers.

The attraction is an architecture that consumes extremely low amounts of power relative to its performance. It’s perfect for mobile computers, cars, robots and even smaller devices that operate the edge of larger data center dependent networks.

Imagine a world where remote sensors on bridges and lampposts communicate with vehicle networks to regulate traffic speed, or factory robots that independently schedule maintenance before parts wear out. The possible applications are endless.

Marrying ARM with NVIDIA, most notably with their AI and data center ecosystem, accelerates a new wave of computing possibilities.

“In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people,” said Huang in a press release.

This internet of things concept is not new. It has been percolating for a decade. NVIDIA is simply combining all of the ingredients to make it ready for actual widespread consumption.

At first glance, the ARM deal is a bit convoluted. SoftBank, a conglomerate holding company, bought the chip designer four years ago for $32 billion. Under the terms of the current $40 billion deal, SoftBank will become the largest shareholder of NVIDIA, which will pay $21.5 billion in common stock and $12 billion in cash.

Investors should focus on the relatively low cash outlay, and what the ARM acquisition means for the future of NVIDIA. The company now owns an ecosystem of AI capable software, hardware and architectures vital to both cloud, and so-called edge computing.

It means NVIDIA is in the process of supplanting Intel Corp. (Nasdaq: INTC) as the brain of modern computing.

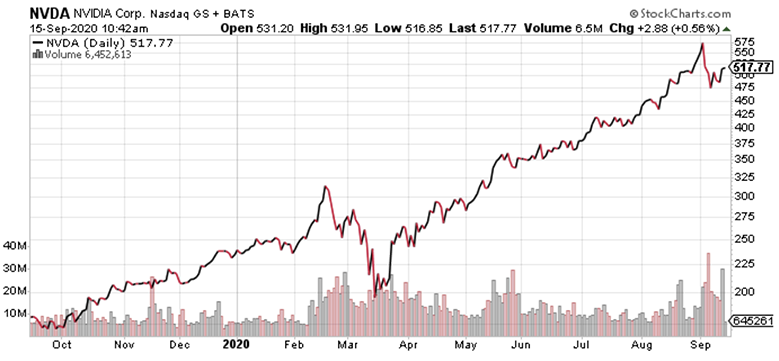

I recommended in March that investors buy NVIDIA shares on the synergies of the Mellanox deal. Since that time, shares are up 138%. The ARM acquisition is much more important than Mellanox. It’s the next big piece of the massive AI everywhere idea.

Shares are recently traded near $490.

Investors would be wise to buy shares into weakness.

Best wishes,

Jon D. Markman