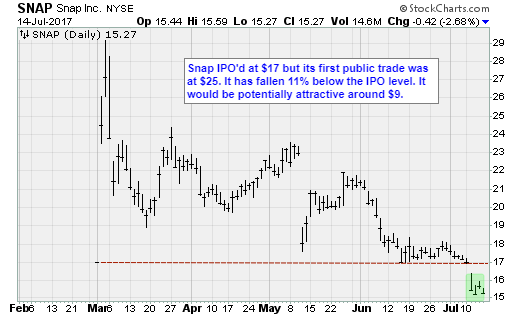

Shares of Snap Inc. (SNAP) crashed 11% last week after negative comments from a major Wall Street research firm.

Morgan Stanley chopped its price target from $28 to $16 for the popular smartphone messaging app. Analysts cited increased competition from Facebook (FB).

It’s an all-too-familiar pattern. Wall Street wants investors to buy high and sell low. (As you can see by the trading action, that’s exactly what happened.) It’s their hustle.

Don’t Get Caught up in That Hustle …

Snap is no stranger to controversy. It was the most-hyped Initial Public Offering since Facebook. Millennials fell in love with its unique take on storytelling. A formula of cryptic taps, swipes and augmented reality made it feel exclusive, fresh.

But the company has never made money. And as the IPO approached, losses swelled to $514 million. In the prospectus, Evan Spiegel, its boyish chief executive, warned that the company might never be profitable.

Never. Be. Profitable. Think about that. And think about the fact that profits are the market’s way of saying you are a useful part of the ecosystem.

What makes the Morgan Stanley downgrade shocking is its role in Snap’s $3.4 billon March IPO. It was the lead underwriter. Presumably, it was well-aware of the challenges. As investors clamored for the newly listed shares, those obstacles certainly did not deter its research department from setting a lofty price target of $28.

That analysis valued the company at $32 billion.

And Facebook’s quest to kill Snap is not new, either. The social media giant has been gunning for it since a rebuffed $3 billion buyout offer in 2013.

By 2016, it was copying Snap features. This year the process evolved to near-outright theft of the user interface.

Morgan Stanley missed this?

In 2003, the New York Times reported that the Securities Exchange Commission reached a $1.4 billion settlement with major Wall Street firms. The purpose was to bolster investor confidence in the independence of Wall Street research and investment banking.

At the time, analysts were suspected of being too cozy with bankers. Two rising stars, Henry Blodget and Jack Grubman, were fined a total of $19 million and issued lifetime industry bans.

It was a big scandal. Yet, not much has changed.

The relationship between Wall Street and retail investors has always been adversarial. The Street has other interests. Money managers and corporate underwriting candidates want to grab the big fees. Retail is for distribution.

The game is rigged.

And the buy-high-sell-low hustle is pretty much a Wall Street reflex at this point …

Last May, Goldman Sachs (GS) upgraded Tesla (TSLA) shares and raised its price target to $250. Just a

few hours later, the electric car company announced it was selling stock to the public in a secondary offering.

Oh, and Goldman was a lead underwriter in the offering!

Research and banking are supposed to be divided by a Chinese wall. The practice dates back to 1929. The goal is to stop professionals from using insider knowledge to profit in stock-market trading.

Unfortunately, the process is more sinister. It’s systemic, and has been around forever. The illustration above is from a magazine called The Ticker, published in 1908.

Wall Street is a business. It pulls together the raw materials. It sources manufacturing. Then distribution. Along the way, everyone involved gets to wet their beak, so to speak. Profits for everyone involved. When the product is ready, it marks up the price and sells retail.

Unfortunately, in this scenario, retail investors are suckers.

And it works the other way, too. Suckers need to buy high, and they need to sell low.

In his note to clients, Morgan Stanley analyst Brian Nowak explained he had “been wrong about Snap’s ability to innovate and improve its ad product this year.”

These are the facts:

- In June, the company signed a $100 million content deal with Time Warner.

- It’s actively seeking ad targeting acquisition.

- And it’s still adding innovative features to its platform like Snap Maps.

I’m not suggesting you go out and buy Snap shares on the Morgan Stanley downgrade. At least not yet. One of the services I provide to my members is helping them understand that being right about a stock too early is just as bad as being wrong.

I’m not even equating the fledgling company with Facebook. Buying “me too” stocks can eat through your wallet like moths in a sweater drawer.

However, both companies are following eerily similar paths. The same premature analyst cheerleading pump … followed by dump calls a quarter later.

I’m keeping a close watch on Wall Street’s hustle. I have seen this before. Just like Facebook was a buy after it had fallen 50% from its IPO level, there might be a price at which Snap — which is without a doubt popular among a vast array of users — makes sense.

Best wishes,

Jon Markman