What Do You Get When Big Data Meets AI? Big, Real Profits

In movies and novels, overnight success stories are frequent. Real life doesn’t work that way. It takes years of hard work, vision and at least one gigantic bet-the-farm moment.

This week, Nvidia Corp. (NVDA) released a $3,000 video card. But its big price tag isn’t the story.

The Titan V is a graphics powerhouse. Yet, is not meant for graphics. Its purpose is to extend Nvidia’s GPU computing platform to the next generation of workstations.

Investors should take note of this kind of forward thinking. This is what great companies do.

Jen-Hsun Huang, Nvidia’s CEO and co-founder, is comfortable with uncommon choices. Leather-jacketed and tattooed, his company cut its teeth two decades ago making high-end graphics cards for PCs.

But it’s come a long way since then. Its clientele, mostly gamers, demanded photorealistic imagery. So, Huang pushed the company to invest heavily in developing better software modeling.

And then … it clicked. Nvidia was sitting on a completely new method of computing.

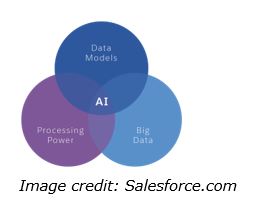

It used artificial intelligence to combine traditional instruction processing from CPUs, with data processing from graphic processing units.

This result did not come cheap. The New York Times reports that Nvidia has spent $10 billion developing its GPU computing platform.

Given the initial size of the company, that was a huge bet. One that continues to pay off, as the shares are up more than 5,000% since the 1999 IPO.

Today, GPUs are standard fare in the field of artificial intelligence. From university researchers to bitcoin miners, smart coders are using the platform to push the limits of learning. In the process, Nvidia has broken free of the cyclical nature of the chip business.

The company put itself in the business of solving big problems, using AI.

Fortune magazine just called Huang Businessperson of the Year. That’s cool … but a decade late.

Gartner, the global IT consulting firm, predicts migration to the cloud is a $1 trillion opportunity by 2020. Public cloud companies Amazon Web Services, Microsoft Azure and Google Cloud are all investing heavily in AI.

They see it as a value-added service — a way to entice corporate customers. And they want to make sure they are covering all bases. So in addition to their own CPU-based frameworks, each enthusiastically supports Nvidia’s GPU.

Consequently, Nvidia’s data center business is booming. In the second quarter, business surged 250% to $416 million.

Consequently, Nvidia’s data center business is booming. In the second quarter, business surged 250% to $416 million.

And then there are self-driving cars. The popular perception is that fully autonomous cars are decades away. However, Teslas equipped with the current-generation GPU gear can navigate most road conditions autonomously right now.

The industry has noticed. Nvidia’s Drive PX platform is in use at 225 car, truck and HD map makers. And Audi, Toyota and Volvo announced high-profile partnerships in 2017 as they try to keep pace with Tesla.

Given the size of these markets, the move to workstations might seem trivial. It’s not.

Titan V brings the same components found in Nvidia’s $10,000 data center compute cards, to the desktop. This means 5,120 compute cores, 640 machine-learning cores, 21 billion transistors, and the Volta GPU architecture.

All of this adds up to a monumental performance leap over everything in the marketplace.

It will allow researchers and developers to build AI software models right at their desk. More important, it extends GPUs into more applications.

And that will help Nvidia sell more hardware.

I pointed my members to Nvidia long ago. The attraction was not AI then. Rather, it was smart management. And sure enough, the company leveraged its graphics expertise into an entirely new way to solve complex problems. When the advantage was apparent, it bet big.

This is the attribute investors should seek. Great companies are focused. They leverage talents. When it’s clear they have a competitive advantage, they strike … and chew up the competition.

Nvidia shares have climbed steadily with verve, +1,432% in the last five years. Sales have increased by $2.7 billion, to $6.91 billion during that time. And all signs point to more upside ahead, as I believe the company will continue to find new applications for AI using GPUs.

The goal is not to find the next Nvidia. The current one still has plenty of runway left. But we do know that more Nvidias will emerge, and we’ll use our proven methods to find them … and invest in them for the long haul.

Best wishes,

Jon Markman