Decentralized finance — often referred to as DeFi — promises traditional financial products like loans and payment options without the high fees from banks and transaction processors.

Now, the Bank for International Settlements, a trade group for banks and transaction processors, is mounting a public campaign to expose the risks of DeFi.

Although the potential future benefits of DeFi are extraordinary, the organization’s points of concern are valid, which brings a unique opportunity to the table for investors.

Related Post: How Tesla Is Building an AI Powerhouse

That assessment might sound strange to some. I get it … traditional transaction processors are supposed to be the legacy companies being swallowed up in the race to DeFi.

That is not necessarily so.

The true strength of blockchain technology — the cryptographic digital ledger behind cryptocurrencies and DeFi — is that it’s trustless.

The foundation of blockchain is decentralized across thousands of computers. There is no need to place trust in any one entity for the network to function effectively.

- In theory, this eliminates trusted middlemen that earn fat fees.

Currently, Mastercard (NYSE: MA) and Visa (NYSE: V) operate businesses that are mostly about being that trusted middleman, and they do an incredibly good job at it.

Although credit cards are issued by local banks and financial institutions, all of the actual heavy lifting — millions of transactions per minute — are carried out on networks built by Mastercard and Visa.

These companies have become so proficient and trusted that …

- Credit cards are the preferred payment choice by 45% of Americans, up from 36% in 2019.

The great promise of DeFi is the elimination of trusted processors.

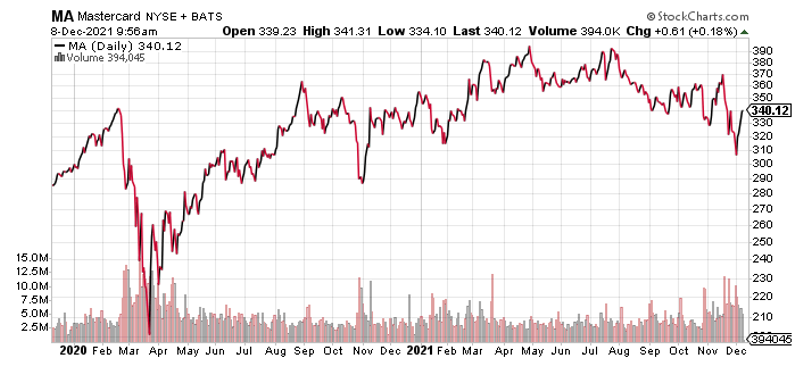

As an investment narrative, that idea is gaining steam. Even as business at Mastercard and Visa continues to grow, their shares have performed poorly.

- Like the electric vehicle (EV) versus internal combustion engine (ICE) paradigm, investors have bought into the idea that the disruptors must win the future.

The motor behind that sentiment in this scenario is the world’s second-largest cryptocurrency by market cap, Ethereum (ETH).

Ethereum is an open source blockchain technology that has become popular for its smart-contract functionality. It was conceived by Vitalik Buterin as an alternative to typical financial intermediaries like brokerages, banks and exchanges.

The platform was built from the ground up to work well with applications and allow the creation of non-fungible tokens (NFTs).

It’s cool technology and big tech innovators like Amazon.com (Nasdaq: AMZN), Microsoft (Nasdaq: MSFT), JPMorgan (NYSE: JPM) and even Visa have all dedicated engineers to DeFi development.

- The disconnect is that investors are betting the transition to DeFi is coming far sooner than is realistic. They are also wagering that traditional intermediaries — like Visa and Mastercard — will play no role in implementation.

Buterin is the first to admit the platform he conceived is not anywhere near ready.

Ethereum is notoriously slow, capable of processing only 20-50 transactions per second.

And the costs associated with performing those transactions — called gas fees — are outrageous. Simple transfers can cost $10, and making purchases often ranges from $50-$100.

- A third stumbling point: The most popular DeFi applications are neither decentralized nor secure.

This is the point being carefully made by Agustín Carstens, general manager at Bank for International Settlement (BIS).

CNBC notes that during 2021, these applications collected more than $100 billion in investor capital. According to Eliptic, a blockchain analytics firm, a total of 10% of those funds have been lost to theft and investor scams.

- Mastercard and Visa have robust networks that are capable of processing exponentially more transactions per second, and at a cheaper rate to the end consumer. They are also far more secure. That is the opportunity for longer-term investors.

When Mastercard executives revealed third-quarter financial results in early November, they noted that earnings and revenue growth are accelerating.

Related Post: Bitcoin Gets More Real as Germany Gives Its Blessing

If there are any headwinds coming from DeFi, the top brass is not feeling them. Despite this, the stock is down from a high of $400 in May to around $339.50 as of writing.

Shares of Visa have been upgraded at Morgan Stanley, Raymond James (NYSE: RJF), RBC Capital Markets and UBS (NYSE: UBS) … all since Oct. 27.

Price targets range from $263 all the way to $297. At the current price of $207.37, moves to those levels would represent gains of 27% and 43.5%, respectively.

Savvy longer-term investors should consider buying Mastercard and Visa into the current weakness.

Best wishes,

Jon D. Markman