While the crypto market as a whole continued to consolidate last week, the industry's smaller sectors outperformed.

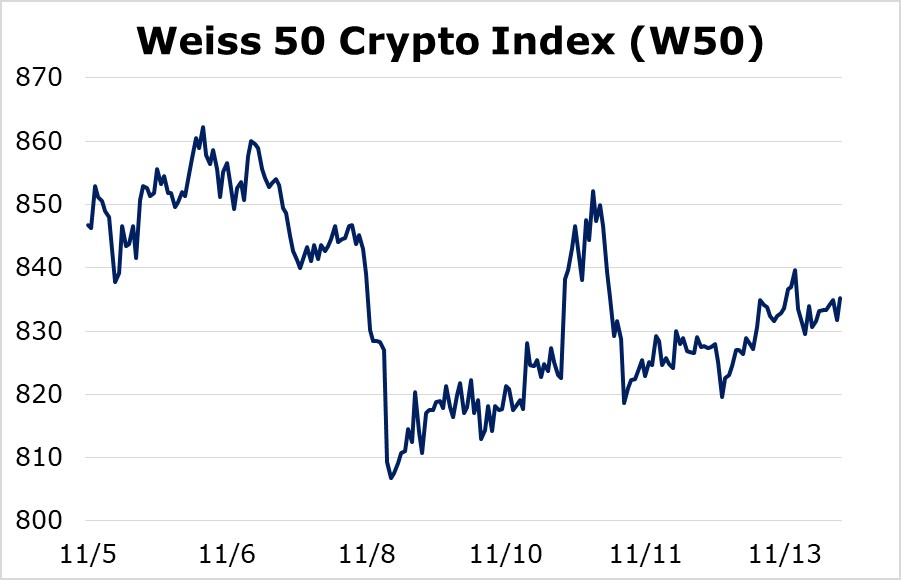

The Weiss 50 Crypto Index (W50), the world’s broadest measure of the industry, slipped by just 1.36% on the week ended Nov. 14, which, in the crypto world, is essentially flat.

|

And if we strip out Bitcoin, the picture is not very different, as the Weiss 50 ex-BTC (W50X) rose 2.11%.

|

Both these indices are telling us that, whether we're talking about Bitcoin (BTC), or large altcoins, such as Ethereum (ETH), XRP (XRP) and Litecoin (LTC), the big picture is a sideways chop.

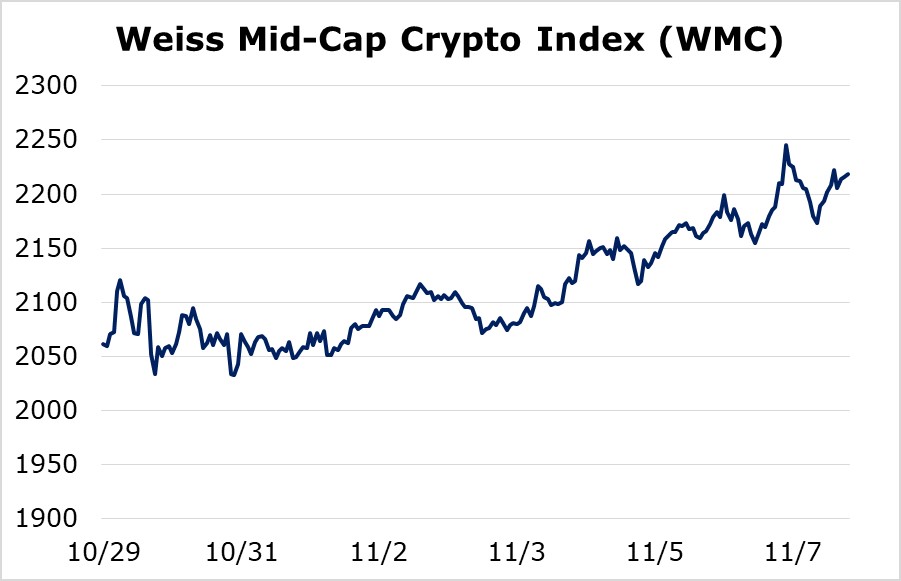

But the story is quite different when we look beyond the large-cap coins. Consider the Weiss Mid-Cap Crypto Index (WMC), for example:

|

This index is up 7.61%. That may not sound remarkable, but it's actually quite a feat in contrast to industry-leading projects, stuck in a range ever since their late-October rally.

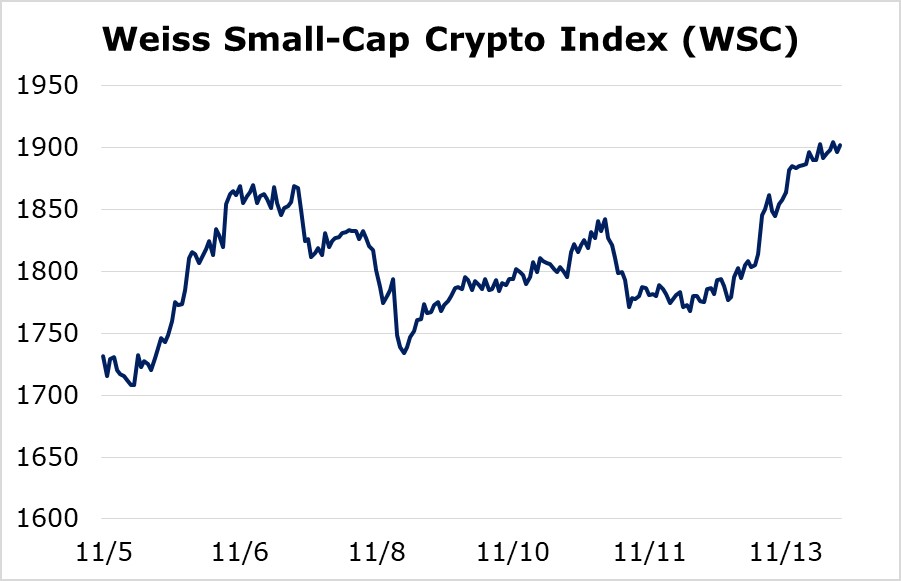

The picture is even brighter in the smallest sector of the industry, tracked by our Weiss Small Cap Crypto Index (WSC). Have a look:

|

This index is up 9.85%, which is quite bullish in the midst of a mostly neutral market elsewhere.

Overall, the picture is clear: Altcoins, especially smaller ones, are once again taking the lead in the crypto markets:

- As a whole, the crypto markets are flat on the week.

- Large caps are pulling the market down.

- Small caps are posting considerable gains.

The outperformance by altcoins has also been reflected in another key metric:

Bitcoin's share of the crypto markets peaked in early September of this year at almost 69.9%, and it has been falling since to a low of 66.36%, established this week.

The move may not seem significant, yet the last time we observed altcoins take the lead was the period from December 2018 through April 2019, right as the markets were gearing up for a major surge.

Bottom line: Altcoins are flashing some bullish signals for crypto markets overall.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.