Amazon Dominates as Consumer Spending Shifts Further Online

|

My mother really knew how to stretch a dollar. She always bought a whole chicken, rather than cuts of meat, and used every part. She would also reuse aluminum foil several times before throwing it away, canned her own vegetables and patched my pants so many times they looked like a patchwork quilt.

My parents, maybe like yours, were children of the Great Depression. They learned to be frugal out of necessity. And they carried that penny-stretching philosophy for the rest of their lives.

The Great Depression profoundly altered the way people handled money generations ago, and I expect that the Great Corona Recession will also radically change the way we spend our money for the rest of our lives.

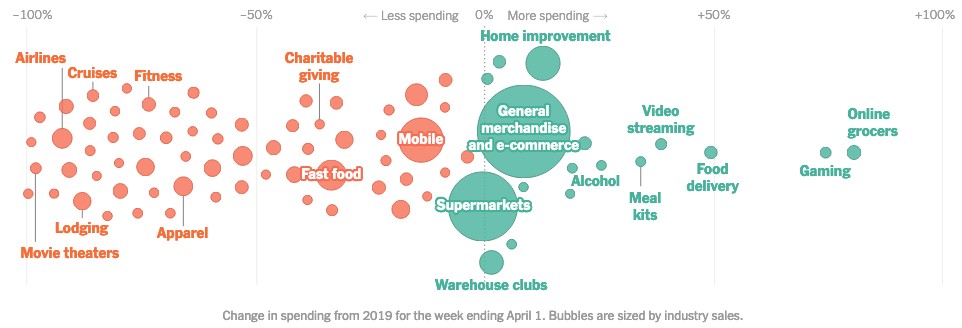

Just look at the travel industry. Spending was down 85% in the month of March from the previous year. April is going to be even worse as airplanes, hotels, and restaurants are empty.

|

|

Source: The New York Times |

The most notable change in American spending habits is the gigantic surge in e-commerce spending. Sure, a lot of that is out of necessity as we all deal with shelter-at-home directives, but I believe that the coronavirus has permanently accelerated internet shopping. With more people shopping online now, it will enforce habits that will last well after the outbreak subsides.

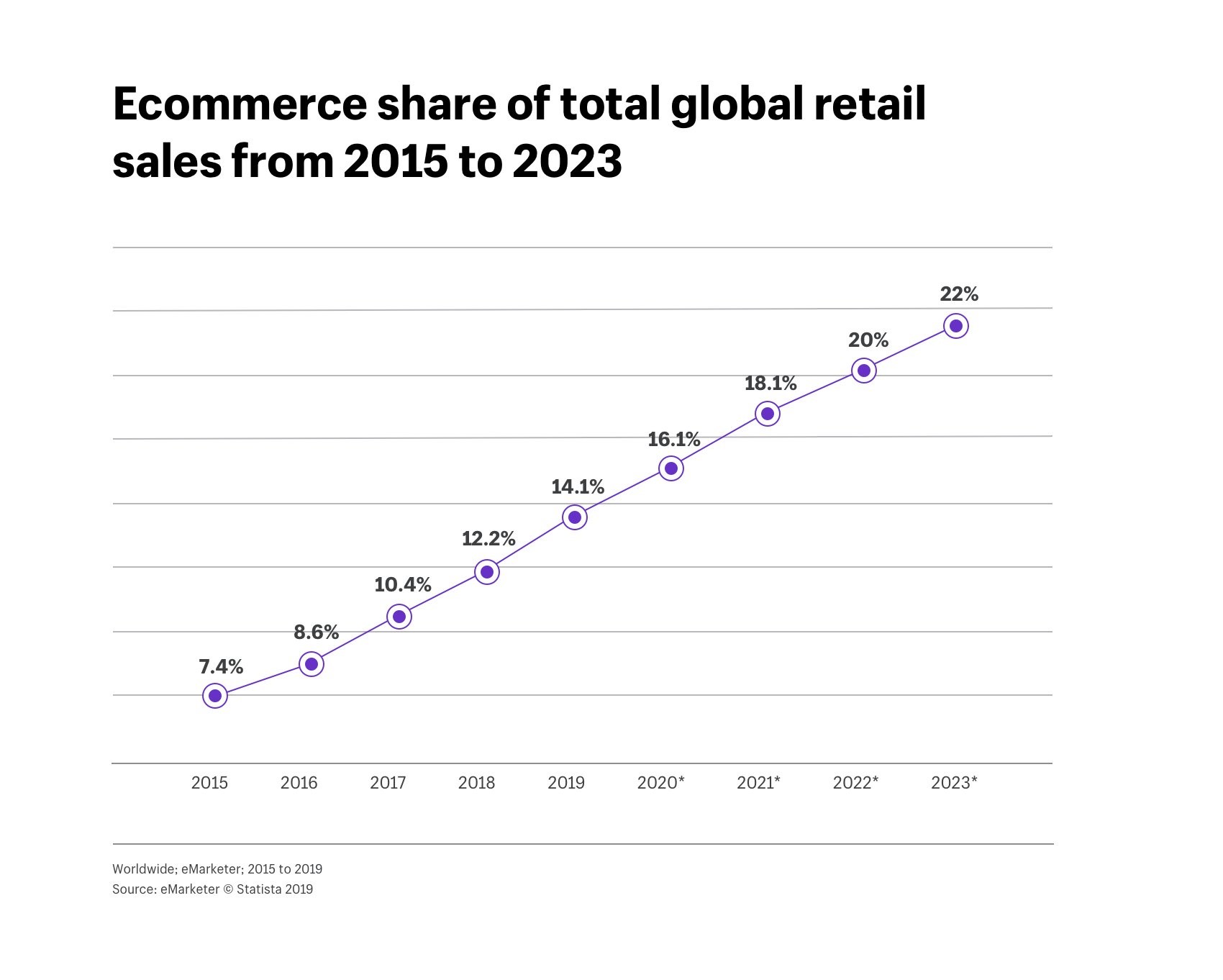

But does any of this come as a surprise? After all, e-commerce sales have been steadily growing over the last 10 years. In 2019, e-commerce accounted for 22%, or $5.5 trillion, of the entire $25 trillion global retail market.

|

So, that number was likely going to increase without the coronavirus. But now, it is going to absolutely explode. E-commerce retailers are going to steal even more market share from the traditional brick-and-mortar retailers.

How can you take full advantage of this swing in consumer spending? By investing in Amazon.com (AMZN). For starters, this company has the scale to dominate its field: In the U.S., Amazon already controls nearly 50% of the e-commerce market share!

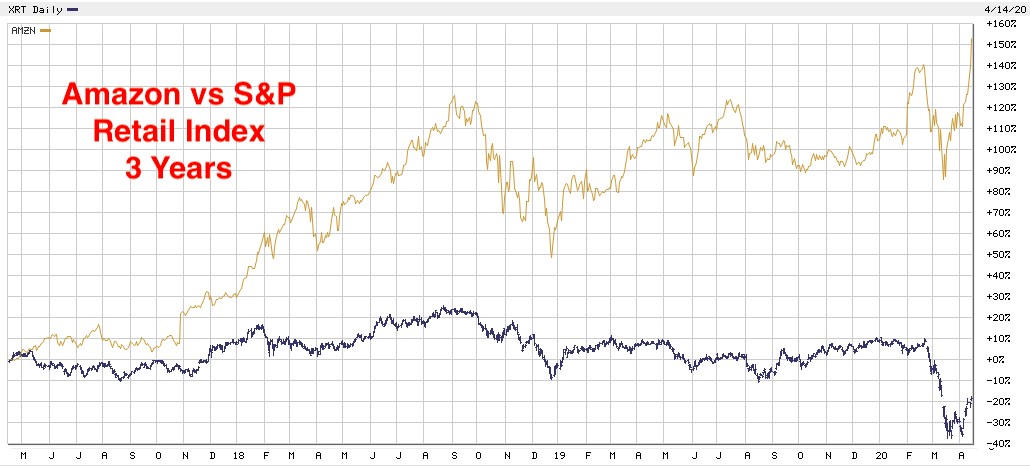

Amazon is big, and data suggests it’s only getting bigger. Amazon stock is up 484% over the past five years, while the SPDR Retail Index ETF (XRT) has lost 26% in that same time. We’re talking about a nearly 500% swing!

|

By the way, Amazon hit a new all-time high last week and is up over 28% so far this year.

That’s right, 28% this year!

To be fair, I need to disclose that my Weiss Crypto Investor subscribers own Amazon and are sitting on huge open gains. And I’m not taking a dime of those gains just yet. That’s because I expect Amazon to go a lot, lot higher.

But this doesn’t mean you should rush out and buy Amazon stock tomorrow morning, though. As always, timing is everything. Smart investors know to wait for weaknesses.

The coronavirus pandemic may change the way you spend your money, and I absolutely hope that it also changes the way you invest your money.

The time to be bullish on e-commerce companies like Amazon has never been more obvious.

Best wishes,

Tony Sagami