Bitcoin Holds Near Highs Amid Slight Pullback

As we did during the Thanksgiving holiday week, we’ve shortened our normal seven-day trading week to six days in observance of Christmas Eve and Christmas. Index data are through midday Wednesday.

As of this writing, Bitcoin (BTC, Tech/Adoption Grade “A-”) remains near its all-time high above $23,000.

This week saw significant volatility, as much of the early gains for larger cryptocurrencies were negated by a late-week pullback.

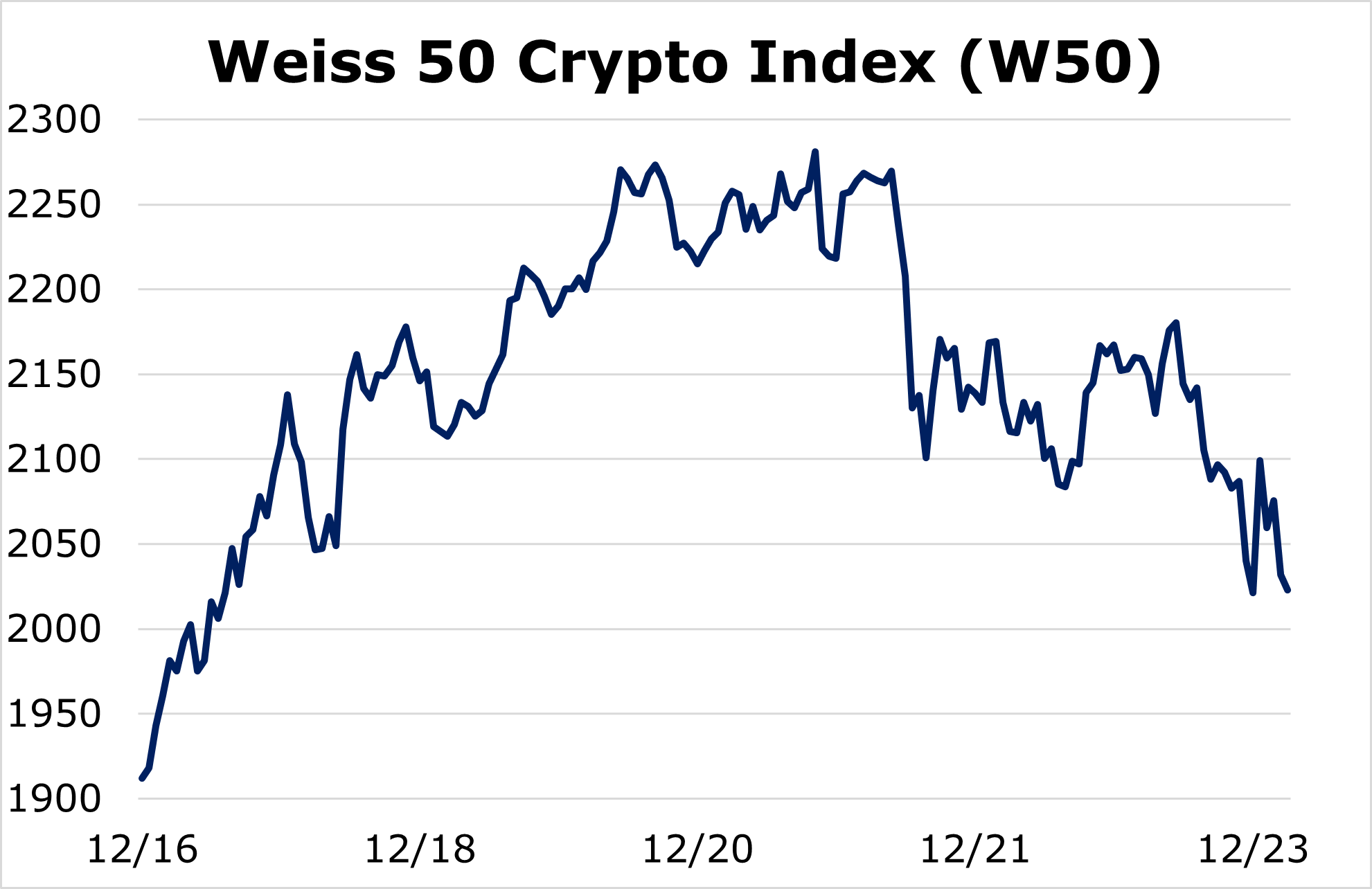

Our timing model suggests the market may continue to correct over the short term, but our long-term outlook remains extremely bullish. The Weiss 50 Crypto Index (W50) rose 5.79% as Bitcoin carried the index higher, despite some altcoin slippage.

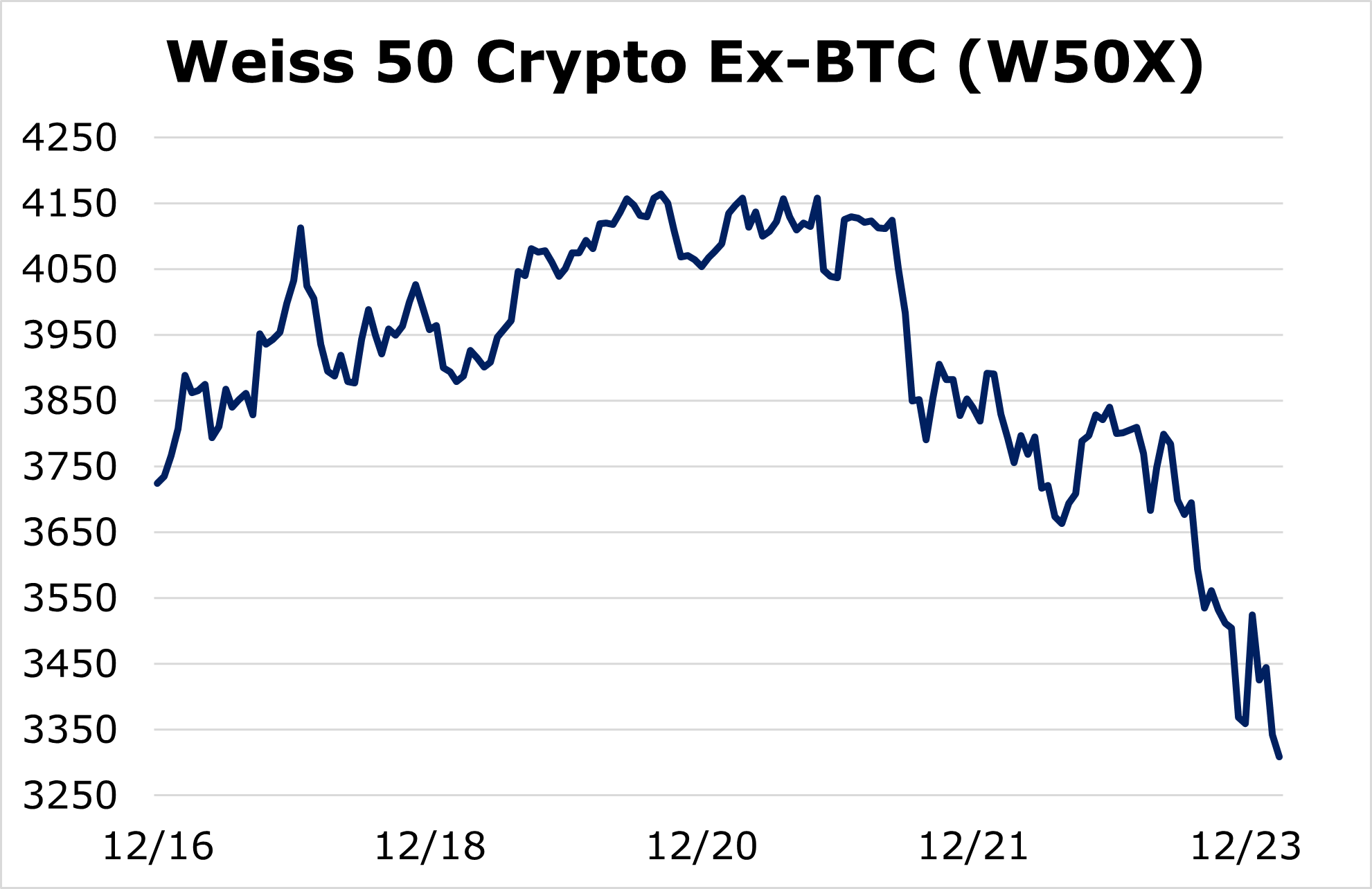

The Weiss 50 Ex-BTC Index (W50X) slid 11.17%, showing Bitcoin was able to hold its value the best during the slight correction in the broader market.

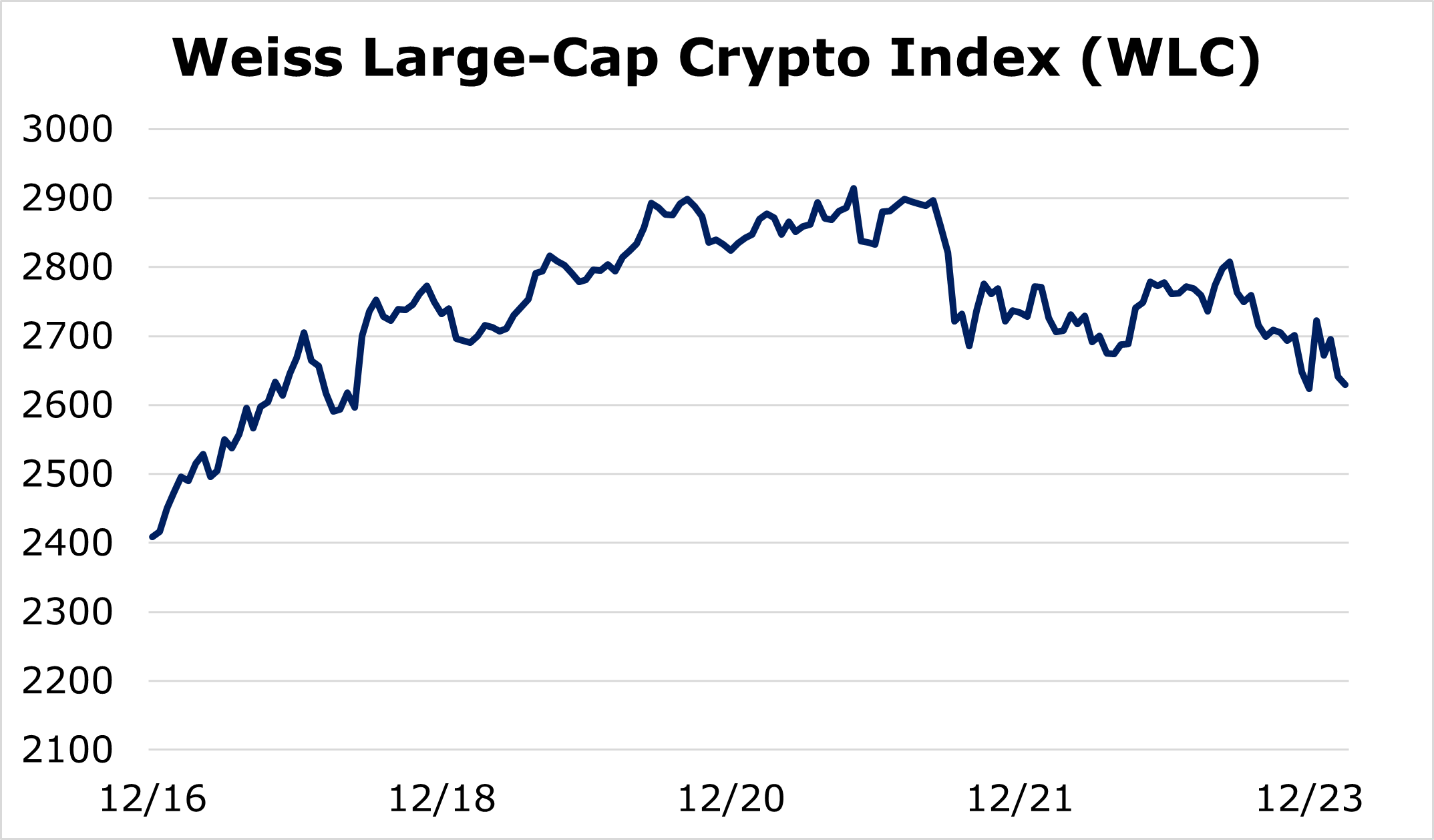

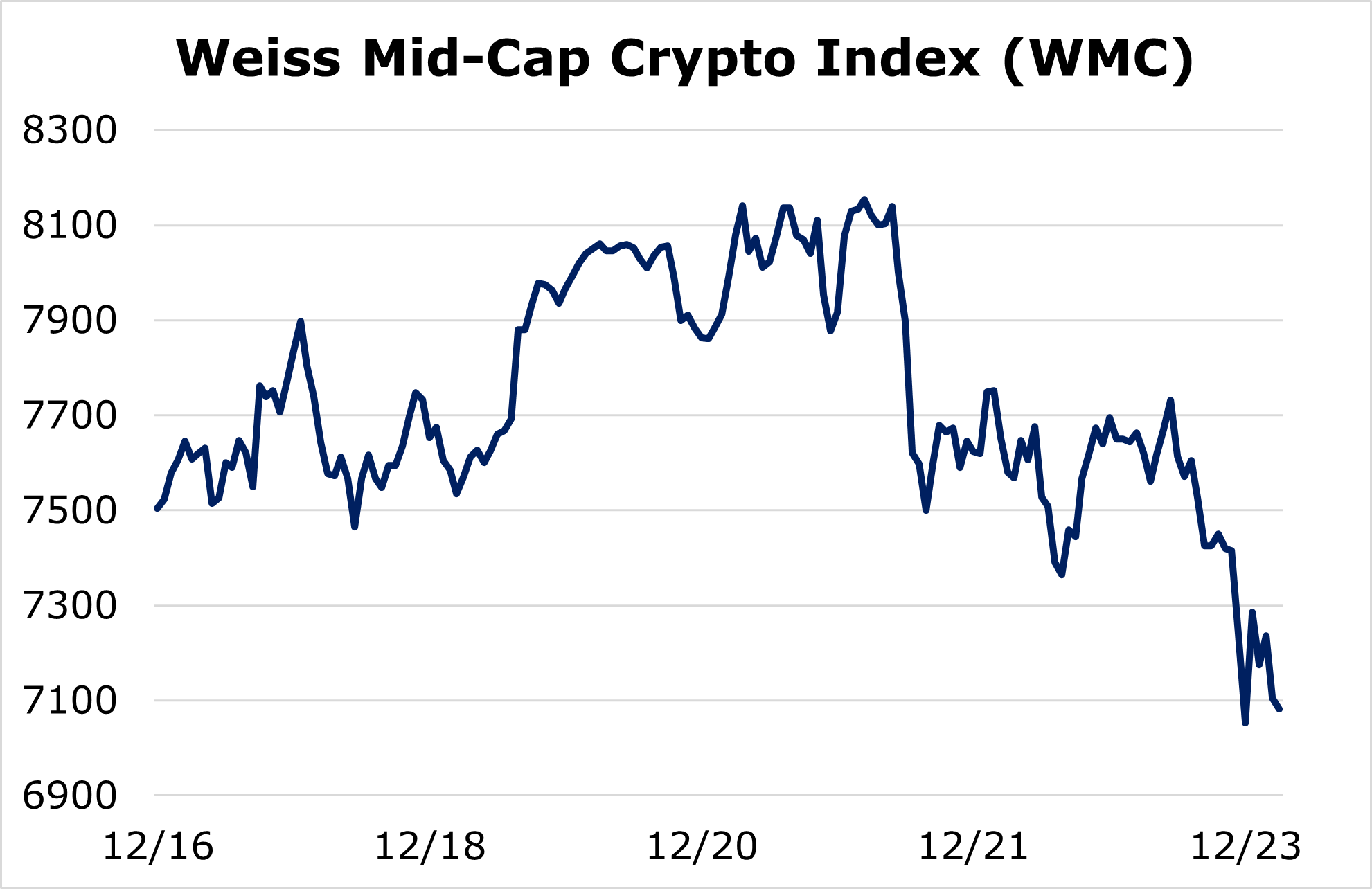

Breaking down performance this week by market capitalization, we see that the largest cryptocurrencies managed slight gains, while their smaller and mid-sized counterparts suffered small setbacks.

The Weiss Large-Cap Crypto Index (WLC) gained 9.18% as investors jumped into the largest coins simply because they’re bigger and safer.

Mid-sized cryptocurrencies slipped slightly as the Weiss Mid-Cap Crypto Index (WMC) shed 5.63%.

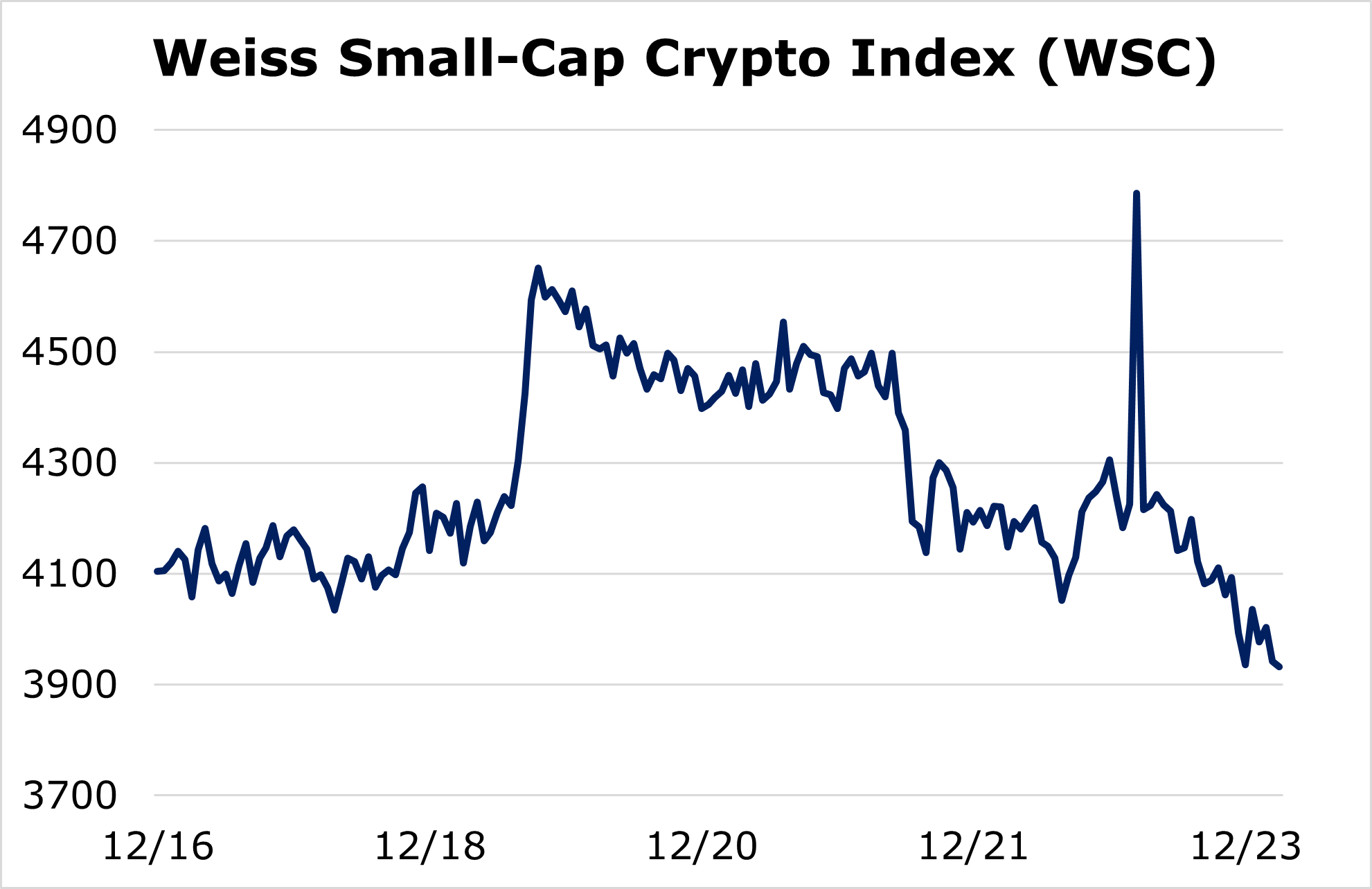

Small-cap cryptocurrencies fared similarly to mid-caps and the Weiss Small-Cap Crypto Index (WSC) lost 4.19%.

The King of Crypto continues to outperform altcoins overall, and this week was no exception. As the broader market fell, Bitcoin was able to increase slightly. This makes sense because during market corrections, investors flock to the largest, safest names.

Bitcoin’s dominance of the crypto market increased three more percentage points to 69%. As the market catches its breath during a large rally, Bitcoin is seen as crypto’s “safe haven.”

While our timing model suggests we may see some more short-term headwinds, our long-term outlook for the price and adoption for cryptocurrencies remains extremely strong. We saw some initial evidence of a slight short-term pullback this week, but it will not change any of the important factors driving its rally.

The health of this months-long rally is strong, as both macroeconomic necessity and institutional adoption confirm its long-term legitimacy. Retail investors are piling in, but at a rate nowhere close to the frenzy in 2017.

Google searches, one of the best proxies for measuring “FOMO,” or “fear of missing out,” remain low compared to their maxed-out numbers in 2017. “Bitcoin” currently scores 26 out of 100 on Google’s interest ratings scale, while “Bitcoin Price” scores a comparable 25 out of 100.

Governments and central banks continue to print and spend money recklessly, and their wanton approach to fiscal and monetary policies are driving the need for change. A viable alternative is desperately needed, and cryptocurrencies provide a sustainable alternative.

Institutions recognize this, and they continue to pile more money into the space. Business intelligence company MicroStrategy Inc. (Nasdaq: MSTR) has invested over $1.1 billion of its assets in Bitcoin, and U.K. asset manager Ruffer Investment Company Ltd. (LON: RICA) amassed $744 million in Bitcoin.

In addition to these investments in the King of Crypto, companies have been focused on improving accessibility in the space and developing blockchain technology.

Coinbase, the largest cryptocurrency exchange in the U.S., is readying for an initial public offering. S&P Dow Jones has committed to launching a customizable cryptocurrency indexing service, and its parent company S&P Global has made an investment by hiring blockchain engineers.

The long-term crypto boom is still in its infancy ... and the world’s largest banks and institutions will continue looking to increase their exposure and develop new technology.

It all bodes extremely well for early investors.

We wish you and yours a happy holiday season.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.