Central Bank Money Printing Drives Crypto Asset Rally

Crypto assets have enjoyed solid, across-the-board gains across the board this week, driven primarily by massive, global monetary response to the coronavirus scare.

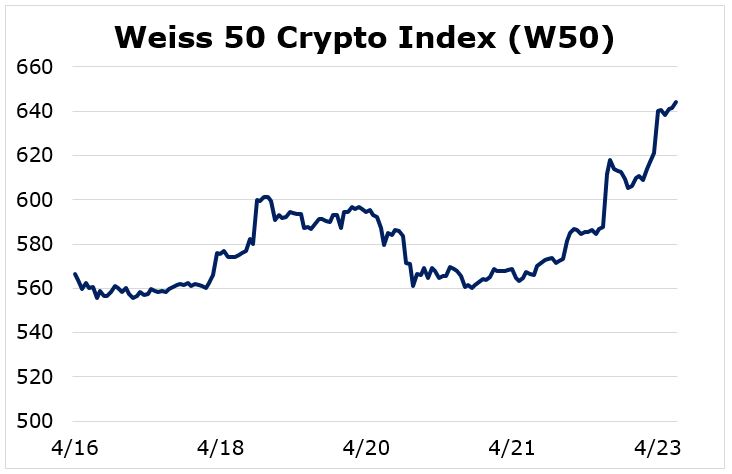

The Weiss 50 Crypto Index (W50) — a broad-based measure of the crypto industry — was up 13.67% over the seven days ending April 23.

What’s more, most leading crypto assets have now fully retraced their losses suffered during a fierce crash last month. In fact ...

Many — such as Bitcoin (BTC, Weiss T/A Grade “A”) and Ethereum (ETH, Weiss T/A Grade “A”) — are up more than 100% since their March 13 lows.

|

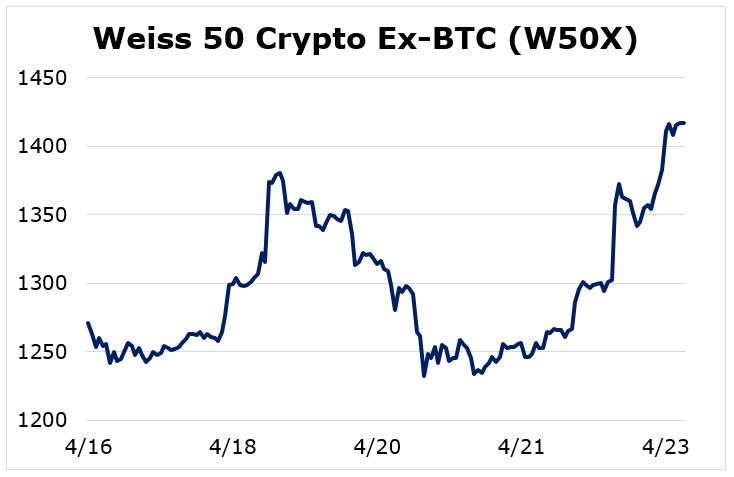

The Weiss 50 Ex-BTC Crypto Index (W50X) was up 11.44% on the week, a sign that Bitcoin, in particular, continues to drive performance for the whole industry.

|

Splitting the sector by market cap, we see the following:

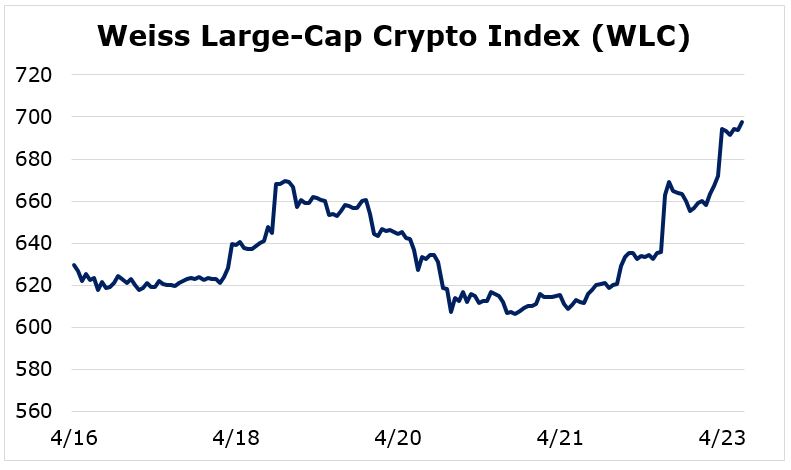

- The Weiss Large-Cap Crypto Index (WLC) is up 10.8% on the week.

|

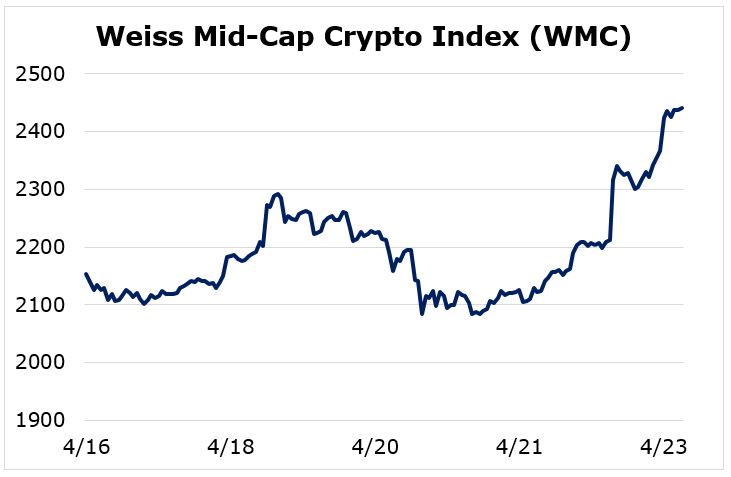

- The Weiss Mid-Cap Crypto Index (WMC) is up 13.39%. And …

|

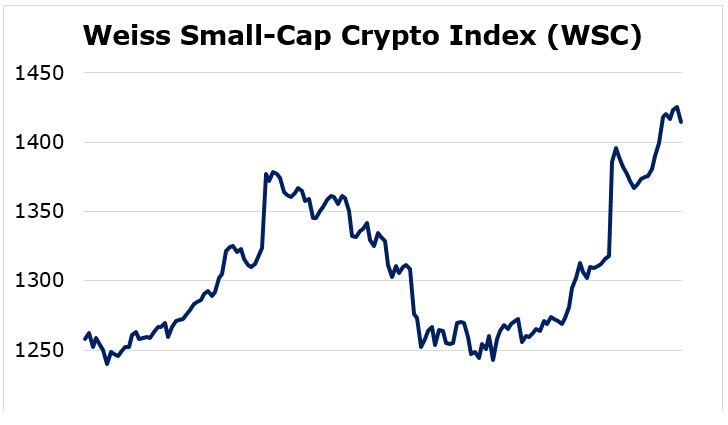

- The Weiss Small-Cap Crypto Index (WSC) is up another 12.50% on the seven-day stretch ending Thursday.

|

Overall, it was another classic “risk-on” week in the land of crypto.

So, to better understand it, let’s about what a “risk-off” environment really looks like:

The sell-off in stocks, bonds and other traditional assets from mid-February to mid-March was massive. It had all the hallmarks of a secular deflationary event.

Market participants sought to unwind leveraged positions they’d been accumulating for over a decade.

In response, monetary authorities around the world did what they do best: They fired up their printing presses and launched a fresh round of balance-sheet expansion unlike any in history, and with no end in sight.

That’s an environment in which crypto thrives.

And despite any near-term corrections, it’s precisely the fundamental backdrop that’s likely to propel crypto to new all-time highs in the months and years to come.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.