Crypto Assets See New Cycle Highs as Rally Continues

Last week, we discussed crypto assets showing signs that they’d break out to new cycle highs, as multiple sub-indices were showing positive momentum.

Well, that breakout happened, as multiple sub-indices rallied by double-digits and established fresh new highs to extend the rally that started March 13.

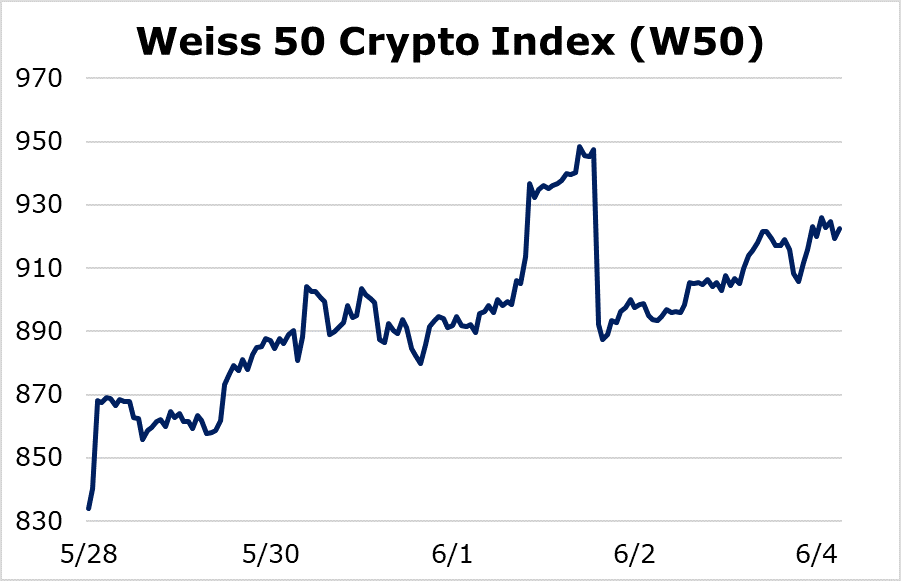

The Weiss 50 Crypto Index (W50) — the broadest industry benchmark — posted a 10.62% gain over the seven trading sessions ending Thursday, June 4.

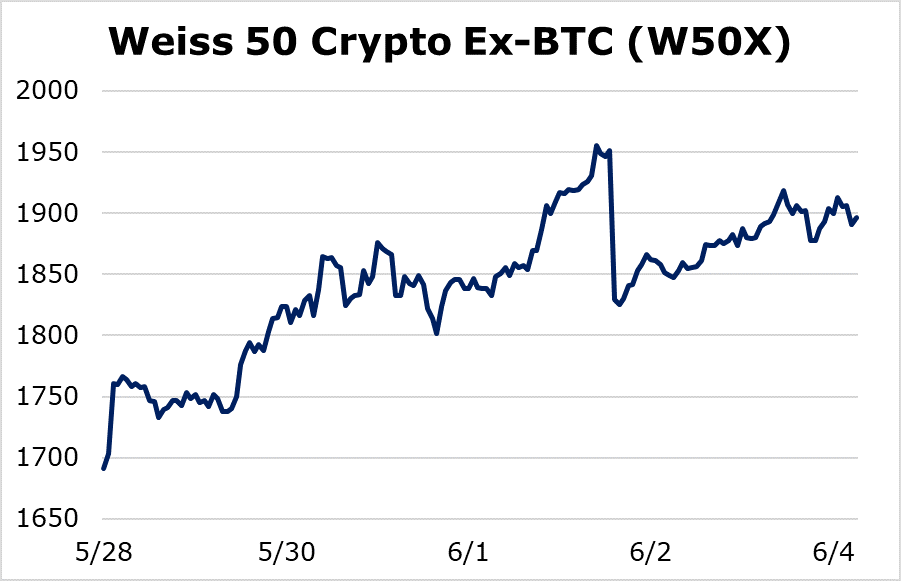

Stripping out Bitcoin and looking at altcoins alone, we see even more robust performance. The Weiss 50 Ex-BTC Crypto Index (W50X) rallied 12.18%.

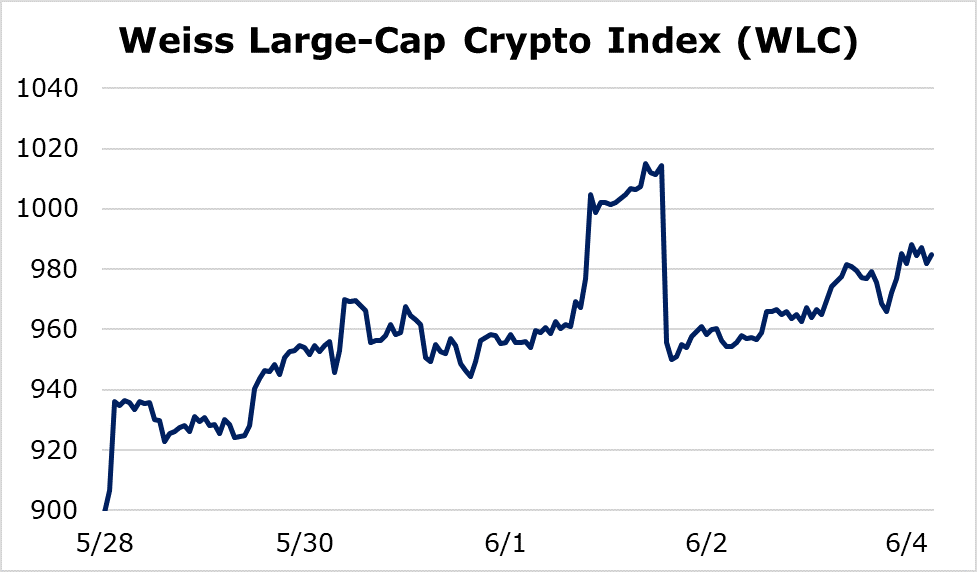

Breaking it down by market capitalization, however, reveals what may be some signs of exhaustion. Let’s start at the top ...

The Weiss Large-Cap Crypto Index (WLC) was up 9.53% for the week ended Thursday.

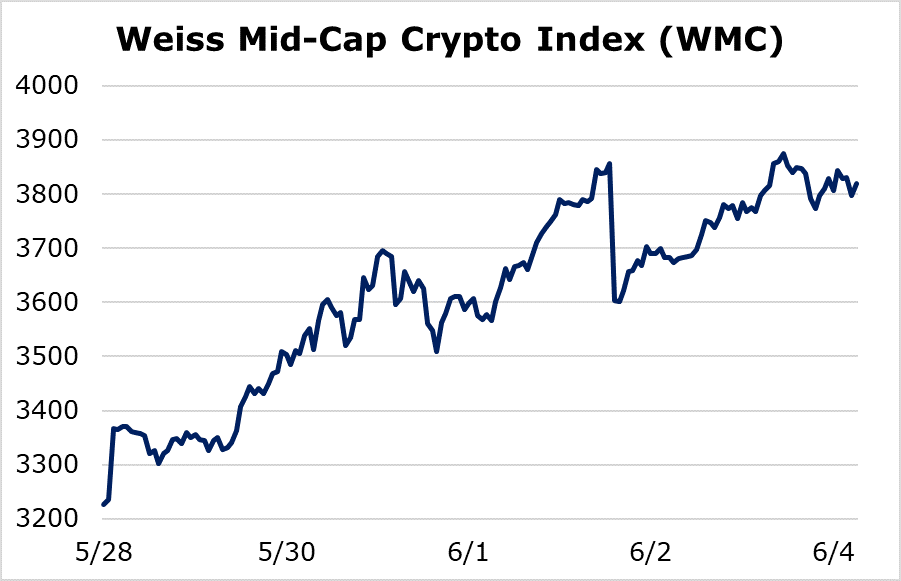

And the Weiss Mid-Cap Crypto Index (WMC) was up a remarkable 18.40%.

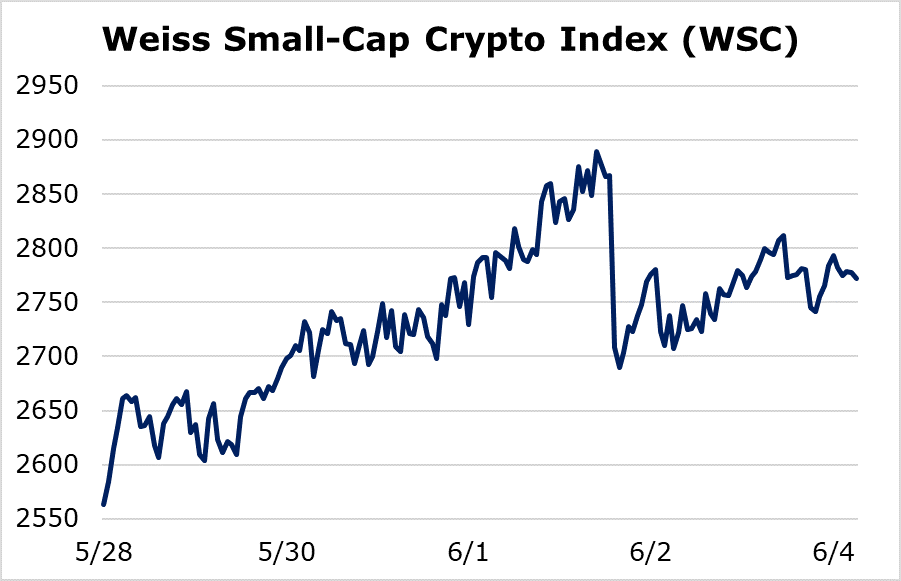

But the Weiss Small-Cap Crypto Index (WSC) was the clear laggard, as it moved up “only” 8.17%.

Last week, the small-caps provided most of the evidence that the broader crypto space was breaking to new highs. This week, the small-caps are showing the most weakness. Gains were concentrated mostly among the mid-caps, which is dominated by higher-tier altcoins.

It’s not just that small-caps surrendered the lead. It’s the way it happened: The breakout took place on Monday, it was met almost immediately with fierce selling and gains were entirety erased by Tuesday.

This mixed reaction to a new cycle high — in addition to relative weakness from the most “risk-on” assets in the industry — is good reason to question whether the impressive rally we’ve seen since the March 13 crash may be due for a pause in the weeks to come.

We’re also seeing traditional safe havens like gold and U.S. Treasuries take a breather. Those assets typically lead crypto markets — which is being considered by an increasing number of investors an “alternative” safe haven by many — by a few weeks.

Only time will tell if this crypto rally still has legs.

But this is a long-term story, and a “pause” here would be entirely reasonable. When one inevitably happens, it’ll leave crypto refreshed for a run to higher highs.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.