|

Large- and small-cap crypto assets posted strong gains last week amid broadly bullish action heading into Bitcoin’s halving, set for this coming Monday, May 11.

It’s ironic: Bitcoin is preparing to cut the supply of new coins in half just as central banks across the world engage in “Quantitative Easing Infinity” — effectively confirming the supply of government-issued fiat money is unlimited.

Indeed, this juxtaposition reveals another name for the halving; “Quantitative Hardening.” It’s the factor that will take Bitcoin to new highs.

As Bitcoin supply grows scarcer than ever before, miners must be at the very top of their game, as the inefficient among them will fall by the wayside.

This forced churn hardens the network. And it will become more competitive and more efficient than ever before.

But Quantitative Hardening isn’t the only bullish force acting on Bitcoin. Indeed, the Fed’s Quantitative Easing is doing its share to propel the King of Crypto higher, as well. It’s making investors desperate to put their money in assets away from bureaucratic control.

And nothing does decentralized and trustless like crypto assets.

Diminishing new supply and soaring demand as central banks bring out their money-printing bazookas is a formula for a fresh bull market.

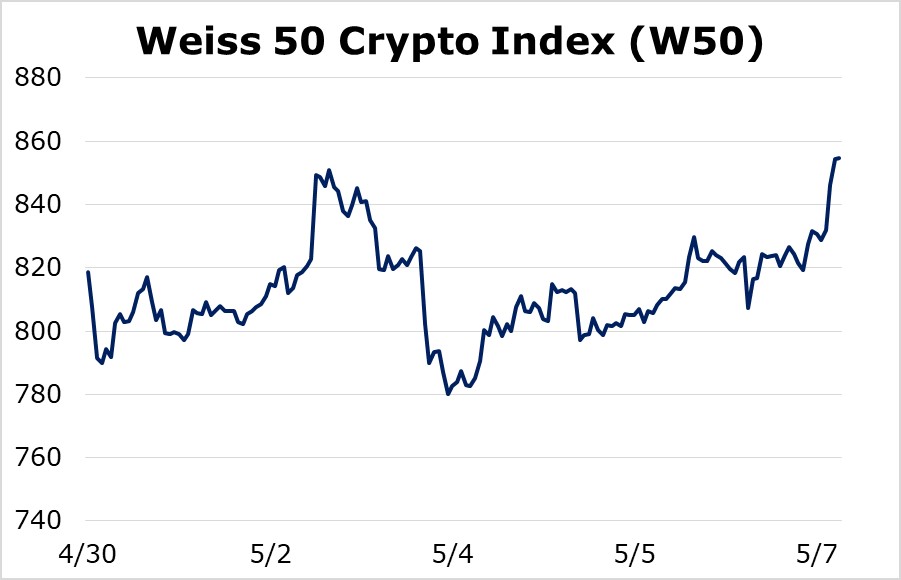

We can already see significant buying in anticipation of this event, as the Weiss 50 Crypto Index (W50) posted a gain of 4.40% during week of trading ending Thursday, May 7.

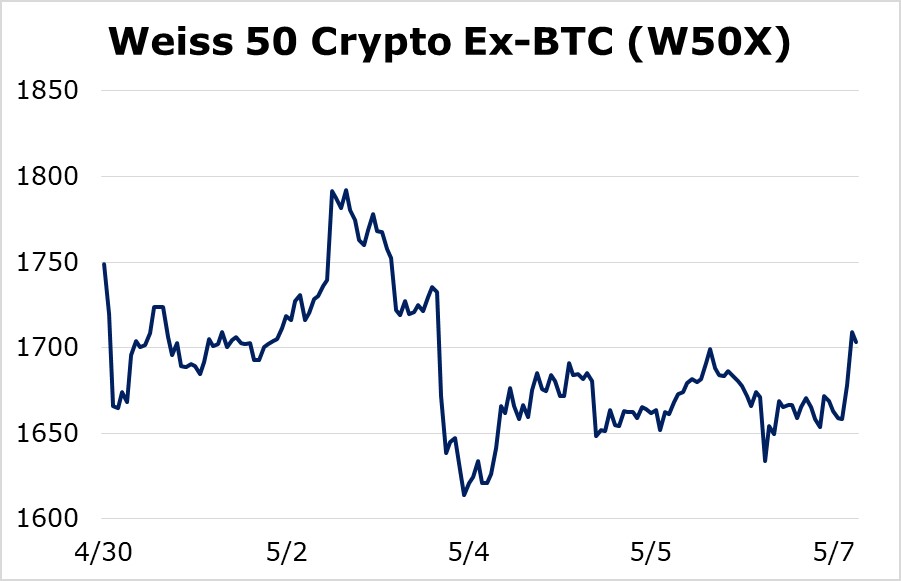

Stripping out the impact of the biggest name in the crypto sphere, we can see that altcoins are still playing catch-up. The Weiss 50 Ex-BTC Crypto Index (W50X) was actually down slightly, at -2.59%, through Thursday.

Let’s take a look at the industry by market cap.

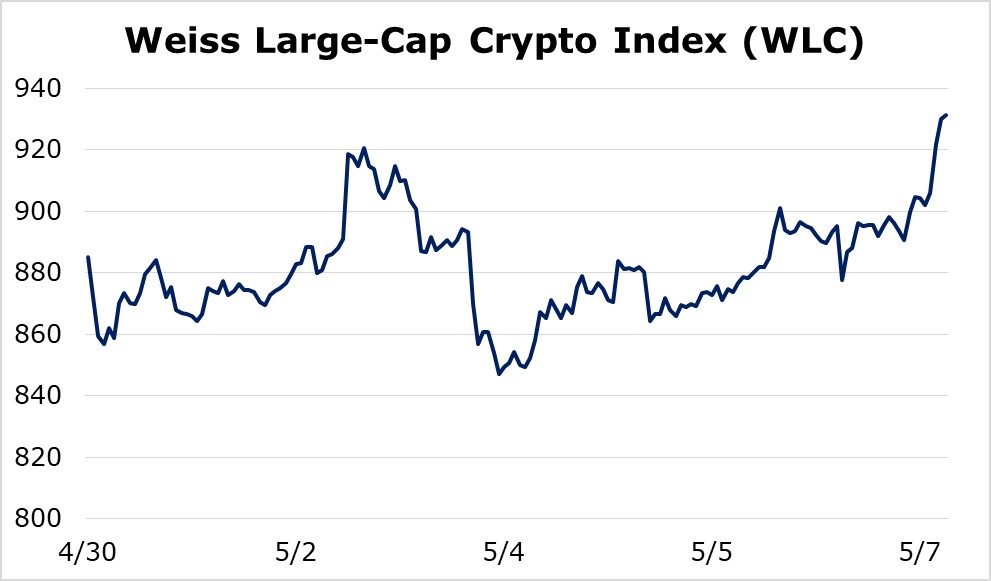

The Weiss Large-Cap Crypto Index (WLC) was up 5.21%.

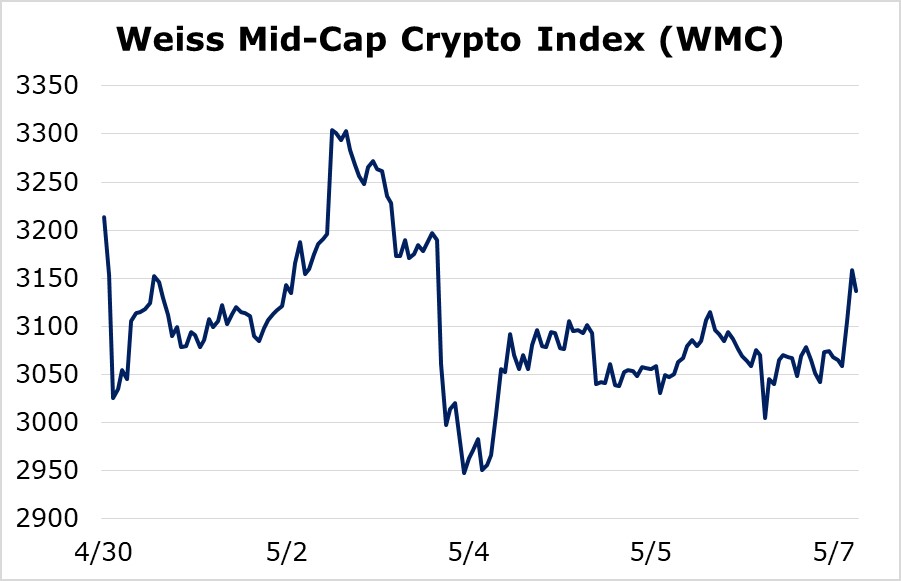

The Weiss Mid-Cap Crypto Index (WMC) followed the altcoins and was down 2.39%.

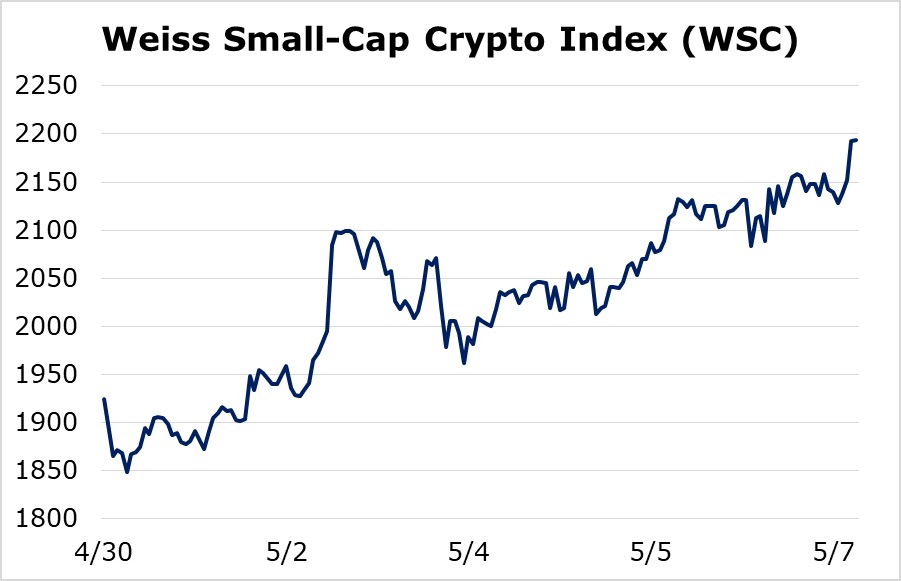

And the Weiss Small-Cap Crypto Index (WSC) was up 13.98%.

This sector split is quite interesting. On the one hand, we clearly see Bitcoin-led strength, as the large-caps posted a 5% gain, while mid-caps — comprised entirely of altcoins — are actually down on the week.

But the small-caps — the most speculative of the bunch — also posted strong gains.

Remember, last week I reminded you that when small-caps lead the market, investors are declaring a “risk-on” environment.

This points to speculative buying ahead of Bitcoin’s halving, which centers around Bitcoin itself, as well as the most speculative names in the industry, represented by the small-caps.

We’ll be closely watching how the crypto industry copes with reduced Bitcoin supply as we enter the post-2020 halving period next week. This event is likely to rattle crypto markets — don’t be surprised to see volatility in both directions starting as early as Monday.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.