Crypto Ebbs and Bitcoin Lags … but Rome Still Burns

Crypto markets have been stuck in a rut for the past couple months, with action this week representing proverbial “steps back” from what we saw for the seven days ended July 9.

That’s on the surface, though. When we go a little deeper, we continue to see persistent positive undercurrents — primarily, leadership from small- and mid-cap names.

We’ve seen notable rallies since May, including the one we discussed last week, which seemed to be lacking only Bitcoin’s participation before it truly accelerated. Invariably, though, such rallies have been followed by movement in the opposite direction.

Indeed, last week, we noted that crypto assets picked up steam as positive momentum for traditional safe-haven assets seemed to carry over to the new-school variety.

Well, those old-school assets — gold, U.S. Treasuries — saw little to no movement this week. So, based on recent logic, it should come as no surprise that crypto assets didn’t fare so well.

The broadest measure of the asset class, the Weiss 50 Crypto Index (W50), gave back much of what was gained the previous trading week, sliding 4.37% during the seven days ended July 16.

We see the same thing when we strip out Bitcoin, as the Weiss 50 Ex-BTC Crypto Index (W50X) was down 3.55% on the week.

Let’s take a look at the industry split by market capitalization. The Weiss Large-Cap Crypto Index (WLC) traded largely in line with the broad market, as the index was down 4.59%.

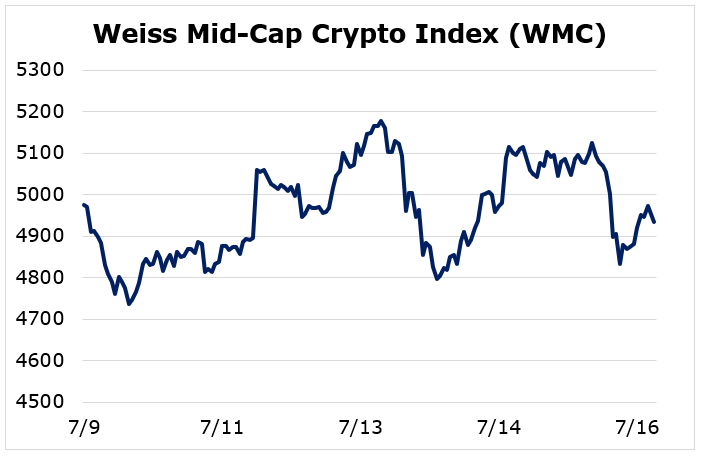

Now, here’s where we start to see the persistent positive trend: The Weiss Mid-Cap Crypto Index (WMC) performed a little better, as it was, down just 0.78% on the week. That is, in this market, basically “unchanged.”

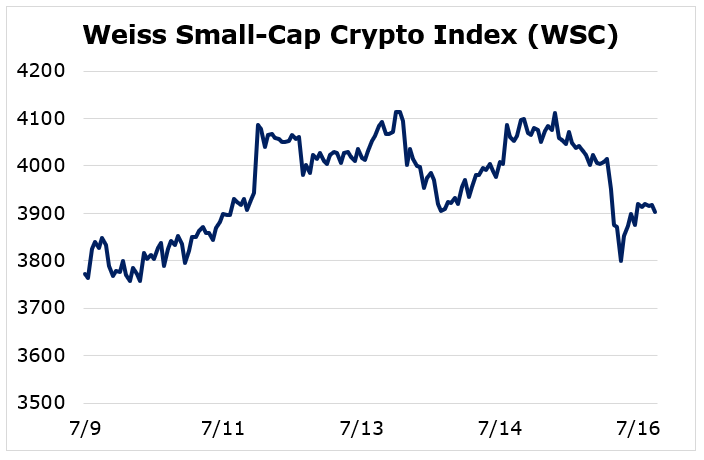

And here it gets really interesting: The Weiss Small-Cap Crypto Index (WSC) was up 3.46% on the week, clearly outperforming large- and mid-cap crypto assets.

From a big-picture perspective, the past seven days have been rather quiet. This is true for crypto markets as well as traditional financial markets.

We’ve seen correlations between crypto and its old-school analogs gold and Treasuries pick up significantly in the aftermath of the March COVID-19 crash. Marginal movement in crypto during a week when global markets seem to be on stand-by continues this trend.

Still, there is one noteworthy takeaway from crypto markets this week: Altcoins continue to outperform Bitcoin, as all Weiss indexes where Bitcoin has a dominant presence underperformed.

Indeed, under the hood, we continue to see a story of two crypto markets, where altcoins as a group seem on the verge of breaking out of their multi-month trading range, while Bitcoin languishes near the bottom end of its own range.

The big question we asked last week is the big question this week … and it will probably be the big question next week: Will Bitcoin muster some strength, join the rest of the crypto market and lead it to new all-time highs?

Given the mixed signals emitting from traditional markets, it’s prudent to ponder whether Bitcoin is an anchor on a nascent altcoin rally because we’re at another serious inflection point.

Damage in that case will be short-term for Bitcoin; old-school institutions that surrender their “storehold” qualities will suffer the direst long-term consequences.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.