“It took about 10 years from when the World Wide Web [started]

… to when my mother started hearing about email.”

— Joseph Lubin, Ethereum founder

Do the wild, unpredictable price swings of cryptocurrencies have you unnerved?

They might after this weekend’s cyber hacking attempt at South Korean exchange Coinrail preceded a flash crash. One that sent crypto prices tumbling as much as 12%, and shaved off some $15 billion in overall market cap.

Coinrail had very little to do with the decline. It was in the cards, regardless of the news. In fact, we’ve been bracing for this precise downside action in cryptos since early May, when Juan Villaverde warned that major lows in crypto were coming in June.

If you had been following Juan’s spot-on recommendations, you would have had half of your crypto portfolio sitting in the safety of cash … waiting to pounce on the next buying opportunity.

Plus, there are other intriguing ways to invest in cryptos …

Soon, You’ll be Able to Use Blockchain to Buy Both Digital Gold and Physical Gold

By digital gold, I mean cryptocurrencies. Juan has forecast that a new, bargain-basement buying crypto opportunity is around the corner … so now more than ever is a great time to follow the Weiss Ratings Twitter page for his latest take.

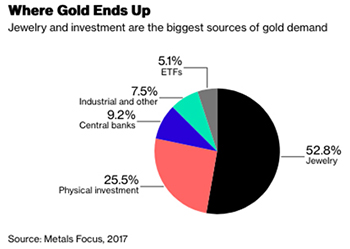

And while we’re on the subject of gold, blockchain technology could soon make investing in physical gold easier, faster and cheaper.

At least, that is what market-watchers expect will happen next year when the London Bullion Market Association incorporates blockchain technology into the gold supply chain.

Think about how cumbersome and costly it is to own gold bullion. Even after you pay for the yellow metal, you’ve only just started spending your money …

You have you pay to store it … pay to insure it … pay to authenticate it when you sell it … as well as pay potentially large bid/ask spreads on both the buy and sell side.

|

It would be infinitely more convenient and dramatically cheaper to own gold on a blockchain ledger instead.

The same is true for all types of commodities — from diamonds to oil to pork bellies.

Blockchain — or, more broadly speaking, Distributed Ledger Technology (DLT) — is the same technology that underpins cryptocurrencies. And it can be used to cheaply and accurately track ownership of just about anything you want to invest in.

I think the most revolutionary thing about blockchain/DLT is that it can help restore trust in big institutions. This will help transfer power to individuals and small companies, cut out expensive middlemen plus, ultimately, lower costs for consumers.

And there’s the opportunity I don’t want you to miss …

New blockchain-focused competitors are going to clobber the big incumbents. They will be able to provide goods or services to us at cheaper prices, and this is leading to one of the biggest investment opportunities of our lifetimes.

Even one of Apple’s co-founders agrees that crypto is the place to be right now …

The Woz Backs Bitcoin

Apple co-founder Steve Wozniak is rich and smart. He’s also a big cryptocurrency fan: “Only Bitcoin is pure digital gold … and I totally buy into that.”

And he puts his money where his mouth is; Wozniak bought Bitcoin when it was only $700. (Kind of makes today’s $6,700 not seem so bad.)

At least he bought the real thing. Some other investors haven’t been so fortunate …

A Rose by Any Other Name: Beware of Fake Blockchain Stocks

The blockchain world is filled with opportunity, but there is also great peril for people who don’t do their homework. The latest example is Long Blockchain Corp., a publicly traded stock that the Nasdaq recently delisted for misleading investors. (It still trades on the Over the Counter market.)

Before 2018, the company was known as The Long Island Iced Tea Corp. It was part of a frenzied spree of companies that added “blockchain” to their business name without any serious plans to actually do so.

Many overeager investors got burned in the process. Don’t let that happen to you. One good way to stay informed is to read your Weiss Crypto Alert briefings every Monday, Wednesday and Friday afternoon.

And don’t forget, Weiss Ratings is the world’s only financial ratings agency that covers cryptocurrencies.

Best wishes,

Tony