Crypto Markets Calm While Stock Investors Panic

|

Sure, crypto markets continued to suffer setbacks this past week. And yes, it just so happened to occur the same week as the stock market crashed.

But the crypto correction was extremely mild by comparison. Moreover, it was right in line with what our timing models had been anticipating all along, even before investors began to worry about a pandemic.

In a week in which stocks suffered a shellacking that felt like the dark days of the 2008 Debt Crisis, it was reassuring to see crypto markets so calm and normal.

Overall, they’re trading more in line with traditional safe havens like gold than like “risk on” assets.

So how did the crypto assets behave in a disaster week for world markets? Very much like in any normal correction week.

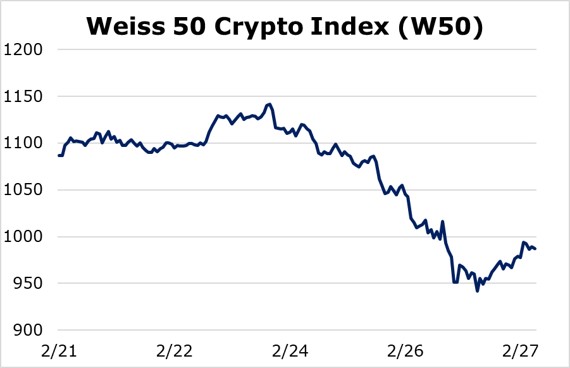

Our Weiss 50 Crypto Index (W50) is down just 9.18% this week. (By comparison the S&P 500, supposedly a far more “stable” asset, fell by about DOUBLE that amount.

|

Stripping out Bitcoin (BTC, Rated “A-”) gives us a similar picture. The Weiss 50 Ex-BTC Crypto Index (W50X) — a broad benchmark for the altcoin sector of the crypto markets — is down 11.11%, just slightly more than Bitcoin.

|

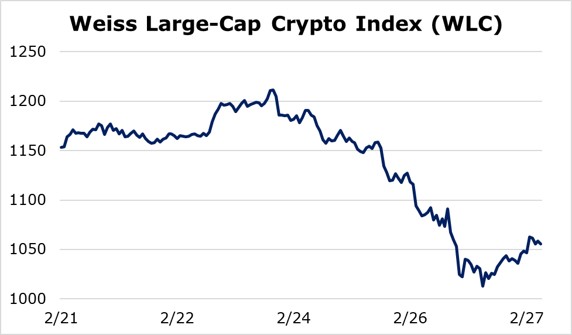

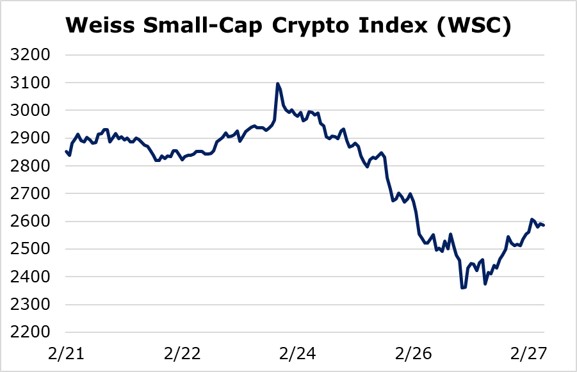

When we split the markets by market capitalization, this is what we see:

- The Weiss Large-Cap Crypto Index (WLC) was relatively robust, down only 8.46%. It held its ground thanks to Bitcoin’s outperformance compared to the rest of the crypto market.

|

- The Weiss Mid-Cap Crypto Index (WMC) fell 12.85% on the week that ended Thursday. For crypto assets, that’s still not very bad.

|

- Finally, we continue to see curious performance from the small and micro caps, as the Weiss Small-Cap Crypto Index (WSC) is down about the same as the overall market — 9.33%.

|

Once again, it’s curious to see the small caps hold up relatively well. They’re typically down the most during crypto market routs. The fact that they’re trading in line with the broad crypto markets tells us the selloff is likely not done yet.

It’s only after we see capitulation on the most speculative names that we can confidently call for a bottom.

So far in 2020, altcoins have DOUBLED in price. To see them give back so little of those gains in a week of crashing world markets is a feat in itself.

This strength speaks volumes to what we can expect in crypto assets once they work off their temporary overbought conditions.

Bottom line: Our timing models indicate an important low is likely by mid-March.

After that, those same models are indicating another massive bull run for Bitcoin. Of course, with the May halving event, we were on the look out for such an indication.

So, the big question is: How high will Bitcoin will go?

I want to hear your thoughts. Take a moment, head over to my blog and let me know how high you think the King of Crypto will go in 2020.

I look forward to reading your answers!

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.