Crypto markets continued their sideways chop this week across the board, as traders tip-toed cautiously with reduced volatility.

Apparently, they still haven’t fully recovered from the psychological shock of the March 12 crash, and you can’t really blame them: The crash wiped out as much as half of the crypto market cap. It hit them like a ton of bricks.

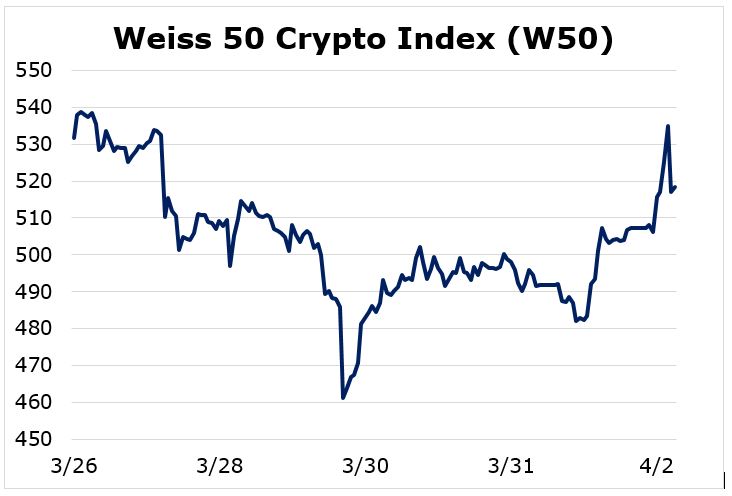

So, even though our Weiss 50 Crypto Index promptly bounced back by an impressive 71% in the following week, the memory of the crash is still weighing on most investors.

That’s a good thing: The longer the market consolidates, the bigger the subsequent risk is likely to be.

This week, the Weiss 50 Crypto Index (W50) was essentially unchanged, down -2.54% for the seven-day stretch ending yesterday.

|

Ditto for altcoins, which was down only 1.67% for the week, per our Weiss 50 Ex-BTC Crypto Index (W50X).

|

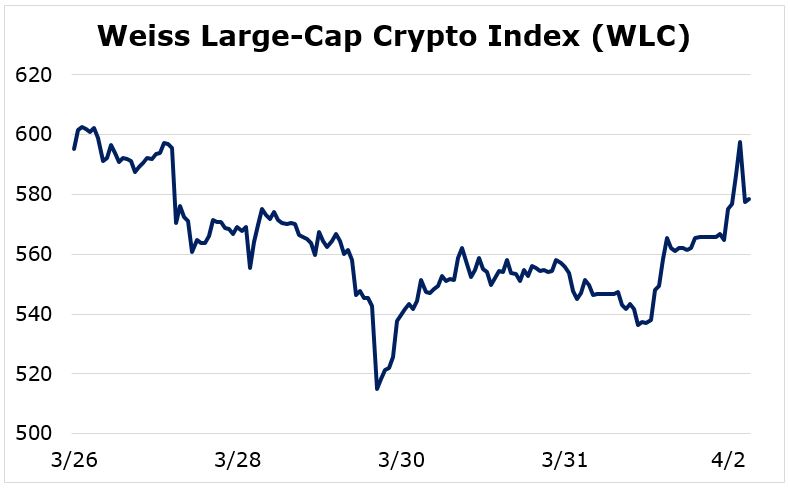

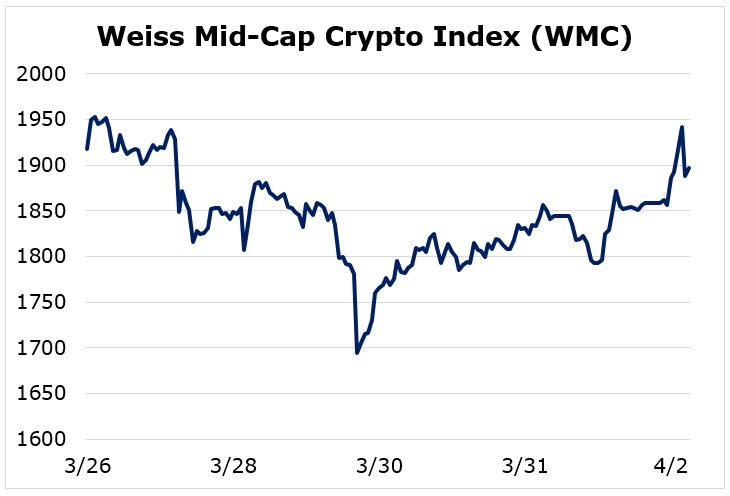

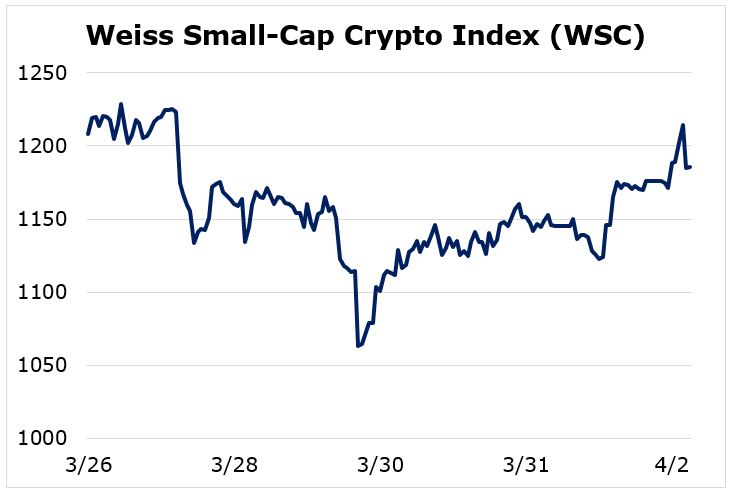

In recent weeks, we’ve pointed out important divergences between our small-cap and large-cap indexes. Not this time. They’re all mostly unchanged.

- The Weiss Large-Cap Crypto Index (WLC) is down an inconsequential 2.86%.

|

- The Weiss Mid-Cap Crypto Index (WMC) declined even less — only 1.08%.

|

- And finally, the Weiss Small-Cap Crypto Index (WSC) is down just 1.87%.

|

This sideways price action isn’t the only thing that denotes caution.

We see it in the Bitcoin hashrate, which tells us the total computing power of mining rigs has diminished.

And we also see it in Bitcoin futures, where prices are lower than the spot-market prices.

But while this tells us traders are playing it safe for now, our cycle model says there’s a lot more to the story than meets the eye.

Both our short- and long-term cycle models are clear: Expect a major crypto rally sometime in May, opening up a major buying opportunity.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.