Crypto Markets Down on the Week, But Smaller Players Stand Firm

Crypto markets fell early in the week, but then enjoyed a moderate bounce as the week came to a close — a sign that prices should soon find support at or near current levels.

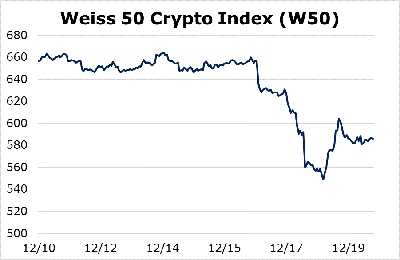

Starting with a broad view of the industry, the Weiss 50 Crypto Index (W50) was initially down as much 16%, but ended the week down with a loss of 10.8%.

|

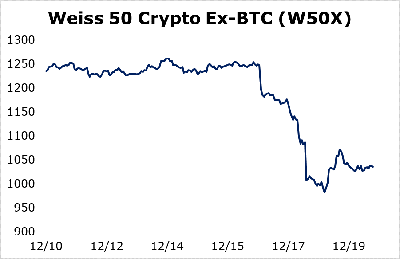

Bitcoin held up relatively better than the rest of the sector. This is why the Weiss 50 Crypto Ex-BTC Index (W50X), which excludes Bitcoin, was down even more for the week, or 16.4%.

All gloomy? Not quite.

|

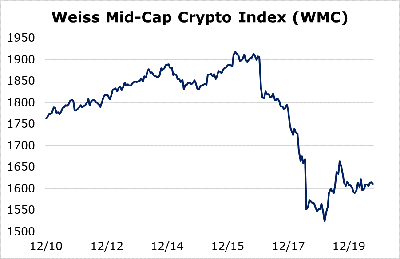

The Weiss Mid-Cap Crypto Index (WMC) was down significantly less – by 8.65%.

|

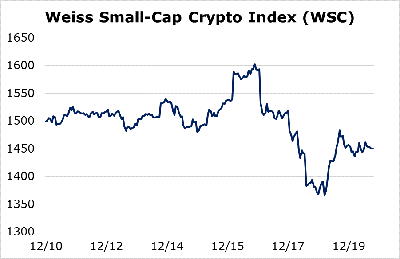

Moreover, the Weiss Small-Cap Crypto Index (WSC) fell by only 3.3%.

|

This tells us the sell-off was not across the board, primarily weighing down the big names: Ethereum, XRP and Litecoin were among the hardest-hit coins, while lesser-known altcoins held their ground relatively well.

Here's the key: During sustained crypto market declines, the small caps are typically the most affected. This makes sense inasmuch as they’re less popular and thinly traded.

The fact that the small caps were virtually unaffected by the bearish price action this week is a signal that this market sell-off probably does not have legs. It’s certainly not an indication of the broad, risk-off shift in sentiment that one usually sees with a major correction or bear market.

Plus, as we head into the holidays, trading volumes are thin.

It all adds up to mounting evidence that crypto markets are close to finding good support levels from which they can consolidate and even rally.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.