Crypto Markets Flatten as Global Fears Ease Somewhat

Over the past few weeks, crypto assets have rallied strongly on the back of the monetary largesse displayed by the world’s leading central bank, the Federal Reserve.

This week, however, we find that markets are finally taking a breather, as global fears about the COVID-19 pandemic ease somewhat.

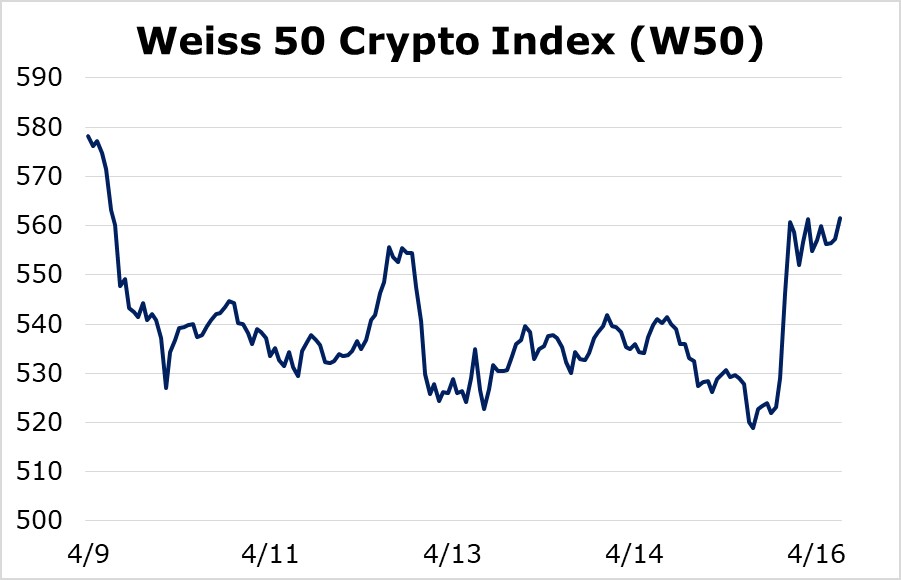

Starting with the Weiss 50 Crypto Index (W50) — the broadest benchmark for the crypto asset space — we find the index was essentially unchanged on the week, down just 2.90% — a relatively tiny move for crypto.

|

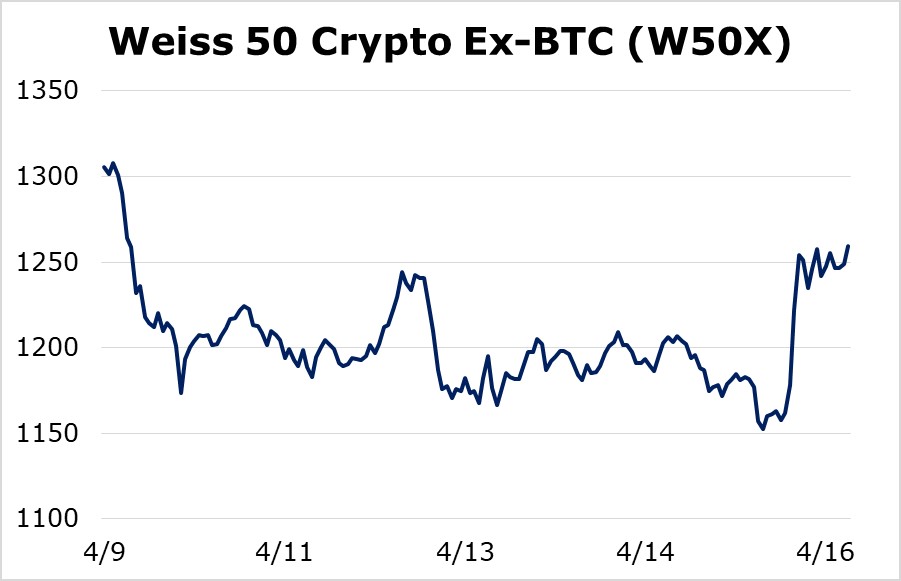

Stripping out Bitcoin and zeroing in on the altcoins reveals pretty much the same picture, as our Weiss 50 Ex-BTC Crypto Index (W50X) was down 3.52% on the seven-day stretch ending Thursday.

|

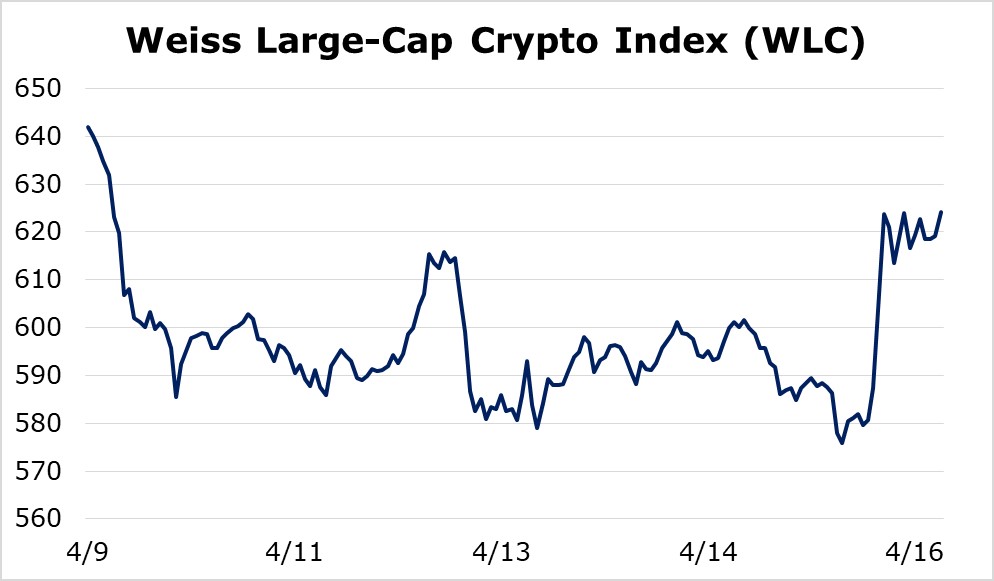

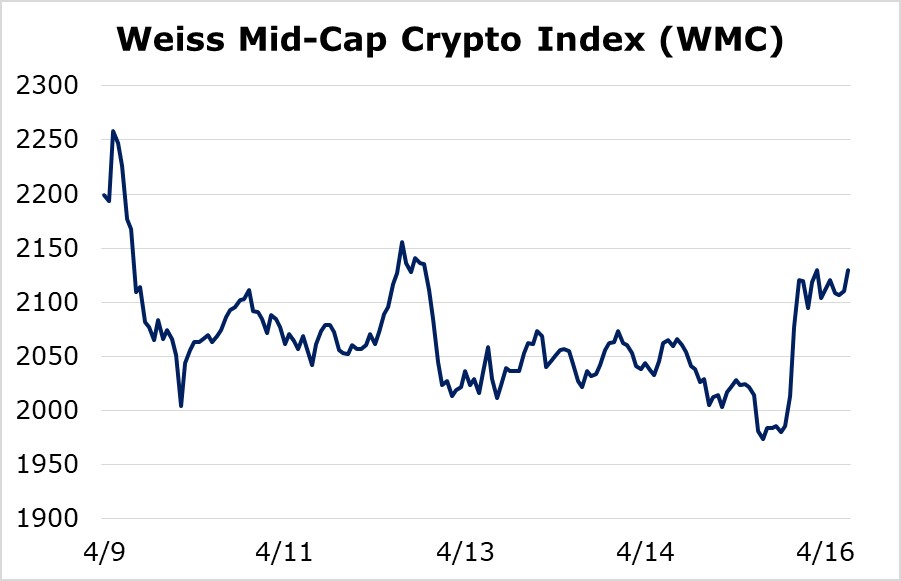

Here’s what we see when we split the industry by market cap:

The Weiss Large-Cap Crypto Index (WLC) moved in line with the broad market as the index, down only 2.80% on the week.

|

The mid caps mirrored the move as well, as the Weiss Mid-Cap Crypto Index (WMC) declined 3.15%.

|

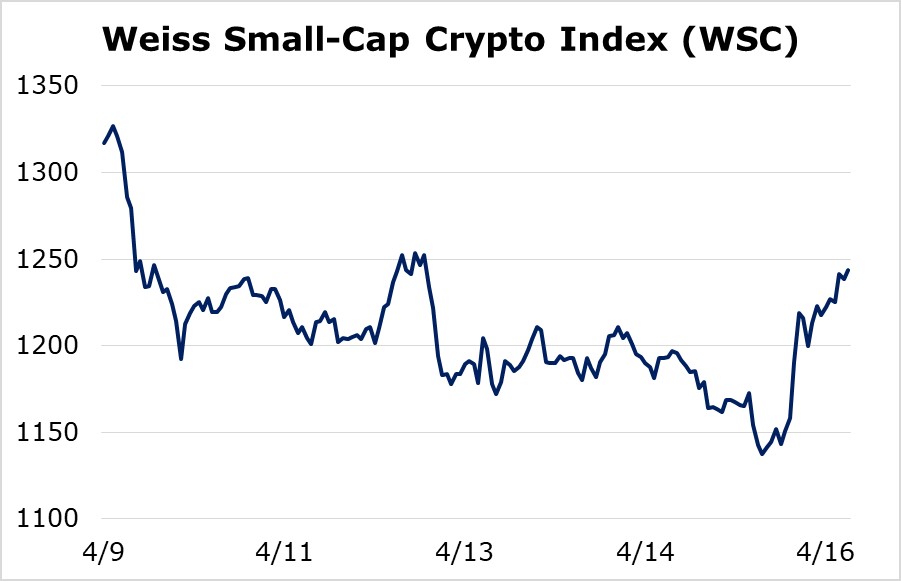

Finally, we find the small caps lagging and showing relative weakness as the Weiss Small-Cap Crypto Index (WSC) was down 5.56% on the week.

|

Overall, we’re seeing mild consolidation across the entire crypto asset space. Our Crypto Timing Model tells us this flattening of the market’s momentum is probably a signal of some more weakness ahead.

But long term, the unprecedented levels of monetary easing displayed by world central banks — with the Federal Reserve announcing it would even buy junk bond ETFs — is likely to provide solid, nearly impenetrable of support for Bitcoin (BTC, Rated “B+”) and other crypto assets on any correction.

Central banks have demonstrated time and time again that even the threat of widespread credit defaults will lead to ever-increasing amount of quantitative easing. This helps explain why crypto assets began rallying again in March, and it’s why we’re likely going to see much more strength in this sector going forward.

Our timing model points to a major crypto bull market which will likely get underway relatively soon.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.