This week was brutal for all financial markets, crypto included.

Investors unable or unwilling to book losses on their sinking stocks rushed to sell anything else they could at a profit.

And when the New York Stock Exchange shut down, the desperation to unload other assets accelerated.

And like a financial pandemic, the selling spree jumped from market to market — first to junk bonds, then to gold and finally to Bitcoin (BTC, Rated “A-”).

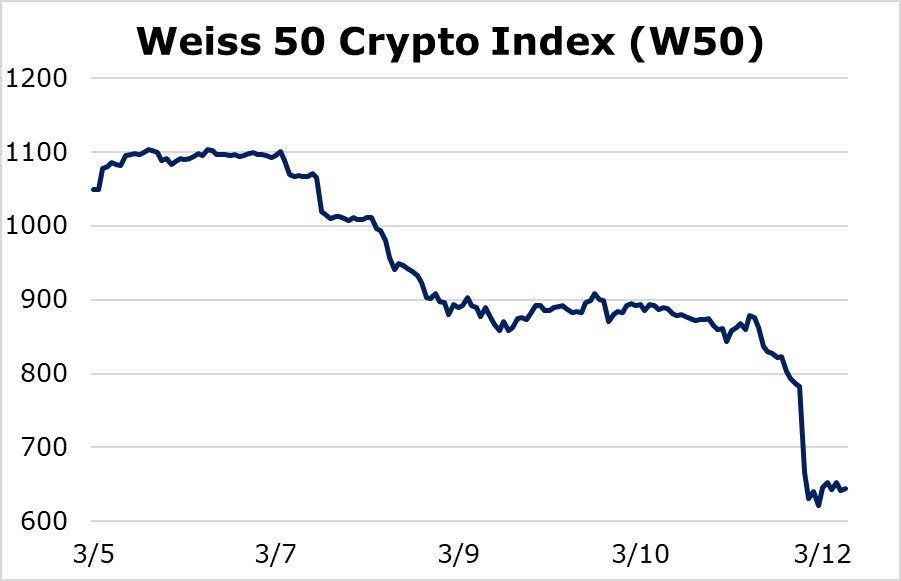

How bad was the crunch? Let’s start with our Weiss 50 Crypto Index (W50), our broadest measure of the crypto asset marketplace as a whole.

The index sold off 38.59% on the week that ended yesterday, with the bulk of the selling taking place early Thursday morning.

|

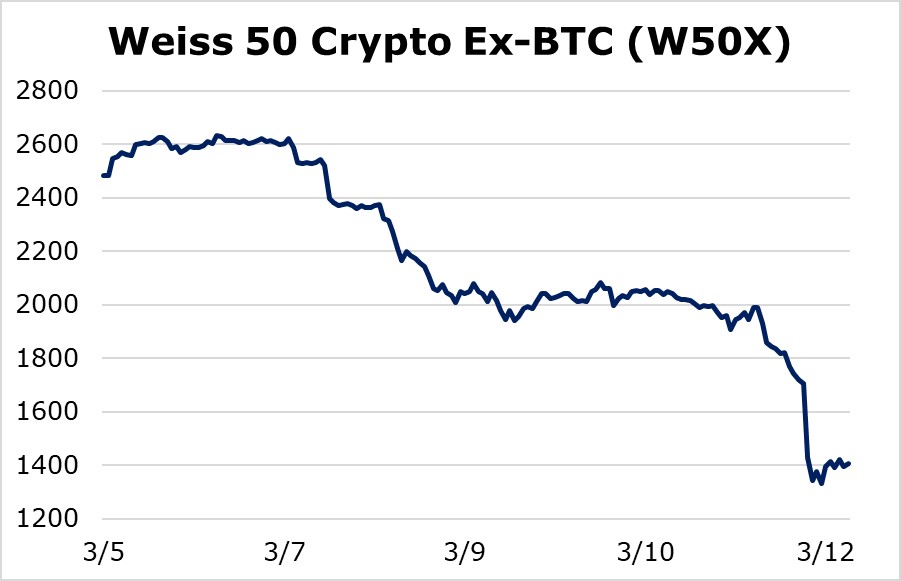

We see a similar picture in our Weiss 50 Ex-BTC Crypto Index (W50X), which ended down 43.41% for the week.

|

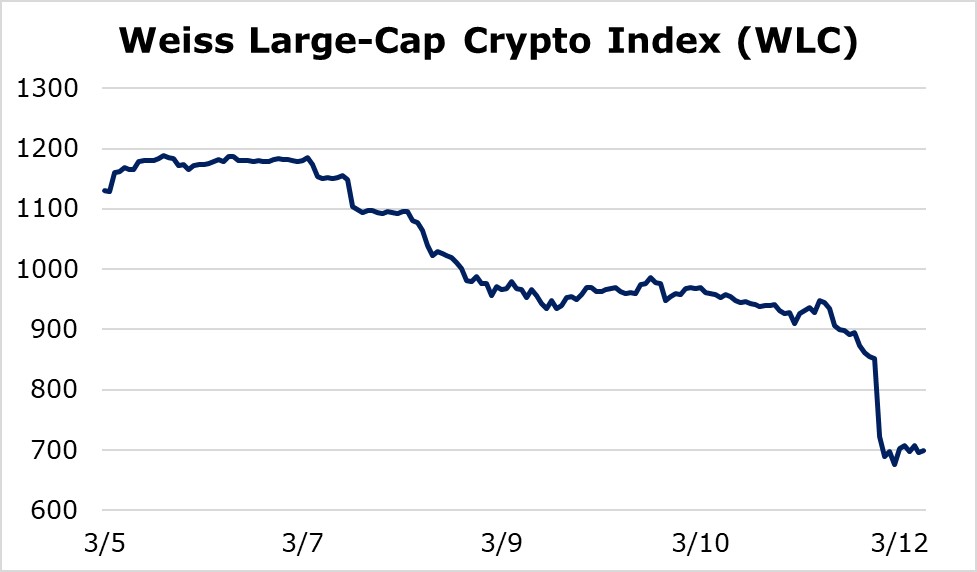

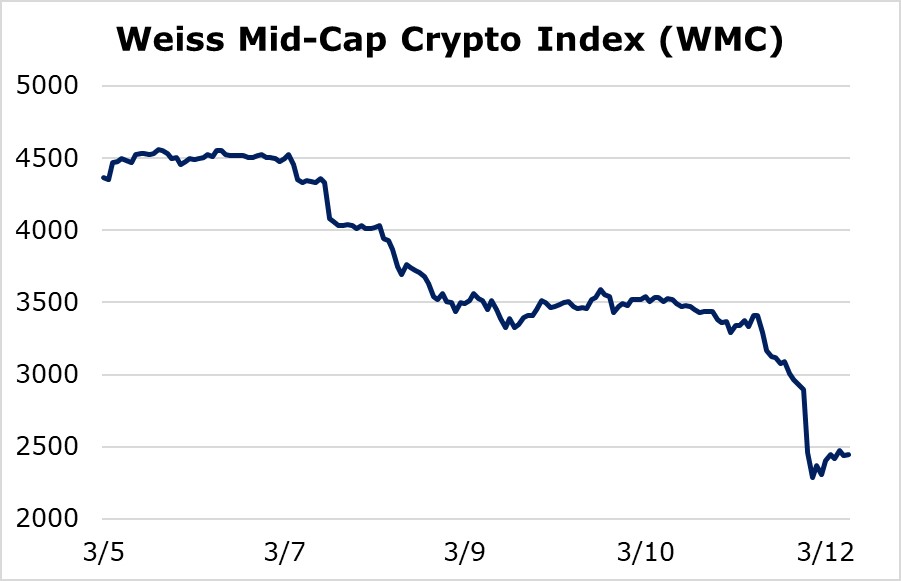

Splitting the markets by market cap shows the selloff hit assets fairly evenly across all sectors.

The Weiss Large-Cap Crypto Index (WLC) fell 38.15%.

|

The Weiss Mid-Cap Crypto Index (WMC) dropped 44.01%.

|

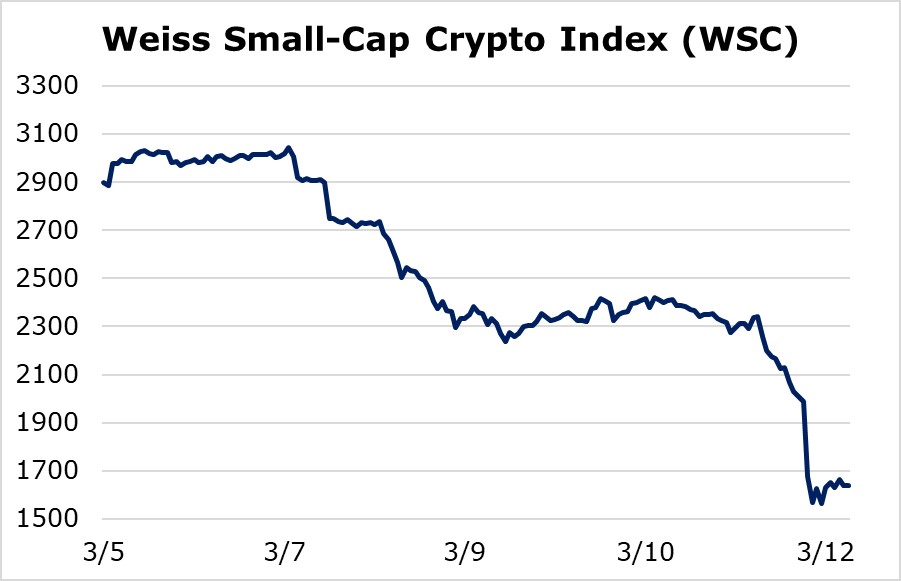

And, the Weiss Small-Cap Crypto Index (WSC) ended the week with a decline between that of the large- and mid-cap indexes, down 43.46%.

|

All crypto markets began to crawl back up a bit last night (as you can see in the charts above) … and then enjoyed a sharper bounce today (not reflected in the charts).

What does all this mean for the future?

The long-term outlook has not changed. It remains firmly bullish, with Bitcoin’s December 2018 low near the $3,000 area. That’s still far, far below current levels.

In the near term, though, the crypto markets are very near support that corresponds to last November’s lows. And, not coincidentally, our timing model tells us that a low is about five days overdue.

Overall, this looks like it could approximately be the right TIME and the right PRICE for crypto markets to find a bottom. But we won’t know with confidence until we see some more bounce.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.