Crypto Prices Flow and Ebb as Fundamentals Get Better and Better

Crypto markets lacked clear direction over the seven trading days ended Thursday, Aug. 20. We saw significant rallies for each of our indexes as the week got started, but these gains were quickly retraced as Monday turned into Tuesday and Wednesday.

All in all, as measured by the Weiss 50 Crypto Index (W50), it was basically a wash. The broadest benchmark of the industry was up 1.07% on the week, a negligible move by crypto standards.

When we strip out Bitcoin (BTC, Tech/Adoption Grade “A-”), we see a similar picture of a sideways market. The Weiss 50 Ex-BTC Crypto Index (W50X) was also basically flat on the week, with a miniscule gain of 0.84%.

Now, as we split the industry by market cap, we start to see some differentiation …

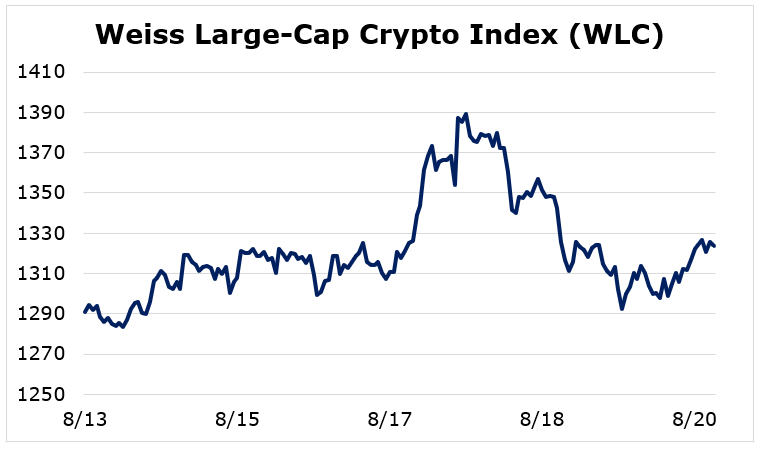

The Weiss Large Cap Crypto Index (WLC) was up 2.54%.

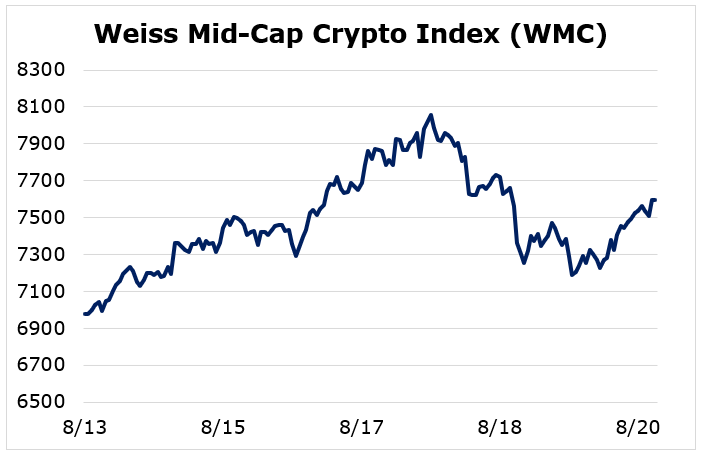

And the Weiss Mid-Cap Crypto Index (WMC) was stronger, moving up 8.84% on the week.

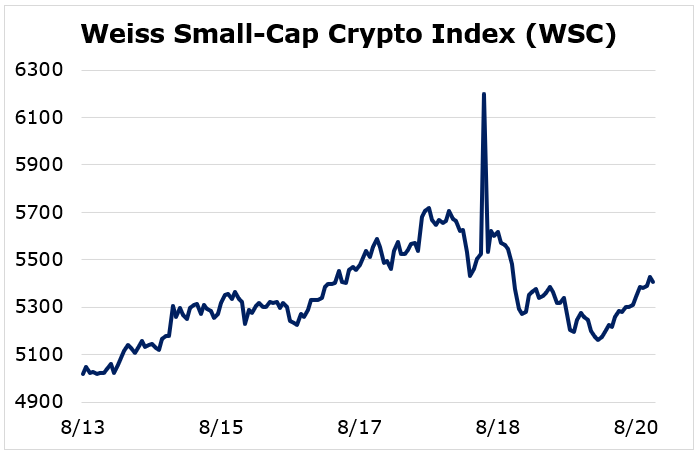

Finally, small-caps, mirrored the mid-caps, as the Weiss Small-Cap Crypto Index (WSC) rose 7.73%.

The major highlight is that, though they diverged somewhat in terms of their weekly performance, all our indexes made generally the same move: They rallied early in the week but reversed in the middle of it.

Our timing models are warning that crypto assets are getting frothy, with several leaders — such as Chainlink (LINK, Availability/Liquidity Grade “B”) and Ethereum (ETH, Tech/Adoption Grade “A”) — showing signs of clear exhaustion from the spectacular runs they’ve had since late July.

Let me be clear: We do not have confirmation that a multi-week high has been reached in the crypto asset space.

At the same time, the price action we witnessed across our indexes over the seven days through Thursday — with sharp rallies followed by equally sharp reversals — tells us we’re getting close to local tops in most crypto markets. And that means we should be prepared for the possibility of a correction that may last well into September.

Beyond this short-term correction, we expect prices of crypto assets to resume their uptrend, as the fundamental drivers remain firmly in place.

Indeed, those forces are likely to take the entire industry’s valuation to many multiples of what it is today.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.