Crypto Rally Continues (And So Does ‘QE Infinity’)

It was another display of double-digit gains for crypto assets over the seven-day trading week ended Thursday, as “safe haven” instruments new and old alike posted strong rallies.

Gold and silver prices were also up for the period in question, further indication that the “QE Infinity” stance held by the world’s top central bankers is starting to fix in investors’ minds as well.

That’s the primary reason the present surge in non-government safe-haven assets looks like the start of a long-term trend. Put simply, more and more people are looking for real alternatives to protect their wealth.

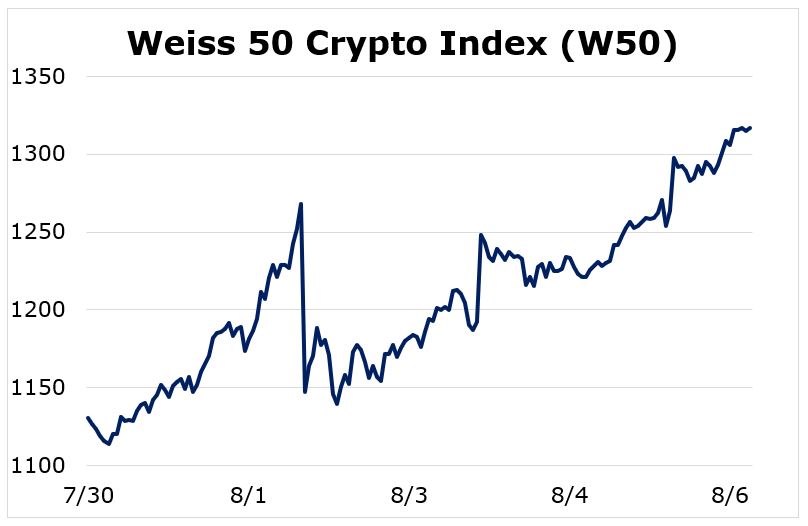

That’s reflected in the price action for what was as strong a week as we’ve seen in recent months. Indeed, the Weiss 50 Crypto Index (W50) posted a gain of 16.45% for the week.

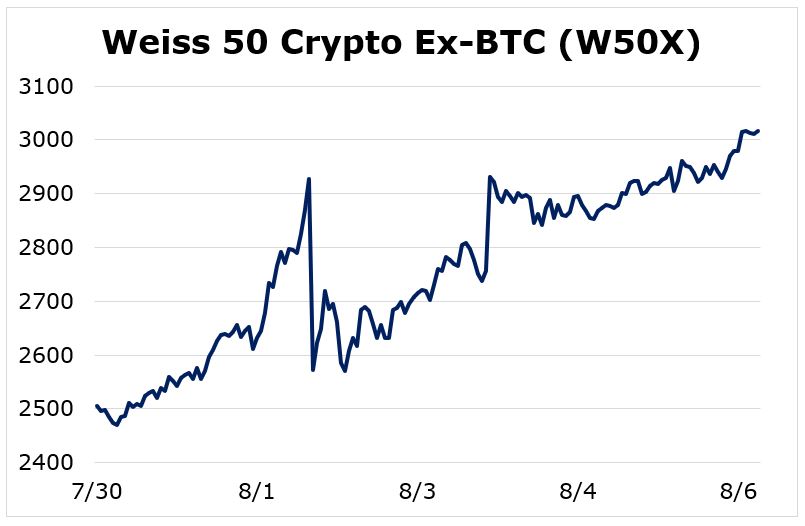

Once again this week, altcoins outperformed, as the Weiss 50 Ex-BTC Crypto Index (W50X) was up 20.43%.

Splitting the industry by market capitalization reveals some more interesting action. The Weiss Large-Cap Crypto Index (WLC) was up just 9.35% on the week.

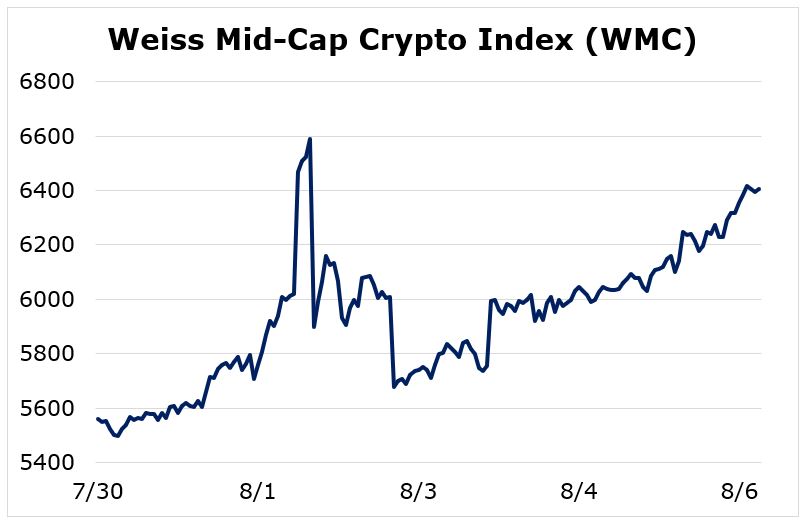

And the Weiss Mid-Cap Crypto Index (WMC) moved up 15.17%.

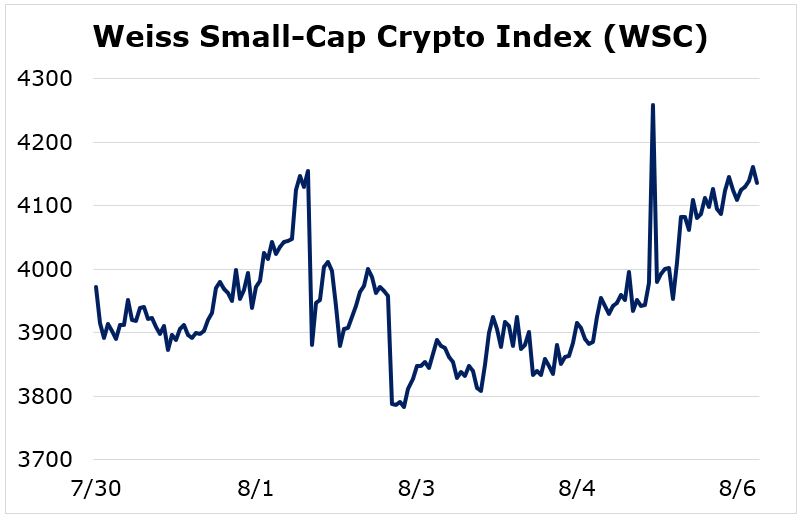

And, finally, the Weiss Small-Cap Crypto Index (WSC) moved up a relatively tepid 4.14%.

This is a lot like the discussion we had in last Friday’s issue: The small caps once again lagged the rest of the crypto space. And the Weiss 50 Ex-BTC Crypto Index was the best-performing index this week.

These two facts tell us we have a crypto market where only the highest-quality names seem to be attracting the attention of buyers.

Bitcoin (BTC, Tech/Adoption Grade “A”) is, of course, an exception. But it’s no surprise that we see the Weiss Large-Cap Crypto Index — dominated by Bitcoin — lagging somewhat, unable to break into double-digit gains this week. BTC weighed on the other big names.

Overall, the relative underperformance of Bitcoin as well as the fact that this rally isn’t broad-based yet suggests it still has legs before we enter the euphoric phase we usually see around crypto market tops.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.