Crypto Rebounds 71%! Flash Crash Done! Bottom Confirmed

Last week, the big story was the flash crash that crushed crypto markets by 50%.

This week, it’s the upward eruption in prices that naturally follows when the crash is totally out of synch with a very bright future.

That’s why I insisted that last week’s big selloff had nothing to do with the fundamental drivers of crypto assets.

And it’s why I told you those fundamentals are still pointing to a great new bull in the long term.

I’ve said before and I’ll say it again: Despite its great volatility, Bitcoin (BTC, Rated “B+”) is beginning to behave more and more like safe-haven assets.

When traditional safe havens sold off, so did Bitcoin (and the altcoins as well). Ditto when they rallied.

Of course, when we say “safe,” we’re not referring to “little or no risk.” All cryptos are still high-risk assets. Rather, we mean they are fast becoming an alternative hide-away where global investor rush for cover.

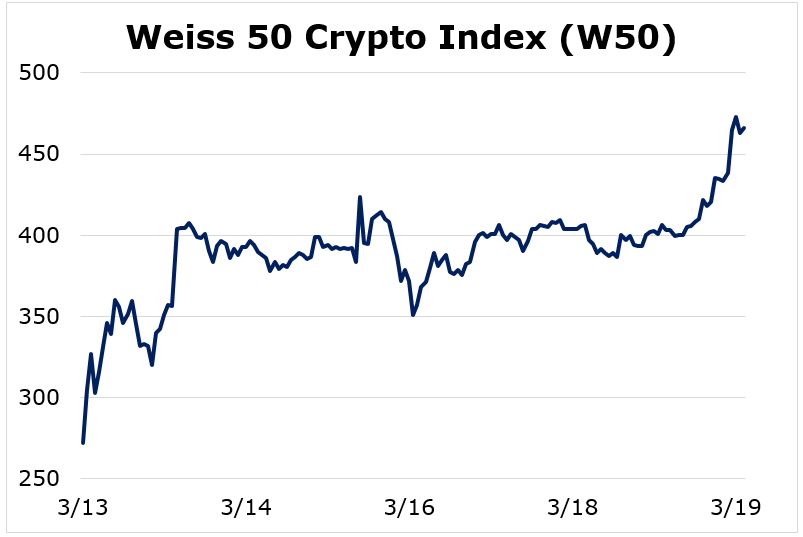

You can see that pattern clearly in our broadest benchmark for the industry, the Weiss 50 Crypto Index (W50). In the week that ended yesterday, it jumped by no less than 71.28% off the prior week’s low.

|

Stripping out Bitcoin, we note that the altcoins did pretty much the same: The Weiss 50 Ex-BTC Crypto Index (W50X) soared 72.49%.

|

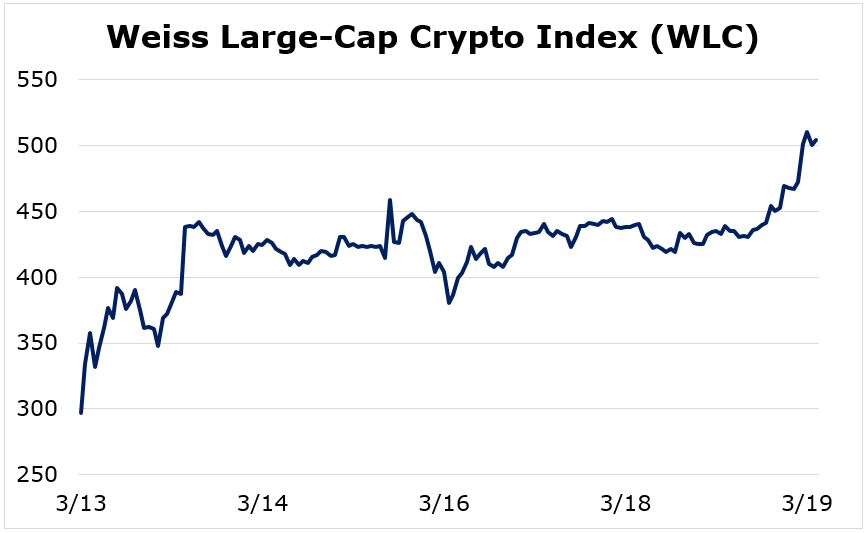

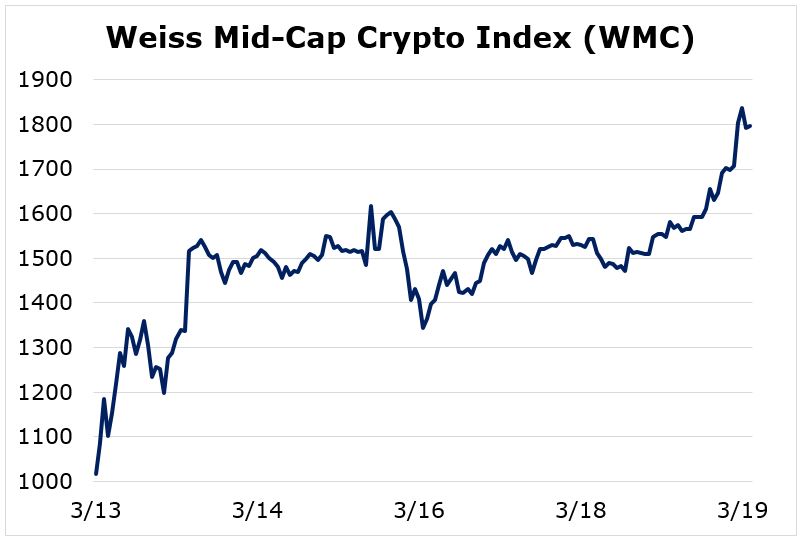

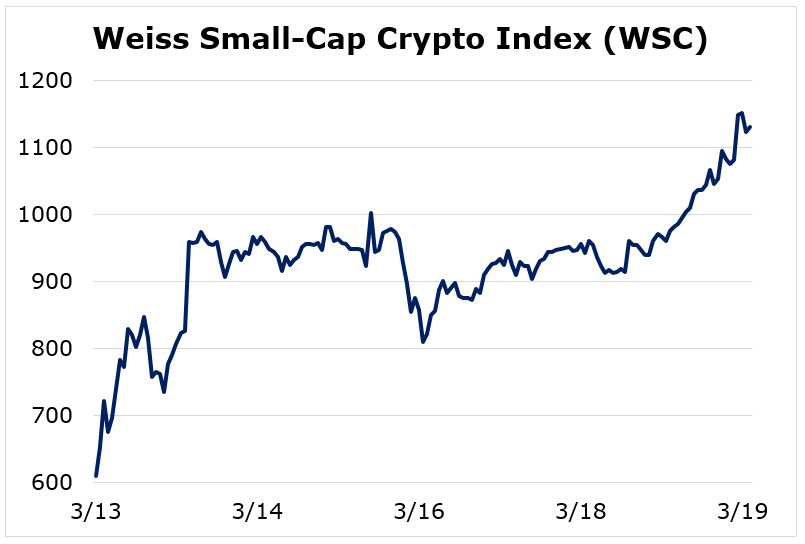

Splitting the industry by market cap we get a similar picture — one that further to confirm crypto market has hit bottom:

- The Weiss Large-Cap Crypto Index (WLC) is up 69.98% on the week that ended yesterday.

|

- The Weiss Mid-Cap Crypto Index (WMC) is up 76.81% and…

|

- The Weiss Small-Cap Crypto Index (WSC) rallied the most, up 85.43%.

|

Seeing the small caps leading the way … followed in an upturn by mid caps … then large caps is good news. It’s exactly what you’d expect to see in a true crypto market bottom.

To us, the most encouraging part of this story is that the crypto market was still able to stage a dramatic rally off the lows made last Thursday even as bond and equity markets continued their declines this week.

No other major market has done that. Even other safe-haven assets are still seeing declines.

Clearly, Bitcoin and altcoins have reasserted themselves as a relative safe haven in a world gone mad.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.