|

With the global economy melting down, with panicked investors dumping stocks like there’s no tomorrow. And with central banks unable to halt the decline, crypto has been mostly holding firm and even moving higher. Consider the facts …

- Just in the last few days, while S&P 500 has been plunging, Bitcoin (BTC, Rated “A-”) is up nearly 8% …

- Year to date, while the stock market is negative, Bitcoin is up about 30%.

- Plus, it’s up by 177% since early 2019 … more than 600% in the past three years … and over 2,000% in the past four.

But that’s not all.

Most recently, one of the biggest stories in this new crypto bull market is that crypto assets — Bitcoin in particular — have been aligning themselves with traditional safe haven assets like bonds and gold.

Some people questioned that narrative last week when, for a short period of time, stocks and cryptocurrencies fell in tandem. But as we stressed before, they were doing so for entirely different reasons:

Stocks — because of the expected impact of the coronavirus on the global economy and earnings.

Crypto — because they were overdue for a short-term correction that had long been anticipated by our models. (We expected it to happen even if the equity markets remained unaffected by coronavirus fears.)

Here are two other telltale signs:

First, while U.S. stock indexes were slammed with their biggest point drops of all time, crypto assets suffered little more than their typical, relatively mild correction.

Second, gold stopped falling. In fact, as I write, it’s about to break into new 2020 highs. Bitcoin and other crypto assets did the same thing. And now we’re seeing nice recoveries across the entire sector.

Consider our Weiss 50 Crypto Index (W50) — the broadest benchmark of the crypto industry’s market performance. It’s up 8.71% this week, approximately in line with gold and other safe havens.

|

Stripping out Bitcoin, we can see that altcoins are showing strength, too. The Weiss 50 Ex-BTC Crypto Index (W50X) is up a solid 9.82% on the week that ended yesterday.

|

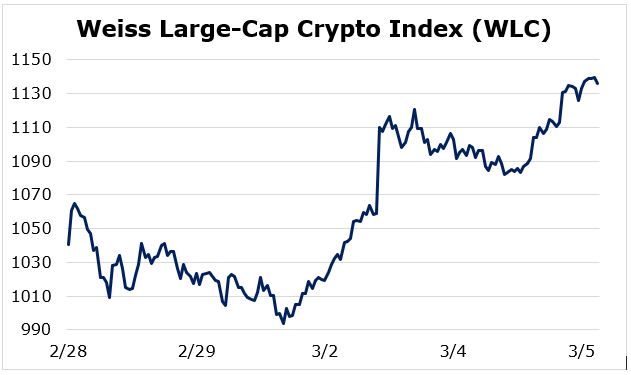

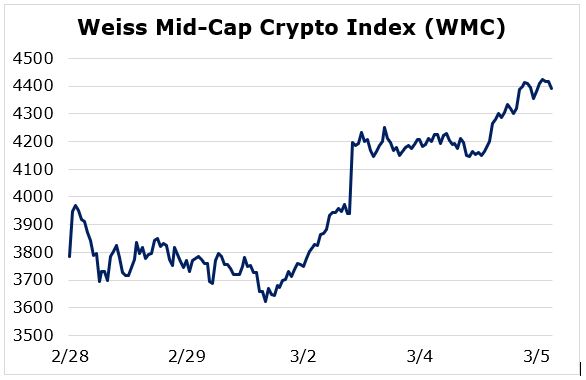

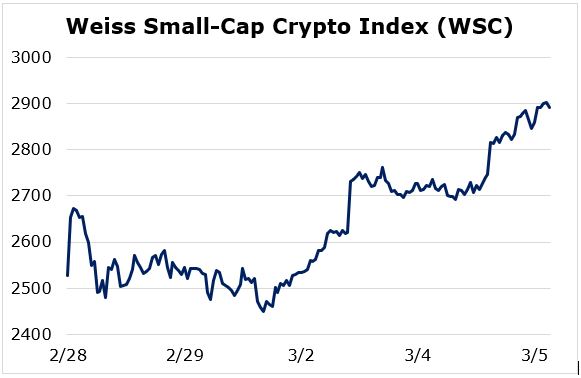

Splitting the markets by market cap, we see the same pattern of strength:

- The Weiss Large-Cap Crypto Index (WLC) is up 9.17% on the week.

|

- The Weiss Mid-Cap Crypto Index (WMC) is up 15.97%. And …

|

- Gains in the Weiss Small-Cap Crypto Index (WSC) are in the same ballpark — 14.39%.

|

We continue to stand by our assessment that crypto assets are establishing themselves as a safe haven. This is particularly true in this world of reckless monetary policies where the solution to every threat of economic slowdown is always to print more money and lower rates even further.

It’s this policy response that sent gold flying this week. And no matter how you slice this market, you can see some of that safe-haven demand creeping into the crypto markets, as well.

Bitcoin may be among the most volatile of safe havens, to be sure. But there’s little doubt it’s a role Bitcoin (and other cryptos) will play for years to come.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.

P.S. As you know, Bitcoin’s halving is coming this May. As I’ve said previously, Bitcoin should easily surpass the $20,000 level. By how much is up for debate.

Not only will the halving send the King of Crypto soaring, it’ll carry altcoins along for the ride.

This is such a monumental event that our founder, Dr. Martin Weiss, will be hosting a FREE online conference this coming Tuesday, March 10 at 2 p.m. Eastern to prepare you for the halving.

To save your seat at this urgent session, click here now.