Cryptocurrency Mining Consumes Massive Amounts of Power; Here’s How to Profit …

Bitcoins — and other cryptocurrencies — are “mined” when computers solve a complex mathematical puzzle.

So, every time a Bitcoin is bought or sold, a computer must solve one of these complicated puzzles. And that takes energy/electricity. Then, a new puzzle is created, and the whole thing starts all over again.

How much electricity do you think it takes to solve these puzzles and, thus, to create a single Bitcoin?

The answer depends on the price of electricity. Louisiana is the cheapest location in the U.S., at $3,224 to mine a single Bitcoin. Meanwhile Hawaii was the most expensive, at $9,483.

|

| Image credit: TheBalance.com |

Yes, just the pure cost of electricity is between $3,224 and $9,483.

With Bitcoin prices hovering around $6,600, somebody in Hawaii would lose money while somebody in Louisiana could make more than $3,000 per coin.

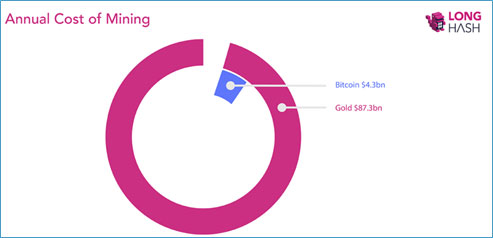

All told, it’s estimated that more than $4 billion — yes FOUR BILLION DOLLARS — of electricity was consumed by cryptocurrency miners last year. That’s why Bitcoin and cryptocurrency miners have come under attack by environmental watchdogs.

However, that electrical consumption to create cryptocurrencies — what I like to call “digital gold” — doesn’t look so bad if you compare it to the energy that the gold mining industry consumes each year.

Get this: More than $87.3 billion was spent on mining for gold last year. That’s 20 times more energy/cost than Bitcoin mining.

|

| Image credit: CCN.com |

In my view, digging big holes in the ground to find gold is more damaging than a bunch of computers whizzing through complex mathematical problems. But that’s just my opinion.

There is no debate, however, that reducing electricity consumption — which in turns means lower production costs — can dramatically increase profits. That is why cryptocurrency miners are frantically looking for ways to lower their electricity costs.

One way is to move your computer farms from places with high electricity costs (like Hawaii) to places with low electricity costs, such as Iceland. Thanks to its abundant geothermal resources, that country has some of the lowest electricity costs in the world.

I’ve been to Iceland, and it is gorgeous. But I wouldn’t want to live there other than in July and August (brrrrrrr). So, the next most effective cost-saving move is to use the most energy-efficient computers and computer hardware that you can find.

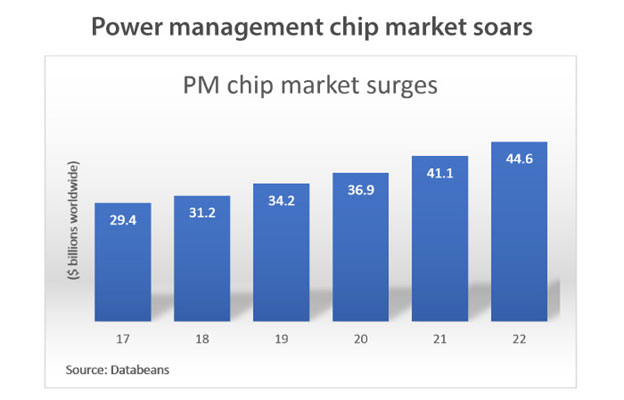

When it comes to computers, electricity consumption is primarily controlled by chips called Power Management Integrated Circuits (PMICs). They’re integrated circuits for managing power requirements of the host system.

The right chips can reduce energy consumption by up to 95%!

|

Those super-efficient chips aren’t cheap, but their price is rapidly falling. And Bitcoin miners are beating a path to the companies that produce those low-power chips. In fact, those companies can’t make chips fast enough to meet demand.

Who makes these super-energy efficient semiconductor chips? There are several startups that have yet to go public, but here are a few stocks that you could consider:

- Dialog Semiconductor (DLGNF)

- Texas Instruments (TXN)

- Maxim Integrated Products (MXIM)

- Infineon Technologies AG (IFNNY)

Power management chip company companies like these could serve as excellent building blocks in your crypto stock portfolio. For more investing ideas, see my recent column, “These 3 Chinese companies hold more than half the world’s blockchain patents!”

Best wishes,

Tony