Ethereum Breaks Out as Large Caps Lead Late-Week Rally

It was all quiet on the crypto front early in the trading week, with mostly sideways movement until Tuesday, July 21, when signs of upside momentum developed early in the day.

Then Ethereum (ETH, Tech/Adoption Grade “A”), the world’s second-largest crypto asset, broke out of a sideways trading range it’d been stuck in since the end of May.

Over the last few weeks, multiple small- and mid-cap names have broken out of multi-month consolidations, one by one. This developing trend – and large-cap ETH’s participation – could be the prelude to a more widespread crypto rally.

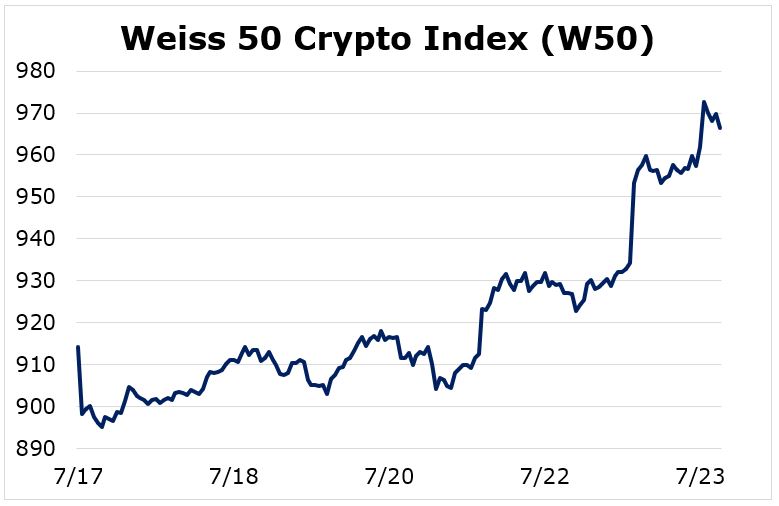

We’re not quite there yet, though. The Weiss 50 Crypto Index (W50) —a broad benchmark for the crypto asset space as a whole — moved up 5.71% over the seven trading days ended July 23. And that’s not exactly gangbusters for this still-maturing market. Of course, we’ll be looking for follow through into the new trading week.

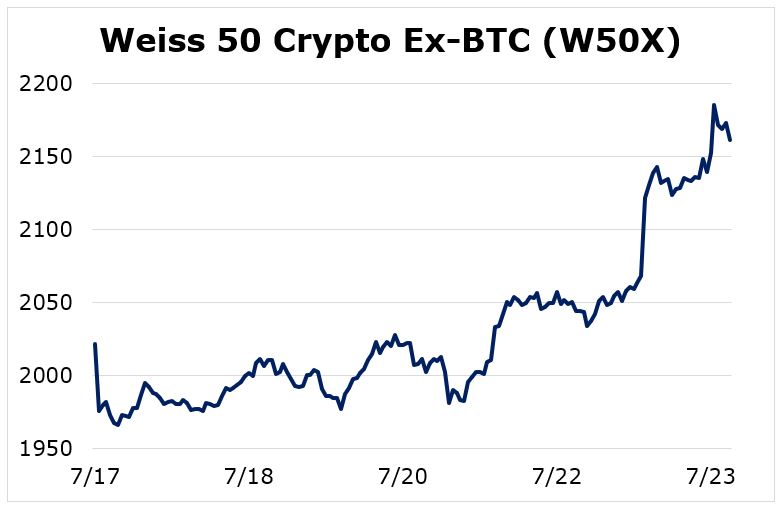

Stripping out Bitcoin (BTC, Tech/Adoption Grade “A”), we see more bullish price action. Indeed, it’s safe to say the altcoins — with ETH the dominant asset in the Weiss 50 Crypto Ex-BTC Index (W50X) —are leading the rally. The late-week spike made the seven-day gain 6.90%. But we’re not talking about widespread strength here. During a truly bullish week, this index will make double-digit moves.

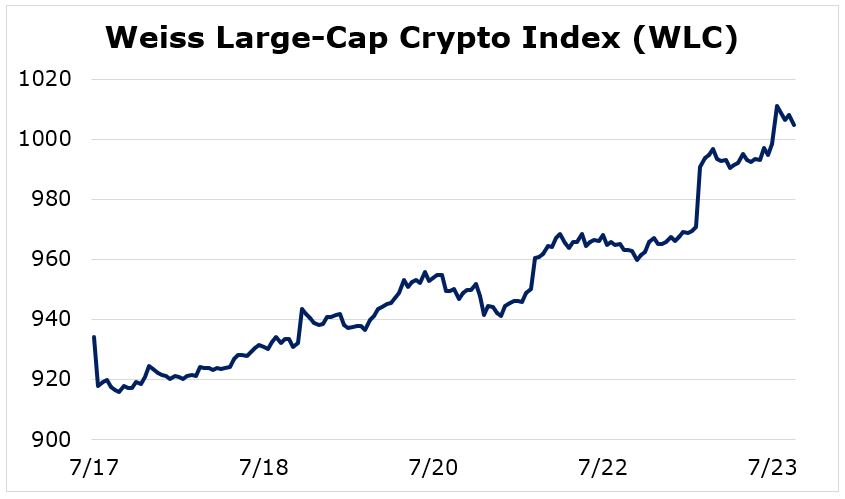

As has been the case lately, the interesting notes come when we split the space by market cap. For instance, the Weiss Large-Cap Crypto Index (WLC) moved up 7.55% on the week.

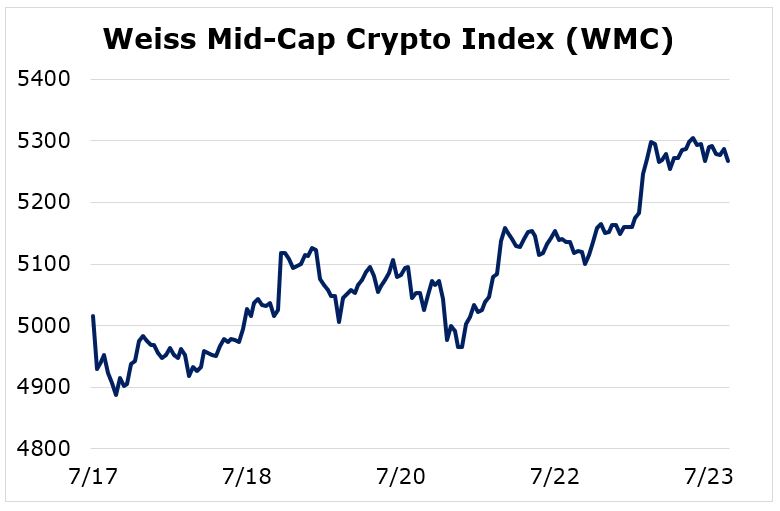

And the Weiss Mid-Cap Crypto Index (WMC) lagged somewhat, posting a 5.04% gain for the seven-day stretch ended yesterday.

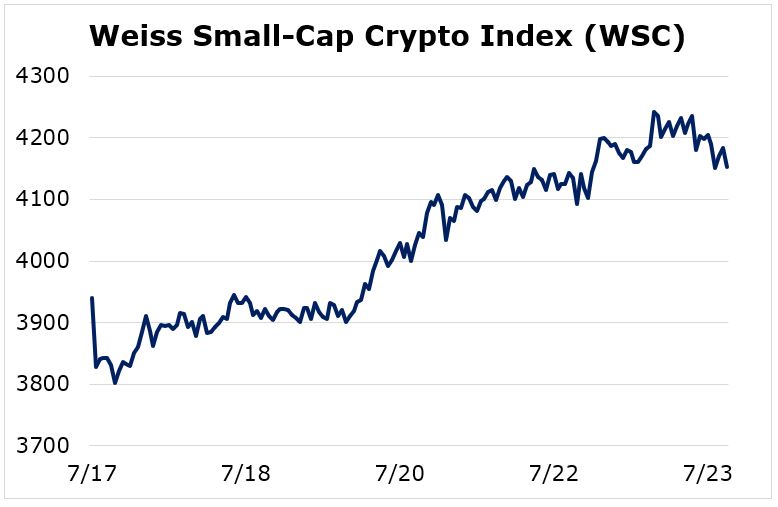

Finally, the Weiss Small-Cap Crypto Index (WSC) experienced a mildly bullish week, rising 5.42%.

It’s revealing that the large caps were the leaders this week. As we talked about at the top, this is confirmation that the bullish week was primarily driven by Ethereum’s breakout. ETH was up almost 18%, with the rest of the market trying to play catch-up.

As I said in the beginning, even though we’ve seen select crypto assets break out of their individual consolidation ranges, we have yet to see a more generalized breakout where all crypto assets move higher together.

Looking beyond crypto, there is no doubt that the select breakouts we’re seeing are related to price action elsewhere in global financial markets, as precious metals — particularly silver — also experienced a significant surge this week. U.S. Treasuries moved to the upside as well.

The fact that the U.S. dollar weakened significantly on the week also seems to have played a role in crypto markets, as we can clearly correlate the most bearish days in the greenback to the more significant up-moves we saw in crypto.

That said, I continue to worry about the lackluster price action from Bitcoin, which barely managed to move higher as the world’s second-largest crypto asset was undergoing a significant bullish breakout.

As I’ve been saying for weeks, any crypto rally that doesn’t include BTC should be viewed with suspicion, and this one is no exception.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.